[ad_1]

(Photo = smart image provided / material photo)

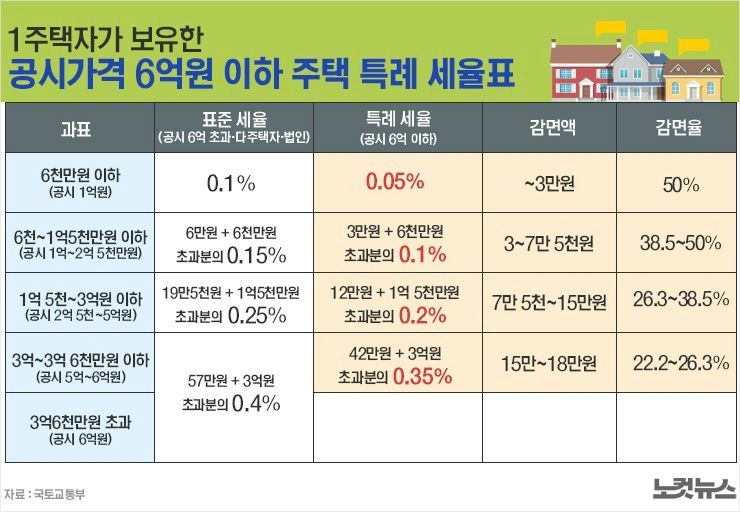

Starting next year, the government decided to reduce the property tax rate for houses with a public price of 600 million won or less by 0.05% from next year.

The official real estate price was raised to 90% of the market price and supplemented so that a homeowner’s tax burden, rather than speculation, would not immediately increase.

On the 3rd, the Ministry of Lands, Infrastructure and Transportation and the Ministry of Public Administration and Security announced a plan to make the official price of real estate property and ease the burden of property tax through a joint briefing at the Sejong Government Complex.

Among them, seeking ways to ease the burden of property tax, it was decided to reduce the property tax rate by 0.05% p for each section of the tax base only for houses with a public price of 600 million won. or less owned by a head of household.

(Graphic = Reporter Seongki Kim)

As for the reduction and exemption benefits received for each section of the tax base, the public price of less than 100 million won is up to 30,000 won, less than 100 million won to 250 million won, from 30,000 to 75,000 won, and from 250 million won to 500 million won or less is 75,000 won. ~ 150,000 won and less than 500 million won to 600 million won will be reduced by 150,000 won to 180,000 won.

The reduction rate is 22.2% to 50%. Due to the nature of progressive tax excess, the lower the home price, the higher the reduction rate. The reduced tax rate will apply from the next year’s property tax (the tax base date of June 1).

Meanwhile, it has been argued that the property tax rate should be lowered broadly to houses with an official price of less than 900 million won, with a focus on the ruling party. One analysis also suggested that variables that would negatively affect the votes of single household residents in Seoul should be eliminated before 4.7’s reelection next year, when the mayor of Seoul is elected.

(Photo = smart image provided / material photo)

However, the government estimated that even with this plan, which is based on less than 600 million won, many homeowners will receive tax reduction benefits.

Depending on the judgment of the ‘household’, the target dwelling may change, but 94.8% of the 10.86 million units per person due to the imposition of property taxes this year, with a public price of less than 600 million won (10,300,000 units) receive this tax reduction benefit. This is because it represents 80.0% (2.47 million) of the 3.10 million homes in Seoul.

This reduction in the tax rate will be applied for three years (2021-2023), as in the case of a typical tax reduction or exemption, but will be reviewed later considering changes in the housing market and the effect of the realization of published prices.

Consequently, the government predicted that the fiscal support effect would be 4.787.5 billion won per year, and a total of 1.4 trillion won over the next three years.

Regarding the point that a reduction of the property tax, which has been raised by local taxes, can put a burden on both local finances, “to minimize the impact on local finances, the increase in the number of local taxes and the general property tax (real estate transfer tax) was reorganized according to the realization of published prices. We have thoroughly considered the effects, etc. “