[ad_1]

Drive all inland transportation to Han Express

Hanwha Solutions Indictment Charges … Except Without Executive Evidence

[세종=뉴스핌] Reporter Min Kyung-ha = Hanwha Group’s flagship subsidiary, Hanwha Solutions, unfairly supported Hanwha Group’s older sister, the family of Hanwha Group’s president’s older sister, Kim Seung-yeon, as the majority shareholder, but was captured by the authorities of the process.

The Fair Trade Commission announced on the 6th that it decided to impose a correction order and a total fine of 22.9 billion won on Hanwha Solutions and Hanwha Express and to file a complaint against Hanwha Solutions with the prosecution.

◆ Driving ground transportation for 11 years … Support to receive toll taxes

Hanwha Solutions, which mainly produces petrochemicals, is a company whose name was changed to the former ‘Hanwha Chemical’ and recorded sales of 3.9 billion won and an operating profit of 350 billion won as of 2018. Han Express is a Logistics company and the family of Kim Young-hye, the older sister of President Seung-yeon Kim, owns 51.97% of the shares.

Until May 2009, Han Express was a subsidiary owned by Chairman Seung-yeon Kim and operated by the Group’s Management Planning Office. The Fair Trade Commission said there was a high possibility that Hanwha affiliates would negotiate on terms favorable to the owner and the nominated company, and that such support activities continued even after Han Express was sold to the Kim Young family. hye in May 2009.

|

| [자료=공정거래위원회] 2020.11.06 [email protected] |

The FTC noted that Hanwha Solutions has paid remarkably high shipping costs by routing all of its container and tanker shipments to Han Express.

First, from June 2008 to March 2019, Hanwha Solutions brought its entire export container inland shipping volume (worth 83 billion won) to Han Express and paid a remarkably high freight cost to support a total of 8.6 billion won.

Hanwha Solutions claimed that such unification measures were due to reduced transportation costs, but the FTC decided it was just a relief.

In fact, Hanwha Solutions stopped all transactions with existing shipping companies in February 1999 to bring the container volume to Han Express. In August 2014, although there was a company that paid freight rates up to 37% lower than Han Express, it continued to negotiate with Han Express.

Additionally, from January 2010 to September 2018, Hanwha Solutions exclusively entrusted its tanker truck transportation transaction volume (worth 151.8 billion won) to Han Express, and paid a remarkably high transportation cost to support a total of 9.1 billion won.

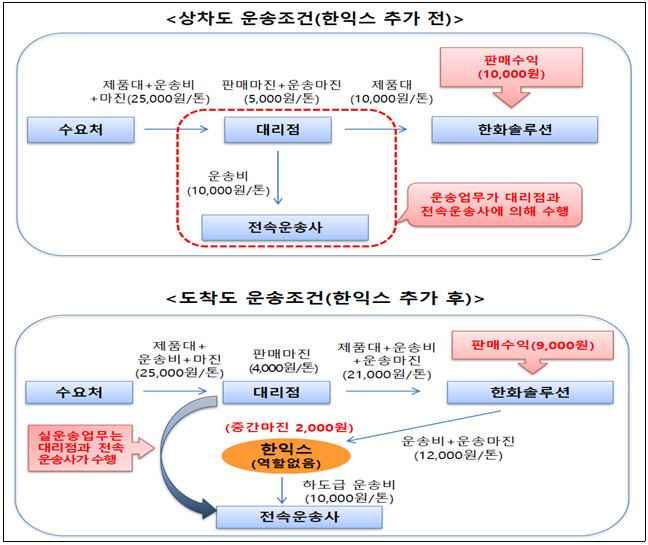

In particular, Hanwha Solutions added Hanwha Express, which has no real role in the transportation transaction process, in the case of transactions with a customer through an agency, so that tolls can be collected.

Although the actual transport management and safety management tasks were carried out between the agency and the exclusive transport company, Han Express was able to take a margin of more than 20% in between. Exclusive transport companies became subcontractors for Han Express and suffered price cuts in the transaction process. Hanwha Solutions paid higher transportation costs as Han Express took an intermediate margin.

◆ Long-term monopolistic offer and impediment of fair trade … Hanwha Solutions indictment charges

The Fair Trade Commission believes that this supporting law has unreasonably improved the conditions of competition for Han Express compared to its competitors.

The tank truck transport volume provided by Hanwha Solutions represents 8.4% of the transport volume of household hazardous chemicals and approximately 40% of the transport volume of hydrochloric acid / caustic soda. Furthermore, KRW 17.8 billion in moving support represented 30.6% of Han Express’ net income during the support period, which explains that it also enjoyed a clear financial structure improvement effect.

He pointed out that it also brought impediments to fair trade such as the exclusion of competitors and the blocking of the market. Hanwha Solutions prevented potential competitors from entering the market by exclusively supplying Han Express with large quantities over a long period of time. Furthermore, the toll transaction violated the basis of competition between small and medium-sized transport companies.

|

| Cho Seong-wook, chairman of the Fair Trade Commission. [사진=공정거래위원회] 2020.09.09 [email protected] |

The Fair Trade Commission imposed a penalty of KRW 15.687 million on Hanwha Solutions and KRW 7.283 million on Han Express along with the corrective order. Additionally, Hanwha Solutions was charged with prosecution. It is explained that there was no evidence of direct participation against the owner’s family and executives, so the charges were not filed.

“This measure is significant because it was not a subsidiary of a large company, but it was not a subsidiary of a large company, but it was confirmed that it brought logistics work to a company that can be said to be a whole family.”

“The Fair Trade Commission plans to develop and implement a plan this year that allows carriers belonging to large corporate groups to autonomously open their logistics tasks and cooperate with each other.”