[ad_1]

![Warren Buffett speaks at the Berkshire Hathaway Online Plenary on Day 2. [로이터=연합뉴스]](https://pds.joins.com/news/component/htmlphoto_mmdata/202005/04/167a06e4-deb9-40db-b3fd-086e6a7e1ac6.jpg)

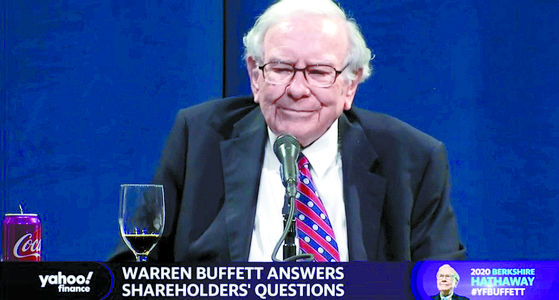

Warren Buffett speaks at the Berkshire Hathaway Online Plenary on Day 2. [로이터=연합뉴스]

Warren Buffett (90), President Berkshire Hathaway, was unable to escape the new shock of coronavirus infection (Corona 19). The Berkshire Hathaway-led investment company had a net loss of $ 49.7 billion in the first quarter of this year (approximately 60.5843 billion won) in the first half of this year. It is the largest loss ever recorded in Berkshire Hathaway. However, President Buffett had an optimistic view that the American economy would overcome the crisis over time.

Berkshire Hathaway first gun online

“I can’t find an attractive investment target at the moment.”

According to the Wall Street Journal and Reuters on Day 2 (local time), Buffett attended the annual shareholders’ meeting in Omaha, Nebraska. Thousands of shareholders gathered and celebrated as a festival, this time for the first time, it was streamed online only by video. President Buffett said he recently sold the six billion dollars (7 trillion won) in shares of Delta, American, Southwest and United Airlines, the top four airlines in the United States.

Investments other than aviation such as insurance, rail and energy have performed well. Berkshire Hathaway owns $ 13.73 billion in cash assets at the end of the first quarter, but has been unable to find a suitable investment destination. “We have not found an attractive investment target,” Buffett said.

President Buffett predicted that the American economy would recover over time. “The potential impact of Corona 19 has been very broad, but the situation has improved in recent weeks,” Buffett said. “We have overcome more difficult problems with American miracles and magic,” Buffett said. President Buffett reiterated his investment principle: “Don’t borrow money and invest.” “You can bet in the United States, but you have to be careful how you invest,” he said. “Because everything can happen in the market,” he added.

Reporter Jihye Kim [email protected]

[ad_2]