[ad_1]

Although the government has introduced “ special real estate measures ” (measures 2 and 4) that contain plans to supply 323,000 households in Seoul by 2025, it is expected to be difficult to break the rise in apartment prices. The metropolitan express train station (GTX) and apartments in the Gangnam area of Seoul are expected to lead the market in the first half. This is the result of a survey of 50 real estate experts on the prospects for the real estate market and the investment strategy after the second and fourth measures.

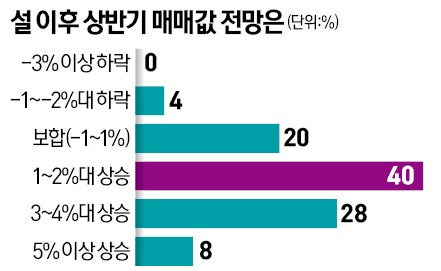

When asked about the forecast for the sale price of apartments across the country in the first half of the year, 40% of respondents answered ‘1 ~ 2% increase’. Adding ‘3 ~ 4% increase’ (28%) and ‘5% or more’ (8%) means that 76% of respondents expected an increase in house prices. Ahn Myung-sook, director of Woori Bank’s Investment Support Center, predicted that “a new investment direction has been determined as of the Lunar New Year holidays” and “there are many variables until the second and fourth measures lead to the offer.

96% of the respondents predicted that the total price will increase in the first half of the year due to the application of the new law for the protection of leases, the shortage of supply and the increase in the demand for reserve for pre-subscription in the third new city.

In this survey, ‘reconstruction and redevelopment projects’ (36%) were ranked as the most promising investment products, outperforming’ villas in the station area where public redevelopment is possible ‘(24%) and’ a new apartment for the third year of occupation ‘(20%). There were many opinions that promising areas for investment were ‘Gyeonggi areas like Goyang, where GTX traffic is expected’ (36%) and ‘Gangnam 4-gu, Seoul’ (26%). Experts cautioned that the homeless are looking to increase public sales and specialty supplies with reduced qualification requirements.

76% of “House prices rise” … Maximum variable measures 2 and 4

Survey of 50 experts

Real estate experts cited ‘2 · 4 real estate measures’ as the biggest variable in the real estate market this year. It is a policy to expand urban supply by supplying 323,000 households in Seoul alone. However, there is a lot of uncertainty as it is not clear if the key is to participate in the private sector. It is observed that the housing market can become more unstable if the government’s measure number 25 does not fulfill its function.

As a result of asking 50 real estate experts about the impact of the second and fourth measures on the market, 72% of the Korea Economic Daily said that it is effective in the medium and long term, but the short-term effect is limited. This measure did not focus on the ‘actual volume of supply’ until 2025, but on ‘securing the site’. Experts agreed that it would take at least three more years to move. This means that the effectiveness of the countermeasure is difficult to appear immediately. So 10% of the responses were ‘it will be effective depending on the region’ and ‘it will further drive the rise in house prices’.

Among the 2 · 4 countermeasures, 28% of the experts answered ‘Designation of a new public housing site’ in the questionnaire that would positively affect the stability of the market. Through this measure, the government plans to supply a total of 263,000 households in new housing sites across the country. It exceeds the supply volume of the 3rd new city (173,000 households). After final discussions with local governments are finished, presentations will take place two or three times during the first half of this year. Siheung, Gwangmyeong, Gyeonggi and Gambuk, Hanam are considered candidates. This was followed by ‘high-density developments such as low-rise residential areas in the station area’ (26%) and ‘sales volume and underwriting opportunities for 30-40 year olds’ (20%).

Regarding the limitations of the 2nd and 4th measures and points to be supplemented, 42% of the respondents chose the “public orientation measures that do not include the activation of private maintenance projects”. In particular, experts note that there is a great antipathy to public-led development. The remodeling and public reconstruction that the government previously promoted is also in a state of low participation.

Woo Byung-tak, Director of Shinhan Bank’s Real Estate Investment Advisory Center, said: “It is suggested that the ratio of floor area be increased and exemption of the over-reconstruction earnings rescue system is proposed to revitalize the public-led development. to maintain it. “There were also many opinions that” are not enough to calm the overheating of the market in the short term “(28%).

Controversy over the constitution, such as infringement of property rights, is also a variable. The government decided to liquidate real estate, such as houses bought after the announcement date (4th), in cash without giving priority to the supply of apartments (occupancy rights), even if a public development takes place. Settlement in cash means receiving compensation at an appraised price lower than the market price. Dae-Jung Kwon, a professor in the Department of Real Estate at Myongji University, was concerned that “it is highly unconstitutional, such as infringement of property rights, in the sense that even buyers for the purpose of living are subject to to cash settlement “. In this regard, the Ministry of Lands, Infrastructure and Transportation said that “while preparing the countermeasures, it went through a legal review and decided that it was not unconstitutional.”

Reporter Lee Yoo-jung / Jang Hyun-ju [email protected]