[ad_1]

The ‘Air Big Deal’ in which Korean Air takes over Asiana Airlines has crossed the threshold of the court, which was considered the first gateway. The court rejected the provisional provision for the prohibition of issuance of new shares raised by the ‘Trilateral Federation’. This paved the way for the 800 billion won, which the Korean Development Bank entered as a withdrawal from big business, to flow in the order of Hanjin Kal, Korean Air, and Asiana Airlines.

However, there are still many thresholds to overcome. It must be approved for domestic and foreign corporate defects. The tripartite shareholders association, which is in dispute over management rights, is still sharpening the knife. After all hardships and M&A work have been completed, the world’s seventh-class super-large airline (FSC) and the northeast’s largest low-cost airline (LCC) will be created at the same time. from Asia.

On the 1st, the 50th Division of the Seoul Central District Law Civil Settlement (Chief Judge Lee Seung-ryun) dismissed the ‘ban on issuing new Hanjin Cal shares’ raised by private equity fund KCGI. The ‘Three-Party Shareholders’ Alliance, which includes KCGI, Bando E&C and former Korean Air Vice Chairman Cho Hyun-ah, are the first shareholders with 46.71% of Hanjin Kal shares, and oppose this great business in which your shares are diluted in the financing process.

As Hanjin Kal’s plan for this big business, if Hanjin Kal promotes a tripartite capital increase of 500 billion won to the Korea Development Bank, the stake in the tripartite shareholders’ association will be reduced to 40.5%. On the other hand, Saneun secures a 10% stake in Hanjin Kal. From the point of view of the chairman of the Hanjin Group, Cho Won-tae, who is being rejected in the participation dispute with the Three-Party Shareholders Alliance, the way to assure KDB as a friendly participation is open.

KCGI said: “We oppose the defense of the management rights of President Won-tae Cho using the blood tax of the public,” and argued that “to allocate new shares to a third party for the defense of management rights or control in a situation where management rights disputes come true, but the court’s judgment was different.

The court admitted that there is a need for “a major venture capital alliance” and “urgent financing” for Hanjin Kal’s tripartite capital increase. It was considered that this great business will be promoted within the Commerce Law, which says that new shares can be assigned to third parties other than shareholders to achieve management objectives such as improving the financial structure.

The judge ruled: “It was done to the extent necessary to achieve the management objectives of the Asiana Airlines acquisition and the integrated management of the airline,” and said: “It is difficult to say that it is for the purpose of defending the rights or the current management control “.

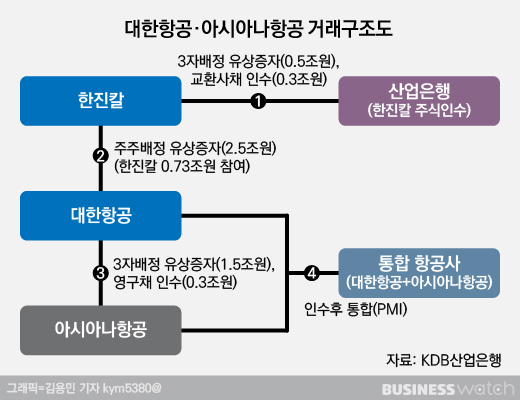

As this great business crosses the threshold of the court, the financing is expected to come true as planned. At the moment, KDB will pay a total of 800 billion won to Hanjin Kal, including 500 billion won in paid-in capital increase on the 2nd and 300 billion won in exchange bonds on the 3rd.

The second step is that Hanjin Kal lends this money to Korean Air, and Korean Air is promoting a 2.5 trillion won paid-in capital increase early next year. Korean Air pays Hanjin Kal’s debt with new shares. Finally, when Asiana Airlines issues a paid-in capital increase of KRW 1.5 trillion and KRW 300 billion in convertible bonds to Korean Air, the big deal will end next June. The governance structure of ‘Hanjin Kal-Korean Air-Asiana Airlines’ is completed.

In the final stage of the acquisition process, the Fair Trade Commission reviews the business combination. The FTC will examine the possibility of a monopoly and conclude a business combination. In the United States, the European Union (EU), and China, overseas business combinations are also being examined. Given the peculiarity that airlines around the world have fallen into the worst management difficulties due to Corona 19 (a new coronavirus infection), it is unlikely that business combinations will be allowed.

However, the observations from the industry are that tensions cannot be delayed until the end, as this big deal may be canceled unless one of the major countries is approved for a merger.

Although the contraction is inevitable due to this court decision, resistance from the tripartite shareholders association is expected to continue. On the 20th of last month, KCGI requested Hanjin Kal to convene an extraordinary general meeting of shareholders. It is about appointing new directors and changing the statutes.

However, if the list of shareholders for the temporary shareholders’ meeting is closed after 22 22, when the new shares invested by the KDB are listed, the “tripartite shareholders association” will lose the vote. There is also a plan for KCGI to buy shares from the market and secure more than 50% of Hanjin Kal’s shares, but this is not easy given the financing capacity.