[ad_1]

‘Public price is raised and property tax is lowered for homeowners under 600 million won …’

The government announced on the 3rd that it would raise the official price of real estate to make it happen and at the same time reduce the property tax for a homeowner with the official price of 600 million won or less. Under the government’s property tax reduction plan, if you own a house with an official price of 100 million won or less, you will pay a maximum of 50% less property taxes. The increase in public price and the reduction of the property tax of a single owner, how much will the property tax change? We look at the examples presented by the government.

Apartment complex in Seoul. News 1

Public listing price of 400 million won Seoul Jongno apartment … Annual average of 90,610 won below

Let’s look at the Jongno A apartment in Seoul as an example from the Ministry of Public Administration and Security. The official price of this apartment this year is 400 million won. In addition to the assumption that the owner of the apartment is a landlord, the property tax reduction effect, which varies under the premise that the house price has not changed for three years, amounts to about 100,000 won.

First, the published price realization rate (based on apartment homes), which was 69% this year, is 70.2% in 2021 (4.568 million won) → 71.5% in 2022 (411.35 million won) → 72.7% in 2023 (417035,000 won)). When the public price increases, the tax base, which is the base of the property tax, also increases. The tax base is calculated by multiplying the quoted price by the fair market price ratio (60%). The fair market price ratio refers to how much the advertised price applies when collecting property taxes. The tax base calculated by multiplying the official price of 400 million won for this apartment in Jongno A by 60% is 240 million won this year.

The amount of the tax calculated according to this tax base is 420,000 won. However, the actual amount of taxes paid by the owner of this home is 282,230 won. The difference is that even though the market price has risen a lot due to the ‘tax burden limit system’, this difference occurred because the tax burden was set at 10% for houses under 600 million won. to avoid an increase in the tax burden. An official from the Ministry of Public Administration and Security explained, “In the beginning, the tax paid on this house was low and the property tax was 28.7230 won since the tax cap was applied.”

If the realization of the published prices only modifies the property tax, the tax will continue to rise for three years. The property tax for this home this year is 282,230 won. The property tax will increase to 3,105,950 won next year, 345,540 won in 2022, and 382,290 won in 2023. The property tax, which was around 280,000 won this year, will increase by about 100,000 won to 380,000 won thereafter. three years.

However, due to the government’s ‘property tax reduction of less than 600 million won for one owner’, the tax is reduced by 90,000 won to 100,000 won. How is it possible?

The tax amount calculated in 2021, which reflects the published price realization rate (70.2%), is 3,068,810 won. This is the result of an increase of 19,580 won compared to 282,230 won in property taxes this year. Although the government lowered the property tax, the tax should not increase, so one more “adjustment” was made here. The adjustment was made assuming that the 2020 property tax (amount of tax paid), which is the basis for calculating next year’s tax, was reduced by 0.05 percentage points. An official from the Ministry of Public Administration and Security explained: “Because the property tax should not increase even though the tax was paid, it was assumed that the special tax rate of 0.05% point was already applied, and the effect of the Subtractive load mitigation could be done through tuning.

The property tax for next year as amended in this way is 225,000 won. It is approximately 60,000 won less than the property tax paid this year. Thus, the property tax for this house will be 248,230 won in 2022 and 275,3050 won in 2023. Property tax continues to increase with the realization of the published price, but up to 109,240 won (as of 2023) is paid. less than the original tax.

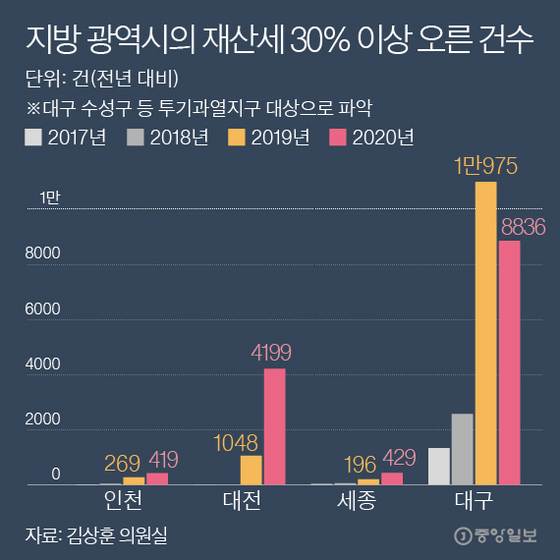

The number of cases in which property taxes in local metropolitan cities have increased by more than 30%. Graphic = Reporter Park Kyung-min [email protected]

165 million won listing price for Chuncheon’s apartment reduced by 50,000 won per year

How about Apartment B in Chuncheon, Gangwon-do, with the official price of 165 million won? Property tax cuts made for a limited time of three years are set differently for each published price range.

The rate is reduced by 0.05% for each section of the tax base, but the largest property tax reduction rate is for a homeowner with a listing price of 100 million won or less. A 50% reduction rate is applied from 0.1% to 0.05%, resulting in a tax reduction of up to 30,000 won. Property tax of up to 75,000 won is reduced from 30,000 won for less than 100 million won to 250 million won (a reduction rate of 38.5% to 50% applies).

Also, for houses less than 250 million won to 500 million won, the property tax is reduced from 75,000 won to a maximum of 150,000 won (reduction rate of 26.3 ~ 38.5%) . If you own a home between 500 million won and 600 million won, you can receive a property tax reduction from 150,000 to 180,000 won (reduction rate from 22.2 to 26.3%).

![The government's property tax reduction plan was announced. [정부 발표안 캡처]](https://pds.joins.com/news/component/htmlphoto_mmdata/202011/04/165ef9ef-a1f9-40af-b4d7-edb91fc8a0f8.jpg)

The government’s property tax reduction plan was announced. [정부 발표안 캡처]

This year’s property tax for Apartment B is 118,500 won. Based on the published price realization, the published price of this apartment will increase from 166.3 million won next year to 168,616,000 won in 2022 and 168,923,000 won in 2023. Property tax will increase from 119,670 won to 12,850 won ( 2022) → 122 030 won (2023) next year.

However, due to the property tax cut, the property tax for this apartment next year will be 60.9780 won, which is 4.9890 won less than the 119670 won estimated for the property tax next year. year, which only reflects the published price update. Property tax due in 2022 will be changed to 7,560 won, and in 2023 it will be 71,350 won. This means that they will receive a property tax cut of approximately 50,000 won each year.

The government-announced price reduction of less than 600 million won for property tax for homeowners will take place for a limited time of three years. An official from the Ministry of Public Administration and Security said: “If the tax returns to its original state (after 3 years), it will be difficult to do so because the tax will increase suddenly.” Explained.

Professor Kim Woo-cheol from the Tax Department of Seoul University said, “If it was necessary to reduce the tax burden, we should have taken exceptional measures in addition to lowering the tax rate.” I will give it to you.”

Reporters Kim Hyun-ye and Choi Eun-kyung [email protected]

[ad_2]