[ad_1]

As house prices continue to rise due to the failure of real estate policy, there is a hurricane everywhere, including not only the property tax increase, but also the increase in real estate brokerage fees and the increasing number of people who have to pay health insurance premiums. A tax notice notice is posted at a real estate agency in Jamsil, Seoul. Yunhap news

As house prices continue to rise due to the failure of real estate policy, there is a hurricane everywhere, including not only the property tax increase, but also the increase in real estate brokerage fees and the increasing number of people who have to pay health insurance premiums. A tax notice notice is posted at a real estate agency in Jamsil, Seoul. Yunhap news

Amid the rise in house prices due to the failure of real estate policy, the official price has even risen (the realization rate has risen), and the consequences are spreading to areas such as welfare and education . Among the elderly, more and more people have to pay health insurance premiums, health insurance premiums for local subscribers are increasing rapidly, and many college students from low-income households find themselves in a situation where they will lose their health. opportunity to obtain national scholarships. The number of people claiming that brokerage fees have nearly doubled when buying and selling houses, and the number of houses that homeless people can buy with tiered loans is falling dramatically.

The government’s real estate situation is already causing the side effects of rising health care fees for ordinary people. On the 19th and 23rd, the National Health Insurance Service sent a directive on the loss of qualifications to 516,000 dependents. Dependents refer to elderly and minor parents who depend on their children for a living due to their low wealth and income. They can receive health benefits without paying health benefits. However, as the official price of the apartments rose to more than 900 million won, the number of people losing those ratings increased significantly.

In November, health insurance rates for local subscribers also increased by 8,245 won (9%) per household. This is the largest increase since the 2009 statistics were prepared. This is also an analysis that the increase in the quoted price is large.

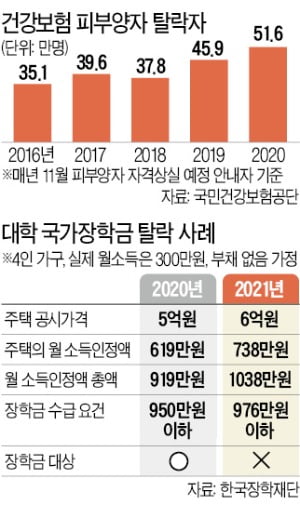

National College Scholarships can be received by household members whose income recognition amount is less than a certain standard, taking into account income and property. College students from households of four whose monthly income increased to 3 million won and the official house price increased from 500 million won to 600 million won this year, but not next year. Seoul’s college students, whose median apartment sales price exceeds 1 billion won, are expected to be hit especially hard this year.

There are also many cases of “blessing bombs”. In Seoul, brokerage fees of 0.5% for transactions of more than 600 million won to less than 900 million won, and up to 0.9% for transactions of more than 900 million won. Recently, the number of people paying the 0.9% upper limit due to rising house prices is increasing rapidly. The tiered loans, which provide low interest rates when homeless people buy houses at a market price of less than 500 million won, are growing calls that “it is difficult to find a house to support yourself” due to the increase in house prices.

Disclosures 價 Increase Side Effects One After Another … 510,000 Dependents Lost Ratings

On the 23rd, Choi Mo, a retiree who owns a home in Yongsan-gu, Seoul, learned that he had to pay a full property tax for the first time in his life. The official price of the apartment exceeded 900 million won, requiring a final tax of 250,000 won. This was not the end. On the same day, a text message arrived from Health Insurance Corporation stating that “as of December 1, the health insurance dependent qualification will be lost.” After retiring, he enrolled as a dependent of his daughter and did not pay for health insurance for more than 10 years, but the price of the house went up so he could no longer maintain dependent status. The health care fee that Mr. Choi must pay starting next month is 240,000 won per month. He exclaimed, “The only income is the national pension of 850,000 won per month. How can I increase the burden of taxes and insurance premiums like this?”

Retired health care dependents drop out one after another

Experts warned that “unexpected side effects will increase” when the government has followed through with the “policy of conducting public prices” last year. This is because the published price becomes the basis for calculating health insurance premiums as well as withholding tax and is linked to the qualification requirements for various welfare systems, such as national scholarships and basic pensions. It was said that a sharp increase in the rate of realization of public prices (price reflection rate) would increase the burden of health care fees and increase the number of people who would stop receiving social assistance. Furthermore, this concern was even greater as the market price itself is also rising rapidly as a result of the failure of the property policy.

Oh

Ryo is showing up as a reality. First, the number of dropouts by health insurance dependents is increasing rapidly. The dependents are elderly parents, minors, etc. They depend on their employees for a living and are not required to pay health insurance premiums. However, as the National Health Insurance Service reflected changes in ownership this year and changes in income attributable to 2019 through data from the National Tax Service, 516,000 people were unable to qualify for dependents. The number of disqualified dependents was 351,000 in 2016, 396,000 in 2017 and 378,000 in 2018. But last year it jumped to 459,000 and this year it exceeded 500,000.

Anyone with an annual income of 10 million won or more at the publicly advertised price of a home in possession of more than 900 million won loses dependent status. If the public price exceeds 1.5 billion won, it will be removed regardless of revenue. Those who have lost their dependent status will have to pay a new health insurance fee as local subscribers starting next month. Those who qualify for the ‘public price exceeding 900 million won and annual revenue of 10 million won or more’ will increase their monthly construction fee from 0 won to at least 231,400 won.

National scholarship dropouts are likely to increase

The burden on those who have already paid health benefits is also increasing. As a result of the Health Insurance Corporation’s recent adjustment of the health insurance rate to reflect changes in income and property, the health insurance rate for local subscribers for November increased by an average of 8,245 won (9, 0%) per household compared to the previous month. This is the largest increase since the preparation of related statistics in 2009. The rate of increase in insurance premiums for local subscribers was around 4-5% between 2015 and 2017. However, the increase in the two new years, including 9.4% in 2018 and 7.6% last year, has increased significantly. It is also an analysis of the “after storm” of the failure of real estate policy.

The subsequent storm is also reaching the students. The Ministry of Education is receiving applications for national scholarships for the first semester of the 2021 school year from the 24th to the 29th of next month. National college scholarships can be received by households whose “recognized income,” which is the sum of the property’s income conversion amount and actual income, is less than a certain standard. As a result of the calculation based on the Korea Scholarship Foundation income calculation method, college students from four-member households with monthly income of 3 million won and the publicly announced apartment price of 500 million won to 600 million won are awarded the national scholarship this year, but not next. The official price of the 600 million won apartment is about 800 million won in market price terms. Considering that the median sales price of apartments in Seoul at the end of last year was 860 million won, it is unlikely that Seoul university students will be able to easily get a scholarship.

President Joo Myung-ryong of the Korean Retirees Association said: “While there were several warnings that retirees would be directly impacted if the public price rose excessively, the harm to ordinary people is increasing because the government ignored it.

Reporter Seo Min-jun / Choi Jin-seok [email protected]