[ad_1]

After Gimpo, Gyeonggi-do was added to the area to be adjusted, a balloon effect appears in Paju, and apartments with new reported prices appear every day. New District of Paju Unjeong City 3. / Hankyung DB

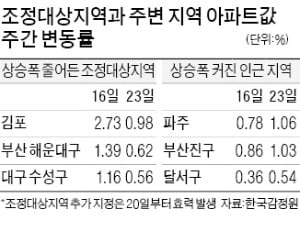

The government has announced that house prices are overheated, such as Gimpo, Busan, 5 districts, and Suseong-gu, Daegu, as regulated areas, but house prices are not easily detected. Rather, the balloon effect is spreading into the surrounding area, such as Ulsan and Changwon. The government is showing other regulatory possibilities in these regions. Consumers are looking for the next investment. It is noted that the flimsy regulation of the “mole-catching ceremony” clamps has rather signaled a rise in house prices wherever the government knocks.

Review of regulated areas of Ulsan, Changwon and Cheonan

According to the real estate industry on the 8th, the government is reviewing a plan to group the places where house prices are overheated by the balloon effect in the unregulated areas of the provinces during this month as regulated areas. Ulsan and Cheonan, Chungnam, Changwon, Gyeongnam and others are counted as additional regulatory areas.

An expert in the real estate industry said: “Analysis of the Korea Appraisal Board’s statistics shows that the rate of increase in house prices in unregulated areas such as Ulsan, Changwon and Cheonan is remarkable.” They are known to be considering designating a target area for adjustment. ”

The Ministry of Lands, Infrastructure and Transport has already stated that it will consider an additional designation if overheating continues in the rest of the non-designated areas, as it grouped Haeundae in Busan and Gimpo, Gyeonggi as areas subject to adjustment. Land, Infrastructure and Transport Minister Kim Hyun-mi also said: “We are paying close attention to the fact that the balloon effect appears in the area close to the regulated area.”

According to the Korea Appraisal Board, apartment prices in Ulsan have increased by 2.32% in the last three months. The house price in Nam-gu was found to have risen 4.64%, causing many jumps. Nam-gu, Ulsan’s growth rate over the past year has reached 10.05%. In Changwon, Seongsan-gu is up 4.38% in the past three months. Seongsan-gu has risen 11.60% over the past year. Uichang-gu is up 2.77% in the last three months and 8.32% in the past year.

In the case of Cheonan, Chungcheong area, the rate of increase in West Buk-gu increased by 2.79% for 3 months and 7.10% for 1 year, while the rate of increase of 3 months in Gyeryong was 1.80%, but the 1-year rate of increase reached 9.59%. In particular, the number of transactions in Gyeryong city apartments in August does not reach 80, but among them, 32 transactions from outsiders accounted for 47.5%, and are registering high levels at 40.0% in September and 32.7% in October.

Balloon effects like Gimhae and Pohang will appear … Strangers en masse

As it is said that Ulsan, Gyeongnam, Changwon, Chungnam, Cheonan, etc. will be included in additional regulated areas, investors are already looking for the next investment. It means that ‘regulation → balloon effect → regulation → balloon effect’ repeats infinitely. An official from a brokerage in Gimhae city said: “Foreigners who have invested in Uichang and Seongsan-gu are said to have recently been looking for real estate in Masan, Jinhae and Gimhae.” It is to see. “

It is news that foreign investors are already buying pre-sale rights or houses with an official price of 100 million won or less in Masan’s member districts. In Gimhae, the highest prices come out every day. The 74th dedicated to ‘One Major Xy’ in Jangyu-dong, Gimhae-si, Gyeongnam, was first established late last month, surpassing 400 million won. Considering that the transaction took place between the mid to late 200 million won in September of last year, the trading price increased by more than 100 million won in one year and three months. The 84 square meters dedicated to the nearby ‘Yulha Xihill State’ also sold for 450 million won, the highest price ever.

An apartment complex in Suyeong-gu, Busan, which was recently redesignated as a target area for adjustment. / yunhap news

Investors who entered Ulsan are flocking to Pohang, Gyeongbuk. The 84㎡ dedicated to the Daejam-dong of Xi, Nam-gu, Pohang-si were recently traded for 550 million won. It was 75 million won more than the 475 million won in the same area that was transferred.

In the metropolitan area, apartments were spilled that renewed the prices reported every day in the new city of Paju Unjeong. The 84㎡ of the exclusive area for I-Park in the new town of Unjeong registered a price of 854 million won the day before the announcement of the regulation last month. The 84th dedicated to Central Prugio, Unjeong New City, also posted a reported price of 865 million won. It increased by 75 million won in less than a week from the previous transaction, 790 million won on the 9th.

In the market, ‘the government touches, the price of housing rises’ officially leaves

When the government regulates, the situation where house prices in areas that are not regulated keep going up, and the market is saying, ‘If the government touches, house prices go up.’ Leading online real estate communities complain that the government’s property regulation policy is a plan to increase tax revenue without tax increases. A member of the online community said: “I don’t know about the side effects of the balloon effect, but it is frustrating to stick to regulations for catching moles. Criticized. Other members also complained and said: “It is to strengthen the real estate regulations to raise taxes in the end.”

Experts are also concerned that the government’s designation of a regulated area in the northern rear may not be a fundamental alternative, but may cause more side effects. The market, which has become accustomed to the balloon effect, now accepts the fact that it has not been included in the announcement of areas regulated by the government as a “sign of speculation.” Sim Gyo-eon, a professor in the Department of Real Estate at Konkuk University, said: “Current government measures may have a short-term effect, but in the medium and long term, most of them have opposite effects. Increase supply in regions with high demand instead of anti-market policies like restricting reconstruction, etc. “We need a long-term plan.”

Ahn Hye-won, Hankyung.com Reporter [email protected]