[ad_1]

|

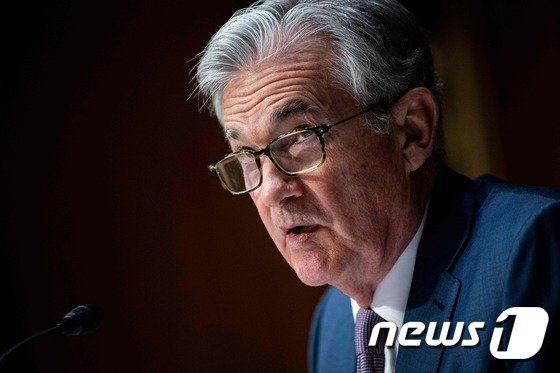

| US Federal Reserve Chairman Jerome Powell attends a Senate Banking Committee hearing on Capitol Hill in Washington on the 1st (local time). © AFP = News1 © News1 Dongmyeong Woo |

In relation to the results of the Federal Open Market Committee (FOMC), the monetary policy-making body of the US Federal Reserve (Fed), Korea Investment & Securities ruled out the possibility of an anticipated rise and fall of rates (phasing out quantitative easing policy) despite upward economic outlook. “He said:” Financial market volatility caused by interest rate hike concerns is expected to gradually diminish “.

The Fed maintained its position of freezing the federal funds rate for 2023, while raising its economic outlook to reflect the recent economic and employment improvement. Fed Chairman Jerome Powell said he would not make changes based solely on the outlook. He also ruled out that this is not the time to talk about the set-up.

In a report on the 18th, Kwon Hee-jin, a researcher at Korea Investment & Securities, said: “This is a reaffirmation of the Fed’s strategy behind the curve. It means that we will respond by looking at the indicators to see how far we can improve. , rather than adjusting liquidity in advance according to the economic outlook as before, “I said.

Researcher Kwon said: “In the case of the former (adjusting liquidity in advance according to the economic outlook), if the objective of the policy is to minimize economic volatility, the objective of the back portfolio strategy is to stimulate the economy. It’s effective enough to offset the adverse effects (increased inflation) (increased employment). If you can wait, I’ll try to take it as far as possible, so don’t worry. ”

He said: “This meeting was the first inflation forecast to exceed 2% after changing to the average price target last year, but it is significant that we have practically confirmed the future direction that we will not respond much to this,” he said.

Researcher Kwon said: “It is expected to have a positive impact on the financial market. The uncertainty has not completely disappeared as it has not yet been confirmed whether or not to extend the Supplemental Leverage Ratio (SLR). Market volatility it will diminish as the possibility of an anticipated rise in interest rates, which is the main reason the market has weakened, will diminish. ”

He added: “The strengthening of the dollar that has accelerated since February and the resulting increase in the won-dollar exchange rate is also expected to gradually stabilize, partially retreating.”

[ad_2]