[ad_1]

‘Tuk-tuk’ with a total established value of 300 million to 400 million

Dizzying fatigue … even moving around in Mapo and Gangdong

Avoid investor anxiety before balance payment

As the jeonse price fell, the jeonse price rate fell, making ‘gap investors’ nervous. A sales flyer is posted at a real estate company in downtown Seoul. / News 1

“Compared to the beginning of this year, the rental price has dropped from $ 300 million to $ 400 million, but not many customers are looking for it. Now the property is stacked. As the semester began, demand from school districts decreased and demand decreased as many lease renewals took place due to the third lease law. “

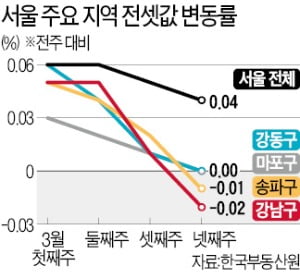

In recent years, due to fatigue caused by rising rents, the rise in rented rents has slowed as apartments in large complexes began to move in some areas. In the jeonse market, March-April is the time when the demand from the school district ends, and in the rental market, it is low season. Instead, it is a time of demand mainly for newlyweds, but the atmosphere is different this year. A certified official near Daechi-dong said: “Even for the most popular apartments of less than 84 square meters, the owners have started to reduce the sale price of the rent.”

Amid the market assessment that the market price will increase, the bargain price has increased, but the jeon tax has decreased. On the site, the rent started to go out one by one, even to the complex, where the rental price fell to the level before the application of the Lease Protection Act. Sales of 76m2 exclusive area for ‘Eunma Apartment’ in Daechi-dong, Gangnam-gu, where there is a great demand for collegiate education for children’s education, as the school district is close, has increased from 1.95 billion won at the end of last year to 2.24 billion won. On the other hand, during the same period, jeonse was hovering around 1 billion won, but now the sale price has dropped to around 600 million won. In June and July of last year, prior to the enforcement of the Lease Protection Act, the same type of jeonse home was marketed for 650 million won.

In the Godeok-dong area, Gangdong-gu, where the number of occupants began to accumulate from February, the jeonse was recently reduced by about 200 million won. For the 59㎡ dedicated to Godeok Grasium in Godeok-dong, Gangdong-gu, the rental price rose to 820 million won in February, but the current listing has risen to 630 million won. A certified official in the Godeok-dong area said, “It is natural for the price to drop as the quantity of goods rushes during the moving period,” he said. “The jeonse price is similar to last June-July year.”

According to the industry, the area around Mapo, Seoul, where the occupation is in full swing, shows a similar trend.

The tenants sigh when the jeonse, who had only been climbing, has fallen. On the other hand, so-called “gap investors” who used the “jeonsenan” to buy high-tax jeonse apartments and made investment returns from business profits seem to be very nervous. In particular, the jeonse, which skyrocketed late last year, was on the rise in the gap investing craze, but investors who paid off the balance after two to three months are spotting signs of a balance in which no they can find tenants. .

An official from the H official in Junggye-dong said: “Gap investors, who bought small apartments with a small gap in mind, began to worry about a drop in jeonse prices before the balance was paid.” out of season, but as the chartered sales offered by investors accumulated, the price of the chartered money in the second half began to fall.

The price of 84 square meters dedicated to the third billing in Junggye-dong rose to 870 million won (15th floor) on the 21st of last month, and a charter contract was signed, but the current market price is between 770 million won. and 780 million. livestock.

View of the Eunma Apartment in Daechi-dong, Gangnam, Seoul. / Hankyung DB

As the jeonse price rate declines in various locations in Seoul, new gap investments are disappearing as well. According to Asil (apartment real estate transaction price), the gap investment share in most areas of Seoul in January was significantly lower than the previous year. In Nowon-gu’s case, the share of the gap investment earlier this year fell to a level below 1% of the total housing transaction. Of the total of 423 transactions, only 4 were gap investments. Taking into account that it was 17% in the same month last year and 4% in the previous year, the proportion has dropped considerably.

Dobong-gu and Geumcheon-gu also posted 1% for the same month. Seocho-gu was in the 2% range and Gangnam-gu was in the 4% range. In February, no gap investment was made in most districts except Nowon-gu, Yangcheon, Nowon, Gwangjin.

A real estate industry expert said: “It is not reasonable to conclude that gap investment will shrink in the future as demand for jeonse in Seoul will continue due to lack of occupancy.”

Ahn Hye-won, Hankyung.com Reporter [email protected]