[ad_1]

Minor accounts All 800% ↑

Buy domestic and foreign growth stocks that are unlikely to fail, such as Samsung Electronics and Apple

Photo = Getty Image Bank

Individual investors bought net stocks worth more than 2 trillion won on the 29th. Overall, this year, individuals bought net more than 60 trillion won and emerged as the mainstream in the stock market. In the wake of this stock craze, parents opening accounts in their children’s name and buying stocks are increasing rapidly. This is the effect of the shift in perception of stocks from “dangerous financial products” to “long-term investment instruments for the future of children.” ‘Papa ants’ (dad’s individual investor) who started financial literacy and early economic education through stocks are also rising rapidly.

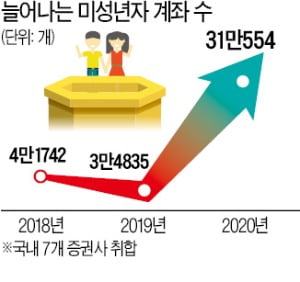

The Korea Economic Daily reported a 791% increase from 34,835 last year to 31,554 this year as a result of a total of recently opened minor accounts at seven national securities companies (Mirae Asset NH Korea Investment KB Kiwoom instead of Kiwoom). It is the greatest of all time. The number of newly established underage accounts, which had declined 17% last year from 41,742 in 2018, increased dramatically with the largest share boom in history.

The defining moment was that parents who confirmed the power of stocks this year recognized stocks that were exclusively for adults as investment destinations in their lives. In the past, bank deposits and savings were used to provide seed capital for children. This year, high-quality stocks are said to be becoming the medium. The top stocks bought through minor accounts were Samsung Electronics, Naver, Kakao, Tesla and Apple, and other growth stocks that probably wouldn’t fail.

In addition to investment purposes, parents who started early education, saying they would open their eyes to finance and the economy early, also affected the increase in bills. Deuk-Hyun Pyun, Vice President of the Asset Management Strategy Department at NH Investment & Securities, explained: “The more parents invest in stocks, the more likely they are to open an account for their children.”

Experts believe that the reasons for opening youth stock accounts as investment, education, and gift for the future are diverse, but this trend will continue to spread.

“Why don’t I have shares?” A word from my daughter … ‘Ant Dad’ bought by Kakao and Tesla

Choi Mo, 51, an executive of a large company, received a question from the daughter of a high school student. While watching TV, my daughter suddenly asked, “Dad, why don’t I have stocks?” There was a mixture of dissatisfaction with the way her daughter spoke of her friends’ actions, but she couldn’t get involved in the conversation. Choi was hot. I was concerned that my daughter would not be left behind because she had not received a proper education. Lately, he joined the ranks of the “parent who buys stocks.” In addition to financial education, a portion of the allocation is withdrawn and delivered as shares each month. Afterwards, Choi was proud to see her daughter studying stocks and economics through newspapers and YouTube.

Kim Mo, 32, a beginning father who works as a fitness trainer in Nowon-gu, Seoul, opened a stock account last month to commemorate his son’s 100 days. Until his son enters college, he plans to buy shares of Samsung Electronics and Apple every month. The goal is to increase the child’s college tuition and independent funding.

Grandma shares instead of pocket money

Share accounts in the name of minors are increasing rapidly. Hundreds of thousands of accounts were opened this year alone. Not long ago, the ‘minor share count’ triggered unpleasant feelings. There was a strong perception that a “means of inheritance” avoids taxes. But this year it has changed. People who set up children’s share accounts and people who gave their pocket money as shares became common. Stock futures and stock allocation are becoming a culture.

The aunt, a 32-year-old office worker, bought shares of Samsung Electronics in front of her 23-month-old son with 10 million won raised through additional funds and a first-birth party. To date, the yield has reached 40%. He said, “I am buying 200,000 won worth of Samsung Electronics shares every month in the name of a child.” Grandpa and Grandma also joined. Han Mo, 61, who lives in Songpa-gu, Seoul, recently opened a new stock account and deposited 3 million won as a Christmas gift for her two-year-old grandson. Mr. Han said: “I deeply sympathize with the words of John Lee, CEO of Meritz Asset Management, that we must cut spending on private education and invest in stocks.

Papa Ant selected by Samsung Electronics and Tesla

In 2020, stock futures have become a new investment culture. It’s a new trend created by ‘parents’ who think both financial education and financial technology can be done. This is due to the decline in the recognition of ‘stocks as risk assets’ in the booming stock market.

In fact, they bought high-quality stocks that could generate higher returns than deposits. Samsung Electronics has always been listed as the number one stock you want to pass on to your kids. According to Yuanta Securities, Samsung Electronics ranked as the most-stored stock in minor accounts from 2018 to this year.

With the exception of Samsung Electronics, the main stocks are changing. Those who primarily invested in SK Hynix Celltrion KEPCO with their children’s accounts intensively bought Naver Kakao and Hyundai Motors this year.

The trend to invest in foreign stocks is also changing. As a result of an analysis of clients who created underage accounts through Shinhan Investment, Tesla was the largest stock owned. They were followed by Apple, Alphabet (Google), Amazon and Bugshire Hathaway. Until last year, China’s non-life insurance and Vietnam’s number one non-life insurance company, Bao Vietnam, were in the top five.

In order to save money

Other evidence that minor stock accounts are a long-term educational and financial means rather than an inheritance is the average balance per account. The number of new accounts this year has increased by nearly 800%, but the average balance per account is similar to last year. In the case of A Securities, where the number of accounts for minors has shot up 1,000% in one year, the average balance has decreased by 30%. A company official explained: “There are many people who have created long-term investment accounts for their children, so the amount is not large, and even this is invested carefully.”

Some parents opened an account in their children’s name to give away. Earlier this year, 38-year-old Park, a medical industry worker who made huge profits from Seegene, opened a stock account in the name of his five-year-old daughter as soon as he heard she could benefit from the tax deduction. on donations by investing in shares. Gifts to children under the age of 19 are exempt from gift tax up to a limit of 20 million won for 10 years. For example, if you buy 20 million won of shares at a year of age and then buy another 20 million won of shares at age 11, 10 years later, you do not have to pay a gift tax of 40 million won. Some parents were found to be using closing accounts that can flexibly manage and deal with various assets such as the US Stock Exchange Fund (ETF) and funds as well as domestic stocks. It is analyzed that the upturn in the balance of branch-type casings (type PB) sold by national securities companies this year also had such an effect on the contraction of the fund market.

Jaewon Park / Reporter Hankyung [email protected]