[ad_1]

![Hong Nam-ki. [연합뉴스]](https://pds.joins.com/news/component/htmlphoto_mmdata/202010/06/16fdf478-73ba-46fa-b157-82aeba6b9460.jpg)

Hong Nam-ki. [연합뉴스]

“It is just a measure that rationalizes the financial abuse of the current government” (Dong-won Kim, former visiting professor in the Department of Economics at Korea University)

Fiscal rules of the 60% national debt ratio

Introduced in 2025, non-liability clause

There are many exceptions, such as disasters and economic crises.

“Increased debt, rationalization of financial abuse”

This is an evaluation of the fiscal rules issued by the government on the 5th. The system that was created to manage the rate of increase in debt and reduce wasteful spending gave leniency to the waste of money. The government announced that it would manage the ratio of national debt to gross domestic product (GDP) within 60%. However, with wide exceptions, the introductory period was also postponed until 2025, the next government. The current administration itself exempted the obligation to manage the debt.

On this day, the Ministry of Strategy and Finance announced a plan to introduce Korean tax rules. The fiscal rule is a system to curb debt congestion. For reference, the ratio of the national debt to GDP was 60% and the ratio of the deficit of the integrated fiscal balance was 3%. Fiscal consolidation measures should be prepared so that if this threshold is exceeded, it can be brought back within the limit.

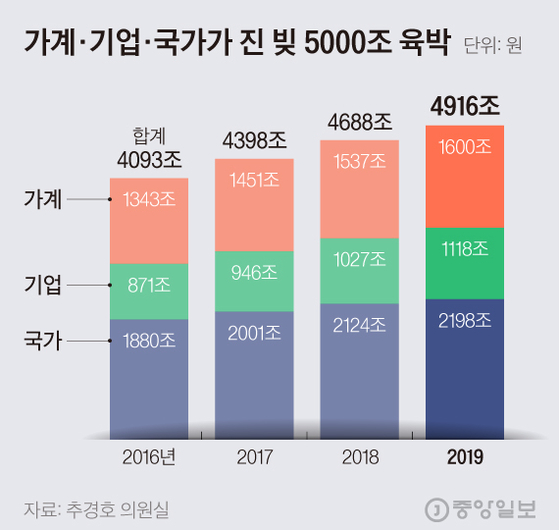

Household, business, and state debt is approaching $ 5 trillion. Graphic = Kim Hyun-seo [email protected]

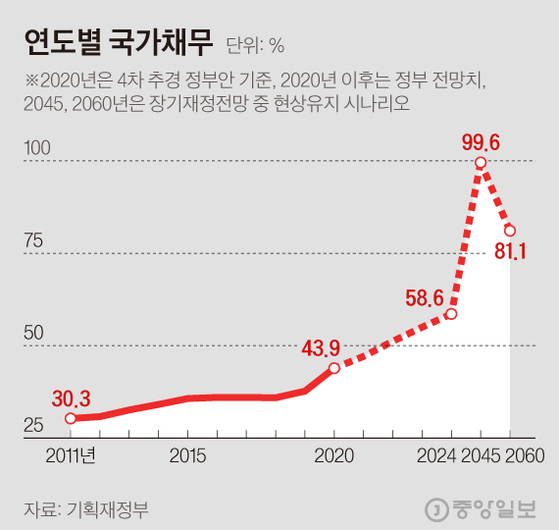

At the end of this year, the government’s national debt ratio was 43.9%, topping 40% for the first time. The rate of increase is also steep. According to the government’s medium-term fiscal projections, the national debt-to-GDP ratio will exceed 50% in 2022 (51.2%) and reach 58.6% in 2024. As it stands, it could rise to 99.6% in 2045. That’s a number to worry about in the financial crisis.

Vice Premier Hong Nam-ki and Minister of Equipment said: “Responding to fiscal robustness is an important agenda when considering the deterioration of the national debt and fiscal balance in the process of overcoming the crisis of infection by the new coronavirus (Corona 19) “. In addition, he explained the need to introduce “in the medium and long term the management of fiscal soundness and the accumulation of financial capacity in the medium to long term considering changes in the demographic structure such as the low birth rate and the aging of the population. and progress in the maturity of well-being ”.

However, experts point out that there are too many holes to escape the government’s fiscal rules. According to the design of the Ministry of Materials, it is not necessary to adhere to the national debt ratio of 60% and the integrated fiscal deficit ratio of 3% at the same time.

If the national debt ratio is less than 60%, even if the deficit ratio of the integrated fiscal balance is higher than 3%, it does not violate the rules. On the contrary, if the budget deficit index is less than 3%, the debt index can exceed 60%.

State debt by year. Graphic = Kim Hyun-seo [email protected]

Ahn Il-hwan, the second deputy minister of the Ministry of Finance, said: “Overseas countries apply the debt rule and the balance sheet individually, but Korea has designed in a complementary way to meet the standard even if an index exceeds the value. standard and if another index falls below the standard value “. Explained.

In addition to lax standards, the exceptions are vast. Exemption from applying the limit in case of large-scale disaster, global economic crisis or war. There are also requirements for mitigation, which are largely left to the arbitrary judgment of the government. If we determine that the economy is slowing down, we raise the standard for the combined fiscal deficit to 4%. The potential growth rate and the employment and production indicators are the basis of the judgment. Vice Premier Hong said: “In the event of a disaster or serious national crisis, we review under the principle that the finance function is not restricted.”

The more exceptions and mitigation rules, the less effective the fiscal rules will be. Ahn Chang-nam, professor of economics and taxation at Gangnam University, said: “The government has left too much room to admit that it is an exception in the form of ‘earrings when worn on the ears.’

The timing of implementation is also controversial. Starting in fiscal year 2025, the next regime. “We believe that the Corona 19 situation is still continuing and the implementation period is needed to comply with the limits,” the government explained. In other words, the current government can freely increase fiscal spending without being subject to fiscal rules.

Professor Kim Dong-won said: “It is no different from allowing the current government to spend up to 60% of the debt ratio using Corona 19. The passport perspective was reflected that advocated expansion of finance and opposed the introduction of fiscal rules. He diagnosed. The ruling party has opposed the introduction of fiscal rules that could play a role in fiscal expansion. Consequently, it was noted that it would be difficult for the government to draw up effective fiscal rules, and when the cap, it was noted to be ‘cotton cover’.

Jo Joon-mo, professor of economics at Sungkyunkwan University, said: “If the government reaches the upper limit, it will not be irresponsible to pass the burden on to the next government only if there is a provision for the responsibility to recover within the mandate.” He said.

Even compared to abroad, the “Korean-style tax rules” are lax. Germany had the strictest tax rules. It suppresses the issuance of new debt to less than 0.35% of GDP, which was nailed in the constitution. France has tax rules as law. Keep the structural fiscal deficit (which is maintained regardless of the economic cycle) within 0.5% of GDP.

Rather, Korea decided to set limits on the debt / debt ratio as an executing decree and review it every five years. It has left a setback for the government to change the “rules” for a national debt ratio of 60% and a deficit of the integrated fiscal balance of 3% without deliberation or resolution of the National Assembly.

Professor Kim So-young from the Department of Economics at Seoul National University said: “The government will stipulate a limit on the execution decree that can be done at will, depending on the situation, and will rewrite it at that time.” It should be specified “.

Domestic + Corporate + National Debt Closes at 5,000 trillion … 2.6 times GDP

Sejong = Reporters Namhyun Han and Seongbin Lim [email protected]

[ad_2]