[ad_1]

Photo = Getty Image Bank

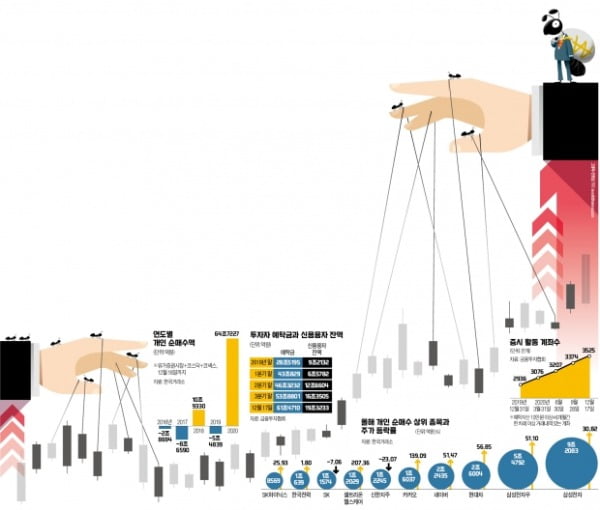

In the stock market, the “defeat of the ants” was like a formula. The individuals followed the foreigners with delay and repeatedly beat them to the top. After opening the stock market to foreigners in 1992, there were no exceptions. Most of the people felt powerless and left the stock market and headed for real estate. While the KOSPI index has been locked in the box for 20 years, the myth of real estate failure has solidified. But this year’s winner is ‘Donghak Ant’. I got the experience of “collective success” for the first time by eliminating all kinds of biases in the stock market.

According to NH Investment & Securities on the 20th, the average profitability of all the company’s accounts (at the end of November) is 10.81%. The average return on accounts opened this year reached 20.32%. This is the result of boldly betting on the Korean market since last March, when Corona 19 went public. After the foreigners left, the empty market was the first opportunity for individuals to buy stocks from below. There was a belief that no matter how difficult the world economy becomes due to Corona 19, Samsung Electronics and Hyundai Motors will not fail.

Individuals have bought shares throughout the year. It was a “game to buy time” to hold out until the stock price rose. This year’s personal net purchase amount reached a record 64,722.7 billion won (as of the 18th). Thanks to that, the KOSPI index is breaking the 10,000 year box-pee (the KOSPI index stuck in the box sphere) and is breaking an all-time high. On the 18th, the KOSPI index (2772.18) was up 90% from the March low (1457.64). Exceeds the rate of increase of the NASDAQ index (86%). Kim Hak-gyun, director of the Shinyoung Securities Research Center, said: “This year has been a year for Korean equity investors to have a new faith in the first ‘collective success experience’.”

Breaking the ‘three biases’ in the stock market … ‘2020 Donghak Ant’, the profit rate winner

“The stock market has a lot of ants and it won’t go up.”

While the KOSPI index reached its lowest point in March and reached the 2,400 line, the research center of the securities firm sounded such a beep several times. It was said that the market led by individuals could easily collapse. Also added is the empirical prejudice that individuals have always been at the bottom of the bull market and have been bitten. The analysis was followed that the overheating of the stock market was similar to that of the dot-com bubble.

Donghak ant, claiming to be a ‘stock market firefighter’

Individual investors didn’t care. The era of “zero interest rates” came when Corona 19 released a large amount of money and increased the intensity of real estate regulations. The only investment left was the stock market. At the end of October this year, people net purchased 62.72 trillion won. It took intact the shares sold by foreigners and institutions. With only individual strength, the KOSPI index broke the 2400 line again last month.

Even on the way to the 2700 line, individuals assumed the role of firefighters for the stock market. On the 30th of last month, foreign investors sold Korean shares on the largest scale in history. On the stock market, he sold a net worth of 2.437.7 billion won. Instead of panicking, the individual bought stocks. The net purchase was 2.2205 billion won. This was also the largest. The KOSPI index decreased only 1.60%. It was right after the 2600 line was broken. Despite concerns that “it’s gone a lot already,” people actively bought stocks because they knew the overseas sell-offs were “mechanical sales.” This was the day the MSCI Emerging Markets (EM) Index was reorganized. The KOSPI index registered 2772.18 (as of day 18), an increase of 6.98% in 15 days. It is a historical record.

Follow the trail of the ant

The prejudice of “buying news and selling it at the box” was also discarded. It was the exact opposite. They invested when they adjusted and made a profit when stock prices rose.

The day people sold the most Samsung Electronics shares this year was July 28. After a long absence, a network of foreign investors bought Samsung Electronics worth 900 billion won. The news of Intel’s 7-nano process delay reflects the expectation that Samsung Electronics will enjoy the reflected earnings. The individual dropped 900 billion won without hesitation on this day. Since March, when the stock price has already bottomed out due to Corona 19, he has been buying Samsung Electronics one by one and making a profit. On this day, the share price of Samsung Electronics rose 5.4%.

In the third week of July, when President Moon Jae-in announced the Korean version of the Green New Deal, Hyundai Motor’s stock price jumped almost 20%. People didn’t miss out on this opportunity and sold 300 billion won worth of stock. In addition, it showed a ‘new build’ that bought leading stocks such as LG Chem in the checkout area and sold at highs.

At each major turning point, the investment strategy also evolved. In March, when the fluctuation was great, companies that would not fail like Samsung Electronics moved to BBIG (bio internet gaming battery) companies, including Kakao and Naver, which benefited from Corona 19 starting in April. Since July, when policy momentum increased, it has shifted towards policy beneficiaries such as the Green New Deal and economically sensitive stocks such as semiconductors, which are expected to benefit from the economic recovery starting in November. The market has come to analyze ‘individual taste’. This is because the stock price could go up only after receiving a personal choice. Dae-Joon Kim, a researcher at Korea Investment & Securities, said in a September report titled “An Individual’s Strange Taste.” “Now the individual has become a representative actor that moves the market.”

The new partner between the company and the ants

It is analyzed that a full-fledged ‘companion’ of companies and individual shareholders has also started the ‘Ant Donghak’ fever this year. In the third quarter, there were 1.75 million minority shareholders who owned less than 1% of Samsung Electronics shares. It is more than the number of residents of Gangwon (1.54 million). Compared to the third quarter of last year (610,000 people), this is three times more.

The “different status” of the individual is found everywhere. Individuals also voiced louder voices than organizations in LG Chem’s LG power solution materials splitting process. It should be noted that not only traditional dividend stocks, but also growth stocks such as Samsung Electronics and LG Chem , dividends are increasing. In order to persuade opposing shareholders, LG Chem has devised a shareholder return strategy to pay out more than 10,000 won per share each year for three years.

It is a task that the interests of management and minority shareholders may differ on individual issues. However, the fact that they finally want the same direction is an analysis that it may be an opportunity. This means that an individual can be a great support force for a company. Jeong Seong-han, director of Shinhan BNP Paribas Asset Management’s Alpha Management Center, said: “When executives deliver results and increase shareholder value, the era will come when individual investors will become ‘Avengers ants. ‘that support and protect corporate decision making. I will, ”he predicted.

Reporter Go Jae-yeon / Go Yoon-sang [email protected]