[ad_1]

The Korea Automotive Industry Association (KAMA) announced on September 9 that global car sales in September reached 7.95 million units, 2% more than in the same period last year.

|

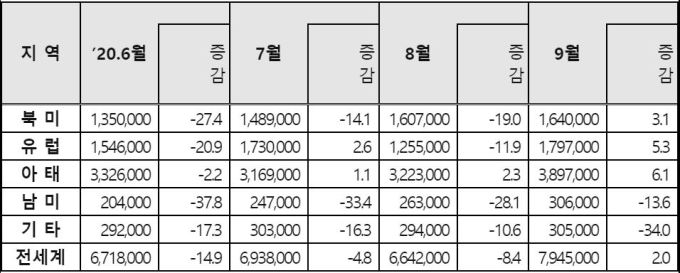

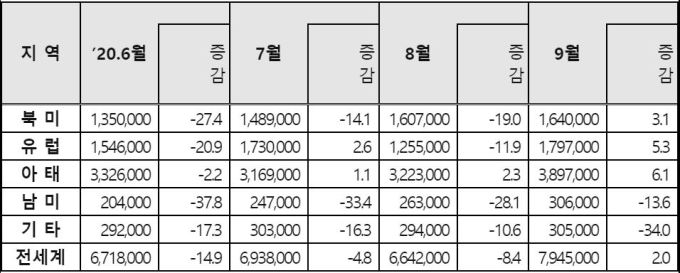

| Recent trends in global car sales (unit: units,%) [자료=한국자동차산업협회] |

By region, car sales in major markets such as the United States, Europe, China and India increased compared to last year.

The United States saw an increase for the first time since the coronavirus in September due to the government’s economic stimulus measures, such as the lowest interest rate in history and the increase in demand for car replacement due to the avoidance of public transportation. , and increased 6.1% to 1.34 million units.

In Europe, sales in September also increased again after July due to incentives for low-emission vehicles, continued travel restrictions and increased demand for air delayed by Corona 19.

However, as Corona 19 is proliferating again in advanced markets such as the United States and Europe as of October, the continued rise is uncertain.

The number of new confirmed cases in the US more than doubled, from 46,000 on October 1 to 93,000 on November 2. France has soared from 14,000 on October 1 to 45,000 on October 1, and major countries like the UK and Germany are also rapidly increasing the number of new confirmed cases daily.

In Europe, with France, the UK and Belgium applying lockdowns since November, new car sales are expected to decline due to the effect of the dealership closure.

Dealers operate in Germany, Austria, Portugal and the Czech Republic, but the negative effects such as the contraction of consumer confidence due to the partial lockdown are expanding.

The US also rose slightly (1.1%) in October, but the continued rise is uncertain due to the still high unemployment rate coupled with the reproliferation of Corona 19, declining consumer confidence due to rising unemployment permanent and delays in negotiations for additional economic stimulus funds due to the presidential elections.

Consequently, it is unclear whether domestic auto exports, which have increased for two consecutive months since September, will continue. As union risks increase, such as the recent implementation of a partial strike by GM Korea, the preparation of the Kia Motors union for the strike, and the delay in negotiations between workers and Renault Samsung management, there is a growing concern about the supplier liquidity crisis.

Man-gi Chung, president of the Korea Automotive Industry Association, said: “It is fortunate that the crisis in the crown has slowed for a while and global demand has recovered.” The conflicts between workers and employers, such as the negotiation and the strike in the automotive industry, which have not reached an agreement recently, must be resolved as soon as possible ”, he emphasized.