[ad_1]

Yogiyo’s sale price is expected to reach 2 billion won. Not only e-commerce companies like Coupang Itz and Wemakepo, which threaten the market for delivery applications, but also large distribution companies or IT companies with sufficient funds are mentioned as candidates for acquisition. However, some predict the possibility that DH will sell it to a private equity fund to defend its market share. In this case, the common opinion of the industry is that the impact on the delivery application market is not that great.

|

| [서울=뉴스핌] Reporter Baek Hyuk = General Service Union Delivery Service Branch Bae Min (Baedal Village) Members of cyclists hold a demonstration for the right to work safely in front of the company with the Democratic Party in Yeongdeungpo-gu, Seoul in the afternoon May 1, Labor Day, the 130th anniversary. On this day, members of the Baemin Riders held the first motorcycle parade, urging for the right to work safely, enacting the Living Logistics Service Act, and reducing motorcycle insurance premiums. 2020.05.01 [email protected] |

◆ FTC “If you want to take over Baemin, sell Yogiyo” … DH, ‘knee’ the FTC super strong

DH announced its official position late in the afternoon of the 28th that it would sell 100% of its shares in Delivery Hero Korea (DHK), a Yogiyo delivery box operator.

DH expects to receive final approval for the acquisition of Baemin from the FTC in the first quarter of next year. DHK also released its position data that day, saying, “The specific sales plan will take some time,” saying, “We will do our best to share the entire sales process transparently with employees and fully support the employees. employees”.

This is because the FTC concluded that DH had conditional approval to sell DHK shares to a third party for the purpose of acquiring approximately 88% of the shares of ‘Elegant Brothers’ that operate the delivery person delivery app ( Bae Min).

Previously, on December 13 of last year, DH purchased 88% of the shares of Elegant Brothers for 4.4 trillion won, and reported a business combination to the Fair Trade Commission on the 30th of the same month.

The FTC is interpreted to be concerned that a merger between Bae Min and Yogiyo will result in a monopoly operator with a 99% market share, making mergers and acquisitions virtually impossible.

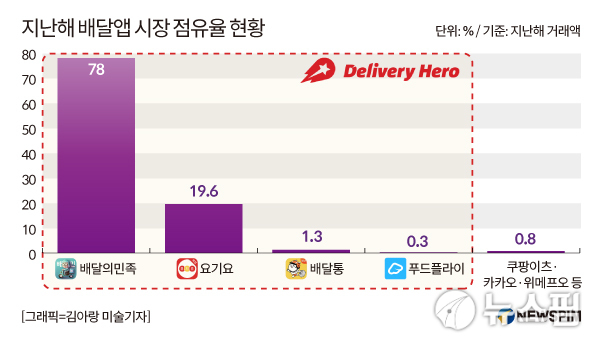

Last year, Baemin accounted for more than two-thirds of the 78% delivery market share in terms of transaction volume, followed by Yogiyo 19.6%, Delivery Box Food Fly (DHK operation) 1.6% and other companies like Coupang Itz, Kakao, Wemepo, etc. It was of the order of 0.8%.

The FTC believes that if DH acquires the monopoly position of delivery applications, there are concerns that it could limit competition in the delivery application market, such as reducing consumer benefits and increasing fees. from restaurants. The FTC’s simulation results also confirmed that consumers are likely to continue to use the two delivery apps, Baemin and Yogiyo, even if fees increase after the merger.

|

| [서울=뉴스핌] Reporter Nam Lada = Market share of delivery applications last year. [자료=공정위] 2020.12.28 [email protected] |

The FTC also issued a corrective order to DH to sell its stake in DHK within the next six months.

The company made a plan to accelerate its entry into the Asian market by reinforcing the synergy between Bae Min, the number one delivery application provider, and Yogi-yo, the number two distribution application provider, but as the Commission of Fair Trade puts a stop to the merger, it seems that things have gone.

As the intent to acquire Baemin has faded in the industry, the prospect has prevailed that DH will not accept conditional approval from the FTC.

Initially, DH made the opposite position clear, saying, “I disagree” with the FTC’s review report on the “sell Yogiyo” condition. Last month, DH said on its website, “(If the sale of Yogiyo is conditionally approved), the basis of the delivery hero to improve the customer experience of Korean users through the synergy of business combinations can weaken”. “Restaurant managers, passengers and consumers It doesn’t help everyone in the community, even,” he publicly refuted.

However, DH is known to have adhered to the position that “the business combination must be approved without conditions” at a subsequent plenary meeting of the FTC. However, it was reported that he eventually accepted the ‘yogiyo sale’ condition as he failed to persuade the FTC.

The prevailing opinion is that DH chose to have an advantage in terms of market share that it gave up Yogiyo with Baemin. The market share gap between Bae Min and Yogiyo has widened more than three times since last year.

Yogiyo, the ransom is only 2 trillion won … Who is in your arms?

Yogiyo’s sale price is estimated at W2tr. DH must find a new DHK owner within the next six months.

Candidates for the Yogiyo acquisition currently include large IT-based and distribution companies Naver and Kakao, late-delivery applications Coupang (Coupang Itz) and WeMef (WeMepO).

If Coupang and WeMef, who recently dominated the delivery app market, acquire Yogiyo, they can quickly rise to second place in the industry. This is the greatest enemy that threatens Baemin. However, Coupang and WeMef do not have many funds.

Considering Coupang is tasked with reducing his 7 trillion won deficit to list on the NASDAQ next year, he’s unlikely to rush to take over. The transfusion of funds from the president of Softbank Group, Son Jeong-eui, who was a great friend, is also difficult.

|

| Yogiyo CI [사진=딜리버리히어로코리아 홈페이지 갈무리] 2020.06.02 [email protected] |

The Vision Fund, led by Son, has not been able to afford additional investments as losses have increased due to successive investment failures. At the end of last year, WeMef had only 477 billion won in cash equivalents, so it is unlikely that it will be added before the acquisition.

The industry believes that it is highly likely that DH will choose a “private equity” instead of a retail and IT conglomerate card to defend its market share. The company is expected to choose a company with a high sales price to make up for it, as it has made a large-scale investment of 4.7 trillion won in the acquisition price of Baemin.

In addition, private equity funds are likely to focus more on financial strength by focusing on investment recovery than external expansion. This is because even if the private equity fund enters the delivery app market, it does not appear to threaten Baemin’s market position.

An industry insider said: “Given the growing uncertainty at home and abroad in coronavirus emergencies, there is a potential for private equity funds to be less expensive than large companies.” I will judge. “He predicted that” if the private equity fund is acquired, the structure of Baemin and Yogiyoga, which currently rank first and second in the industry, will remain intact, without any change in the industry. “

There are also many prospects for large corporations to be skeptical about investing. Yogiyo’s accumulated deficit, which amounted to 7 trillion won last year, is also due to the problem that he can act as a financial burden.

It is clear that there is a positive factor that may enjoy special benefits as demand for deliveries soars in the wake of Corona 19. However, as there is the possibility that profitability will deteriorate due to increased competition in the bleeding, there is a negative evaluation of investing 2 trillion won in funds.

An e-commerce industry official said: “Large distribution companies and large ones like Naver and Kakao will have enough funds, but direct transactions with small business owners will be very onerous as there can be constant noise.” Given that this is an emergency situation, it will not be easy to actively dive into the acquisition. “

[ad_2]