[ad_1]

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665657.1.jpg)

March 10 is an important day in the history of the New York Stock Market. March 10, 2000 was the day Bubble.com peaked. The NASDAQ crashed the next day after closing at an all-time high of 5,048.64 at the time. It was in 2015, 15 years later, that the level was restored again.

In particular, when the Nasdaq rose the day before, the Nasdaq 100 index compared to the S&P 500 had risen to that day’s level 21 years ago.

Until dawn on the 10th (local time), the market remained silent as if it were commemorated 21 years ago. We expected two major events of the day: the release of the Consumer Price Index (CPI) for February and the results of a 10-year US Treasury bill ($ 38 billion).

The CPI, announced at 8:30 am, brought relief to the market. It was just a 0.4% increase from the previous month and 1.7% from the previous year. It was higher than the January figures (0.3%, 1.4%), but it met expectations. Excluding volatile food and energy, the source CPI was also up just 0.1% and 1.3%.

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665656.1.jpg)

“The CPI may continue to exceed 2% in the future,” said Greg Dako, an economist at Oxford Economics, but it will fall again after peaking this spring. It won’t shoot out of control.

Of course, there is still a strong voice warning about inflation. Jeffrey Gundlock, CEO of Doubleline Capital, a famous bond investor, said in a webcast of the day: “The Fed has chosen not to worry about inflation exceeding 3% for a certain period of time.” The CPI can exceed 4% “.

In fact, this month has passed, but the CPI may skyrocket starting next month. This is because the CPI for March-May last year registered deflation due to the pandemic. Considering the base effect and the vertiginous price of oil, it could exceed 2% compared to the previous year.

When the CPI came out, 10-year Treasury yields staggered. In an instant, it fell from 1.569% annually to 1.53% and fell to 1.51% at 12pm, just before the 10-year tender.

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665648.1.jpg)

The New York stock market got off to a strong start. As time passed, the rise increased and the Dow rose more than 400 points. On the other hand, the Nasdaq, which started more than 1% higher, faltered as ‘inflation trading’ (buying a beneficial stock in anticipation of an economic recovery and inflation) strengthened. After 10:30 am, it fell to negative compared to the day before. Tesla, which was once up more than 7%, once was down more than 2%. On this day, Goldman Sachs analyzed that the 3.69% increase in NASDAQ the previous day was due to the short coverage of hedge funds (predicting a fall and buying back to pay for assets sold short).

At 1 pm, with everyone watching, a 10-year tender was held. The winning bid rate was set at 1.523% per annum, slightly higher than the previous market rate. The bid rate was also good at 2.38 times. It was similar to the annual average of 2.42 times. In the market it was evaluated that “it was not very satisfactory, but it was digested relatively smoothly”.

Since then, interest rates have fallen to 1,506% and the main indices of the New York Stock Exchange have risen. The Dow ended up trading at 32,297.02, an increase of 464.28 points or 1.46%. This is a historical record. The S&P 500 Index rose 0.6% to close at 3,898.81, returning to the level of early February, before interest rates soared. A Wall Street official said: “It could be interpreted as a sign that investors are coming out of the uncertainty about interest rates.”

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665685.1.jpg)

On the other hand, the NASDAQ fell 0.04%. Shares of FAANG such as Apple, Amazon and Alphabet showed a slight decline of less than 1%.

Mark Hepel, chief strategist at UBS, said: “Yesterday, economically sensitive stocks were weak, but we expect reflation trading to continue.” It will benefit greatly. ”He added that these actions are positive as interest rates rise.

There was anxiety about the success of the 10-year Treasury bid that day, but it was predicted to some extent. A Wall Street official explained: “I thought this offering would be successful because the price of borrowing 10-year Treasuries in the conditional repo market has skyrocketed, but it was correct.” “The 10-year demand from the repo market was for short sales, but if interest rates fall like this, a short hedge could occur,” he said. That means interest rates can go even lower.

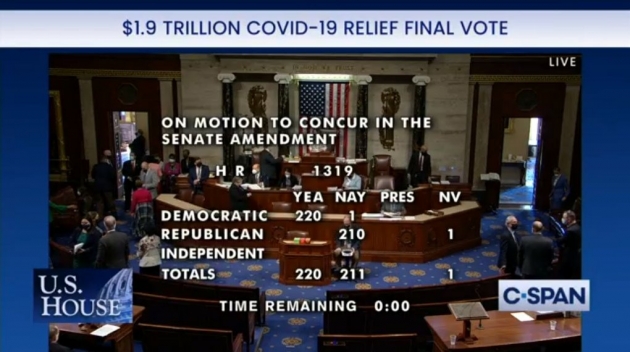

Anyway, on this day, both variables passed safely. Additionally, a $ 1.9 trillion stimulus package passed safely through the House of Representatives. President Joe Biden announced plans to sign it on the afternoon of the 12th. Bob Bassani, CNBC’s trading critic, explained: “Investors had all the stimulus measures, a good CPI and 10-year bids on this day.”

As the market stabilized, speculation took off. Stocks like ‘GameStop’ showed record spikes and crashes.

GameStop, which ended at $ 246.9 the day before, shot up to $ 348.5 at 12 noon on the day. But right after that, for no apparent reason, it plunged 50% in 30 minutes, to $ 172. Since then, the decline has rebounded significantly and the closing price ended 7.33% higher than the previous day. at $ 265. Due to the voluntary movement of the share price, trading has been suspended seven times. Not only the game stop, but also the AMC entertainment and courses moved like a yo-yo.

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665655.1.jpg)

In particular, one of the most traded options in the stock option market that day was GameStop’s $ 800 call option that expires on Friday the 12th of this week. A whopping 43,934 contracts remain. Considering that a contract is 100 shares, there is a contract to buy 4.39 million shares for $ 800. This is equivalent to 10% of the 45.1 million floating stocks. If the stock price goes above $ 800 by Friday, you will make a lot of money. If not, it could be a tissue.

Due to the overflow of liquidity, this type of speculation can lead. With the stimulus approved that day, Americans will receive an additional $ 1,400 per person within this month. Much of this can be brought to the US stock market Deutsche Bank estimates that of $ 1.9 trillion in direct grants, $ 466 billion, of which 37% or $ 170 billion, could flow to the stock market .

The United States Securities and Exchange Commission (SEC) issued a warning to “think twice when investing in a company for business acquisition (SPAC).” With the recent spec boom in the United States, celebrities like Stephen Curry, Shaquille O’Neill, and Alex Rodriguez are also joining in.

The market was good for investors in the New York Stock Exchange, but it was even luckier for emerging markets like Korea.

The recent rise in interest rates has been dubbed a “no-cap tantrum.” In 2013, former Fed chairman Ben Bernanke said he would phase out (to gradually reduce the amount of bond purchases he buys each month), and a market seizure occurred due to a ‘conical tendrum’, or shrinking , now President Jerome Powell. even though he said “I’m not going to cut back”, he still had a seizure.

In fact, on May 22, 2013, the taper tendrum, which arose out of former President Bernanke’s statements that “we will discuss tapering at various meetings in the future,” had only a short-term impact on the New York financial market. York. The stock market crashed as the 10-year interest rate soared from 1.6% to 2.7% in two months from May 22, but fell just 5.7% according to the S&P 500 as of June 24. In particular, the US stock market was up 32.29% that year as the Federal Reserve tried to stabilize the market and slowed down to a real drawdown.

At that time, emerging markets saw the damage. The global stock market went through dark days after the US austerity controversy and the recovery of the dollar that had spread to global financial markets. In the bond market, the dollar tumbled. Looking at the KOSPI alone, it was around 2000 at the time, but it was around 2000 before last year’s pandemic. This is the background of the word ‘boxpi’.

China continued to adjust despite the downturn in the stock market, and the People’s Bank, which periodically tries to reduce its supply of liquidity, may be preparing for this recovery in the dollar and the reduction in the United States. Furthermore, the United States can use it to further harass China as it is in a battle for supremacy with China. This is why the China Banking and Insurance Management Supervisory Commission (CBIRC) Guo Shu-qing warned of the side effects of the expansion of global liquidity on the 2nd. “As the economy becomes highly globalized, the inflow of foreign capital to China will increase significantly, “Guo said. “China is looking for ways to manage foreign exchange inflows to avoid fluctuations in the domestic market.”

In fact, China suffered a difficult time from 2015 to 2016 when the dollar that had entered after opening the money market in the past was suddenly depleted.

![[김현석의 월스트리트나우] Is the interest rate seizure over? ... The reason China is so sick](https://img.hankyung.com/photo/202103/01.25665649.1.jpg)

According to Bloomberg, the volume of China’s optical currency (M2) in February increased only 7.4% from the previous year. That’s well below the market’s forecast of an 11.1% increase.

Reporter Kim Hyun-seok [email protected]