[ad_1]

Recently, the market to contract financial sectors has collapsed. Naver Financial, a financial subsidiary of Naver, began hiring large-scale public careers. Recruitment positions ranged from developing financial services, managing past due bonds, and analyzing financial data. From document review to final pass announcement, it became a hot topic because it was called the “fast-track” method that ended in a month. Employees of various financial companies, such as banks, securities and cards, have posted job advertisement posts on the anonymous ‘Blind’ bulletin board app.

As Naver, the country’s number 1 portal services company, is holding the reins of its financial business, existing financial companies are gaining momentum. The industry reaction is that Naver’s entry into the financial industry is faster than expected and its turnover is large. Naver’s strategy is to expand the financial business to increase participation in the online trading market.

○ Paid with payments

On the 15th, Naver announced the benefits of the ‘Naver Passbook’, to be used as a bridgehead for financial business, and began to advance the financial industry. It is expected to be exhibited later this month in cooperation with Mirae Asset Daewoo, Korea’s No. 1 securities company.

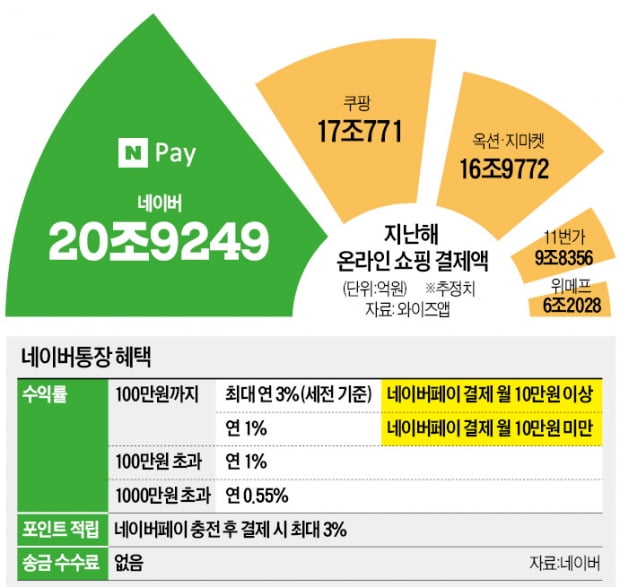

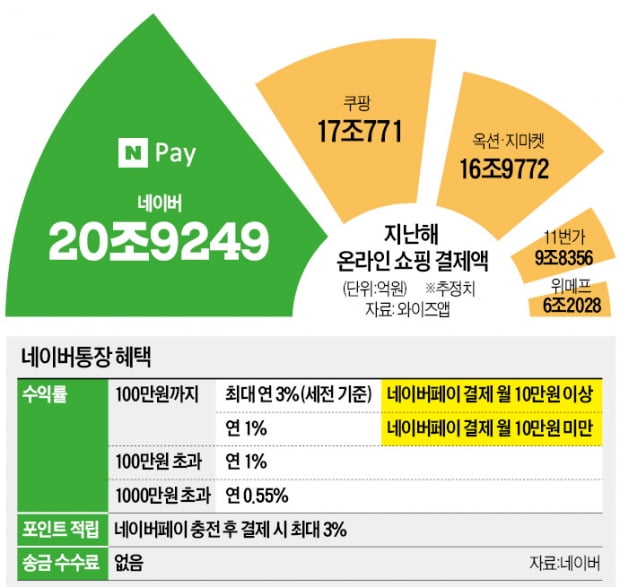

Naver’s Passbook is a comprehensive asset management account (CMA) that is free to deposit and withdraw, and is a financial product that pays interest even if it is overnight. In recent years, it has led to the ‘3% annual maximum return’, which is higher than the existing CMA, whose return has fallen to 0%. However, 3% interest is paid annually up to 1 million won. In addition, the “Naver Pay payment of 100,000 won or more per month” must be met. If the payment amount is less than 100,000 won per month, an annual rate of 1% applies.

Yield decreases to 1% per year from 10 million won to 10 million won, and 0.55% per year for more than 10 million won. Of the amount greater than 1 million won, it is less than the interest rate of regular deposits in commercial banks. A commercial bank official said: “It is not much different from the bank’s” savings book “by setting a limit of 1 million won and paying a 3% annual rate.” The higher the capital, the less benefits the consumer will receive.

However, the addition of Naver Pay, the number 1 simple payment, increases profits. If you collect a payment point with a NAVER passbook and make a payment in NAVER Shopping, NAVER Reservation, NAVER Webtoon, etc., you can accumulate points up to 3%, 0.5% more than before. This is equivalent to increasing CMA performance by 0.5 percentage points. Up to 9% of points can be earned using the benefits of Naver Plus Membership, a paid membership service that Naver will launch next month. For customers who frequently use Naver Pay, the Naver Passbook is more advantageous than CMA products in the existing financial sector.

○ Reliable, active woogun from Mirae

Naver’s bank book is just a sign that Naver is making progress in the financial industry. Based on Naver’s bank book, Naver will soon introduce financial products like stocks and insurance. In the second half of the year, credit card and deposit services and a deposit recommendation are also planned. Park Sang-jin, Chief Financial Officer (CFO) at Naver, explained: “We will rapidly expand the user base using traffic that flows to financially intensive services such as Naver Search, Pay, Securities and Real Estate.”

The financial industry is more cautious because Naver Financial’s partners are Mirae Asset. Mirae Asset Group invested 800 billion won in Naver Financial last year. It is a major shareholder with a 17% stake. It is also analyzed that Naver Financial, which became independent from the company’s headquarters in November last year, was able to issue a Naver account in 7 months. Combining Naver’s information technology (IT) capabilities with Mirae Asset’s financial insight, it is expected to exert strong strength in the “financial technology technology” market.

A Mirae Asset official said: “If Naver Financial is on the main track, it will outperform existing financial companies and quickly take over the market.” “We plan to enter the global market based on our national experience.” The launch of Naver’s banking book is expected to further intensify competition with the securities companies that operate CMA and card companies that have been responsible for online payments.

It is not just the financial market that Naver is targeting. It also helps increase Naver’s influence in the online trading market. Thanks to accumulated benefits, the number of consumers paying for Naver can increase. That is why the distribution industry must pay attention to Naver’s account book. Naver already leads the online commerce market, and more than 10 million consumers bought products at the ‘Smart Store’, a shopping center operated by Naver. It increased more than 25% since January (8 million).

Reporter Kim Joo-wan / Song Young-chan [email protected]