[ad_1]

The Financial Supervision Service explained that “it took time because there was a process to verify and confirm”, when it decided to postpone the timely corrective action after giving Optimus the management of assets twice as long as others. At that time, FSS staff consulted Optimus CEO Kim Jae-hyun several times.

![The photo is from the Financial Supervision Service in Yeouido, Seoul. [연합뉴스]](https://pds.joins.com/news/component/htmlphoto_mmdata/202011/11/fbb704a1-8d4d-42d6-a3c5-5da814858a77.jpg)

The photo is from the Financial Supervision Service in Yeouido, Seoul. [연합뉴스]

After listening to the explanation of the suspicion of ‘consulting’

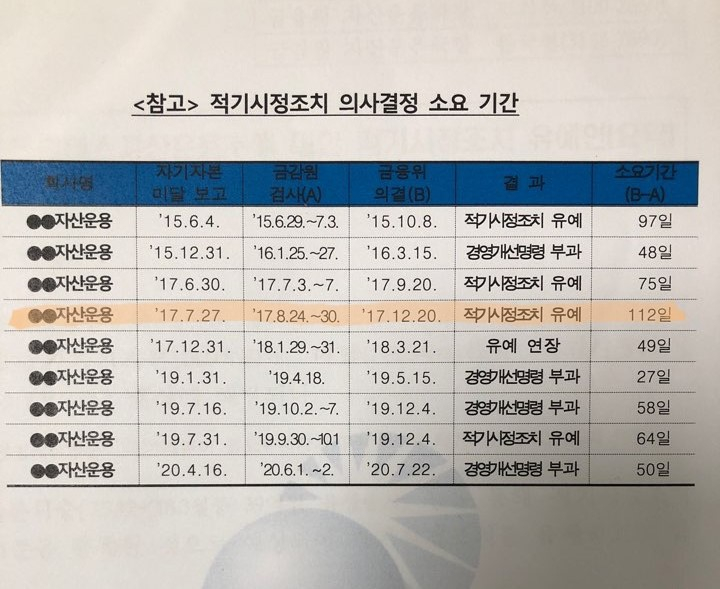

On the 11th, the Financial Supervision Service had time to answer queries related to Optimus’ management through a tea with the reporting staff. The secretariat asked the Financial Supervision Service about the background to the previous decision to suspend the appropriate corrective measures. Previously, the Financial Oversight Service (FSS) took 112 days, which is roughly twice the average processing period (58.5 days) of other asset management companies, in the process of determining whether to take timely corrective action for the Optimus Management’s share capital shortage in the second half of 2017, calling for ‘suspicious suspicion’. There is a bar. The Financial Supervision Service eventually postponed measures to manage Optimus.

Consulting suspect “Kindness with the representative’s phone number”

“At the time, former CEO Lee Hyeok-jin was in a detention center due to various problems, and a major new shareholder (former Nara Bank chairman Yang-ho) said he would contribute money (capital).” I can’t trust the new big shareholder, so it took me a while because there was a process where I had to verify if it really was, and if I set up the fund, I had to verify that the commission was received, “he explained.

Data on the timeline for decision-making for timely corrective actions received by the Office of the National Assembly, Yu-dong, from the Financial Supervision Service. The fourth is related to Optimus asset management. Yu-dong Office

According to the transcript file obtained by this magazine, the staff in charge of the Financial Supervision Service at the time were “careful” and gave advice to Optimus Management CEO Kim Jae-hyun several times over the phone. He first called CEO Kim and said, “Isn’t it possible to receive (money) first and manage some of them? Director Choi said, “CEO Kim Jae-hyun (not other officials) made the phone call.” It is explained that the employee was partially influenced by rank level while speaking with the head of Optimus Management, the audited organization.

“The results of the due diligence are not as expected”

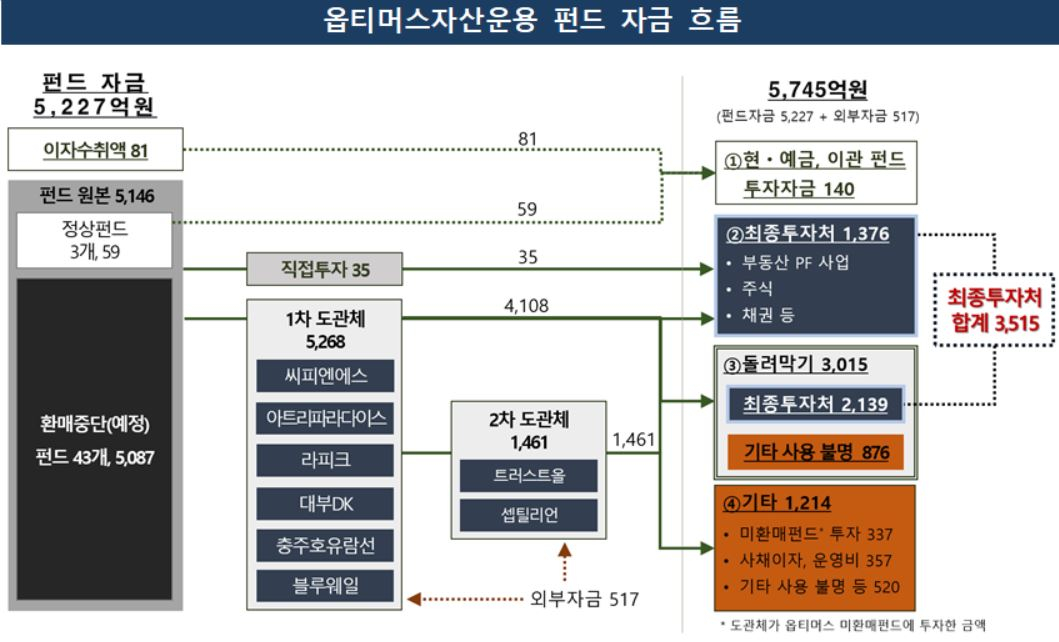

On this day, the Financial Oversight Service revealed the results of Samil Accounting Firm’s due diligence on the Optimus Fund before tea time. According to the results of due diligence, the expected payback rate compared to the original investment of 5146 billion won by fund underwriters is only 7.8% (40.1 billion won) up to a maximum of 15.2% (783 billion won). Of the fund’s capital, excluding 3.515 billion won, which had flowed to the investment destination, the remaining 163.1 billion won was depleted due to embezzlement, setbacks, and operating expenses, making due diligence impossible.

Optimus Fund cash flow. Financial Supervision Service

“We have invested heavily in real estate project (FP) financing, stocks and bonds, and Kim Jae-hyun’s representative futures investment, interest expense, etc.,” said Director Choi. Said.

Upon receiving the results of the due diligence, the Financial Supervision Service plans to initiate follow-up procedures such as transfer of funds, dispute resolution, and sanctions. Director Choi said, “When the due diligence is over and the recoverable amount comes out, there is no choice but to come out naturally on how to make a cash transfer plan and transfer the fund.” “He said.

Will ‘2nd Opti’ come out … Under the direction of 4 managers

On the 15th, reporters are photographing the office entrance in front of the Optimus Asset Management office in Gangnam-gu, Seoul. Reporter Jeong Yong-hwan

Currently, the Financial Supervision Service filters and manages some insolvent managers that meet the Optimus management level. Director Choi said: “We selected 52 managers according to various criteria through analysis of real bonds from private equity funds in January. We selected 10 of them in March and focused on whether or not a buyback request is possible. “. I picked the five that I thought were a problem and started testing in late April, but Optimus Management is one of them. ”

In summary, the four managers in question were classified by the FSS along with Optimus Management at the time, and they are currently under intensive management by the FSS. The Financial Supervision Service is concerned that the second Optimus crisis will be repeated in these managers. Director Choi explained to these managers: “A violation of the Capital Market Law was found, but it is not as fraudulent as Optimus” and said: “It is unlikely that there will be a large-scale rescue stop between these companies.”

Reporter Jeong Yonghwan [email protected]

[ad_2]