[ad_1]

Let’s get off the tax bill … The real estate market intensifies the conflict

There are more than 2 billion charters on Gangnam

“Tell me tax on the large tenant guide”

Seoul apartment complex seen from Namsan. / yunhap news

Moo Yoon (42), who lives in an 84㎡ apartment exclusively for Godeok Raemian Hill estate in Godeok-dong, Gangdong-gu, Seoul, received a comprehensive property tax for the first time this year. The official price of the apartment he lives in jumped to 945 million won, beating the standard of charging a tax of 900 million won. The price of this apartment rose steeply this year and was recently traded at 1,475 billion won, but it was a home for less than 1 billion won in the first half of last year that Yoon bought.

People around me say, “I’m envious that there is a house that can pay the taxes,” but Yun is not happy that the price of the house has gone up. Yoon felt deprived after hearing that the rent in Gangnam exceeded 2 billion won in the same area. He said, “There is no way to make a profit selling it because it is a house to live in anyway, but paying taxes is a burden for a salaried worker.” “I am bothered by the government that is raising the money,” he said.

“Isn’t there an increase in property prices in the Gangnam area from living in a letter?”

According to the real estate industry on the 25th, when the National Tax Service announced this year’s tax bill, the real estate market is arguing about high-priced private tenants in the Gangnam region. Home prices have risen dramatically and the rate reflecting published prices has risen, dramatically increasing the tax burden on homeowners, but high-priced jeonse renters have been diverted from the government’s tax bomb.

In the Gangnam area, there are many privately located houses that outdo quite a bit. As for the actual transaction price information system of the Ministry of Land, Infrastructure and Transportation, the 84 dedicated to the Raemian Daechi Palace in Daechi-dong, Gangnam-gu, was signed for a charter contract for 2.22 billion won on the 21 October. In Banpo-dong, Seocho-gu, 84m2 was sold to Acro River Park for 2 billion won this month.

As rent has skyrocketed around Gangnam’s elevated complexes, the voice of single-house dwellers is also growing. In the online real estate community, “Why do apartment renters in Gangnam with more than 2 billion won have to pay millions of won taxes?”, “Acquisition tax, education tax, property tax , etc. Even if you live alone in an apartment, the tax that is owed to the country is not a penny or two. Opinions are being issued like, “Are property owners in the Gangnam region escaping the trend of the government of raise taxes because they live on cheonsei? ”

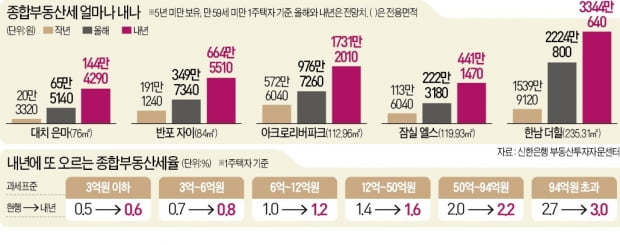

According to the real estate industry, this year’s taxpayers are estimated to exceed 700,000 and the tax amount will also reach 4 trillion won. Apartment owners in Seoul’s Gangbuk area, who did not pay the tax until last year, also accepted the tax bill for the first time this year. According to the data presented by the Ministry of Land, Infrastructure and Transportation to Representative Hyun-jin Bae, the power of the people, the number of houses with an official price of 900 million won or more, which is subject to tax per household this year , increased by 38.3% (7,7859 households) to 28,1033 households in Seoul alone.

Recently, the government is showing a tendency to pay more taxes to people who own a house through measures such as the modification of the tax law and an increase in the market price reflection rate (realization rate) of prices. of the land publicly known. Taxes are increasing significantly at all stages of the purchase (acquisition tax), property (deposit tax) and sale (transfer income tax) of real estate, not just for people with multiple households , but also in a single home. There is also a large tax burden for homeowners who are not subject to the final tax. For example, even if you buy an apartment with a municipal price of 500 million won on the outskirts of Seoul, you will have to pay a 5.3 million won acquisition tax to local governments and a property tax of about 500,000 won.

Controversy over the benefits of the expensive charter rental law

There is also controversy over the benefits of the leasing law. Among the three leasing laws, the right to request the renewal of the contract (2 + 2 years) and the upper limit of jeon and monthly rent (5%) were introduced. From now on, tenants are guaranteed to live in jeon and rent monthly for 4 years, and the tax increase is limited to the minimum range. Tenants in the Gangnam region, living in expensive cheonsei with billions of billions of dollars or more, are free of the tax burden and are legally protected. Because of this, there is a voice of controversy as to whether the tax is really fair.

A Y-certified official in Daechi-dong said, “There are tenants who come to renew their leases after the tenancy law was introduced. Saying. Recently, in Daechi-dong, the total price based on a medium-sized area exceeded 2 billion won from 1.7 billion won.

A real estate agency in the commercial district of the Jamsil apartment complex in Songpa-gu, Seoul. / yunhap news

Park Mo (41), an office worker who bought an old apartment in Gangseo-gu, Seoul after 7 years of marriage after living without a home for a long period of time, said, “After jeonse’s contract ended, the rental property disappeared due to leasing law enforcement. (A slang that attracts the soul) and just bought a house.

Mr Park said, “Despite the situation being like this, there are many people who say that even people who buy expensive charter flights in Gangnam don’t know why the government guarantees the rental period and cost. “Do you want to put all the burden on the owner?”

Ahn Hye-won, Hankyung.com Reporter [email protected]