[ad_1]

The rise of Samsung Group at once

Samsung C&T, de facto holding company

“Undervaluation of the equity value of electronics and biotechnology”

Samsung Electronics bolsters dividends for the time being

“He seems to be working hard to improve shareholder value.”

Samsung Life Insurance, Due to Insurance Industry Law Review

Tapping whether to sell Samsung Electronics stock

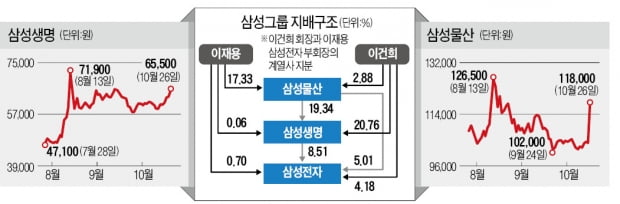

After the death of Samsung Chairman Lee Kun-hee, Samsung Group shares rose significantly. Although the restructuring of the governance structure, inheritance relationship and financial resources for inheritance tax has not been confirmed, investors have been buying because the share price will rise if a change occurs. It is for this reason that the share price of Samsung C&T (118,000 + 13.46%), of which Samsung Electronics (60,400 + 0.33%) owns the largest number of shares, jumped the most. In the market, the opinion prevails that the governance structure of the Samsung Group will not change significantly. This is because in 2018 the circular shareholder chain was completely resolved. In addition, as Vice President Lee has pointed out that there is no succession of fourth-generation management rights, it is highly likely that the inheritance of shares and reorganization of the governance structure are more likely to choose the inherited ‘precision method’ by law instead of the ‘complex scenario’.

Samsung C&T, a ‘general gift set’

On the 26th, Samsung C&T closed the deal at 118,000 won, an increase of 13.46%. The highest intraday price reached 126,000 won (increase rate of 21.15%). Based on the closing price, it is the largest increase rate in 5 years since May 26, 2015 (14.98%). On this day, Samsung C&T was the number one institutional investor in net purchases.

This is an assessment that reflects the expectation that the role of Samsung C&T will become more important after the death of President Lee. Vice President Lee owns a 17.33% stake in Samsung C&T. Samsung C&T owns a 19.34% stake in Samsung Life Insurance (65,500 + 3.80%), while Samsung C&T and Samsung Life Insurance own a 5.01% and 8.51% stake in Samsung Electronics, respectively.

Experts say that Samsung C & T’s holdings in Samsung Electronics (5.01%) and Samsung Biologics (630,000 -0.94%) (43.4%) were undervalued. Jeong-daero, a researcher at Mirae Asset Daewoo, said: “The value of the stake in Samsung Electronics is 82% of the market capitalization of Samsung C&T, but the value of the stake has not been properly assessed.” That means there is a lot of room to climb.

A representative of an asset management company said: “Buying Samsung C&T is the same as buying a complete set of futures as you can control all of its major affiliates. We look forward to a downsizing strategy. “

In addition, shares of Samsung Life Insurance and Samsung SDS (182,000 + 5.51%), which have a high stake in the owner’s family, were up 3.8% and 5.51%, respectively.

Amendment to the Insurance Companies Act, raised as a matter of concern

At the end of June this year, President Lee’s stake in Samsung Life was 20.76%. Analysts say that part of this stake can be sold to finance the inheritance tax. This is because Samsung C&T already has a 19.34% stake in Samsung Life Insurance, so there is no big problem in maintaining control even if the stake is sold.

The problem is the link between Samsung Life and Samsung Electronics. If the ruling party’s “insurance industry law review” passes, this link must be severed. It is also called ‘Samsung Life Act’ because it points to Samsung Life. The main objective is to calculate the equity interests of the insurance company’s subsidiaries based on the “market price” rather than the current “acquisition cost”. The subsidiary’s participation must not exceed 3% of the total assets of the insurance company.

Samsung Life’s stake in Samsung Electronics is 8.51%, with a valuation of about 27 trillion won. Assuming it can hold up to 3% of Samsung Life’s total assets (about 9 trillion won), the stake worth about 18 trillion won should be eliminated.

Samsung Electronics’ ‘expectation’ of improved shareholder value

On this day, Samsung Electronics’ share price rose 0.33% to 6,400 won. It seems to reflect concerns that the inheritance tax burden will increase if Samsung Electronics’ share price rises. However, in the long term, the prospect of Samsung Electronics increasing its dividends predominates. First, the interests of the majority and minority shareholders fit together. The dividend income of the owning family is analyzed to be about 500 billion won annually, and since the inheritance tax deficit cannot be covered by dividing the inheritance tax by five years, there is no choice but follow a return-to-shareholder strategy like increasing dividends. President Lee’s stake in Samsung Electronics is 4.18%. Shinhan BNP Paribas Asset Management’s Alpha Management Center Director Jeong Seong-han said: “Even if the control of majority shareholders decreases due to external variables such as the insurance industry law amendment, Samsung Electronics gets more earnings to increase return on equity (ROE) and increase dividends to increase share prices. If it goes, the investor bets will be friendly actions. “