[ad_1]

“The public price and the fair market price increase, so the number of people and taxes skyrocket”

Homeowner A, who owns a 116㎡ apartment in Seocho-gu, sighed after checking the details of this year’s comprehensive real estate tax (deposit tax) notice on Internet Jiro.

The final tax that Mr. A will pay this year is 2,600,000 won, more than double that of last year (990,000 won).

Mr. A said, “I had the expectation that the property tax would increase and the tax on taxes would increase, but when I saw the reported tax, I started to sigh,” he said. “I don’t know how to handle it when the tax rate goes up next year.”

The real estate-related cafes on the internet portal have also received a tax bill and published articles saying that the tax burden has increased too much.

Mr. B, who captured the confirmed tax notice with a smartphone and posted it in the cafe, said, “This year, the tax amount was 11.24,180 won.

“Will it go up to 30 million won next year and 100 million won next year?” “I live without interest, and now I am interested in selling.

Please help me without knowing the law. “

The comprehensive property tax (deposit tax) was immediately announced, reflecting the published price, which has increased significantly this year.

Due to the increase in the official price and the increase in the fair market price ratio (85 → 90%), the number of taxable tax targets is expected to increase and the amount of tax on the same real estate property is expected to increase considerably.

On the 23rd, the National Tax Service announced on the 23rd that it had notified the final tax for this year based on the status of housing and land ownership as of June 1 of this year.

Taxpayers can check the details of the tax notice through the Hometax of the National Revenue Service (www.hometax.go.kr) or via the Internet Jiro (www.giro.or.kr) of the Korea Financial Settlement Service ( KFTC) before the invoice arrives in the mail.

The final tax is a tax levied on the portion that exceeds the deductible amount by adding the published prices of houses and land per taxpayer (per person).

In the case of houses, if the sum of the published prices exceeds 600 million won, they are subject to tax.

However, up to 900 million won is deducted from a first generation owner.

The amount of the deduction for the total combined land (bare land, hybrid land, etc.) is 500 million won and 8 billion won for the combined separate land (commercial and office land).

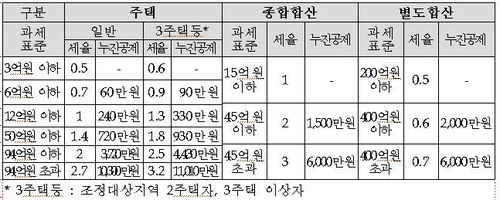

The tax rate for the tax is 0.5 ~ 3.2% depending on the number of houses and the amount of the tax base.

The tax rate is the same as last year, but last year’s taxpayers will receive a bill that has risen significantly, and tens of thousands of single-family homeowners who will pay the new tax are expected to be in Seoul alone.

Like Mr. A, who appeared in the case, in the region where the public price rose sharply, taxpayers whose assessed tax amount was more than double that of last year spilled.

This is because the quoted price has increased significantly this year, and the ratio of fair market price multiplied by the quoted price to calculate the tax base is applied at 90%, 5 percentage points more than last year.

The rate of increase in the price of public housing this year is 5.98% on average nationwide, but the public price of super-high-priced homes of more than 3 billion won in the Gangnam area from Seoul and the so-called Masongseong (Mapo, Yongsan, Seongdong) increased by almost 30%.

Taxpayers who have confirmed the final tax are screaming.

At Naver Real Estate Cafe, Mr. C said, “I live in an apartment in Dogok-dong, and the tax paid was 3,688,130 won, which is only double what it was last year.

“It is bitter because it seems that the fiscal bomb is taking notice.”

Mr. D said, “I have no income, but the tax was 1.63 million won.”

Mr. E raised his voice, “It will more than double this year next year, but shouldn’t we deduct the tax paid when paying capital gains tax?”

I consulted with a tax accountant, but the tax law has changed so much that the tax accountant is also confused. “

Godeok Raemian Hill State 84㎡, in Godeok-dong, Gangdong-gu, was the first to be taxed this year.

The official price has risen to 946 million won this year, beating the standard of taxes collected of 900 million won.

If you look at the bill posted in the real estate cafe, this 84m2 apartment is subject to a property tax of 275,9,400 won along with a property tax of 101.88 won, and a total of 286,488 won must be paid as withholding tax.

The tax burden for high-priced apartment owners has increased.

According to a tax simulation by Woo Byeong-tak, team leader from Shinhan Bank Real Estate Investment Advisory Center, the tax incurred by 84㎡ owners of Acro River Park in Banpo-dong, Seocho-gu, increased by more than 1.7 times from 28.17480 won last year to 4948.2 million won this year.

This apartment is expected to reach 10 million won to 928 million, 630 won next year, and will increase to 1.4746,000 won next year.

The owner of the 114㎡ Raemian Daechi Palace in Daechi-dong, Gangnam-gu, paid 4,024,000,920 won in the final tax last year, but this year he will receive a tax bill that has increased to 6,944,340 won.

The tax for this apartment will increase to 12,372,570 won next year and 2,1334.95 won the following year.

As taxpayers trying to verify the official tax reported on the day were overcrowded, the hometax and sontax mobile apps sometimes caused a connection failure.

Last year, the number of people notified of the final tax was 595,000, an increase of 129,000 (27.75%) over the previous year, and the amount of the notified tax was 3,334.7 million, an increase of 1,232, 3 million (58.3%).

A government official said: “There is no change in the tax rate, but the number of people notified and the amount of taxes notified have increased significantly due to the published price adjustment.”

On the 26th, the National Tax Service will announce the number of people notified of the final tax and the amount of tax notified this year.

/ yunhap news