[ad_1]

Major shareholders, including Mainstone, sold 430 billion won in four days after listing

On this day, net purchase of 9.4 billion won from institutions and 500 million won from other corporations.

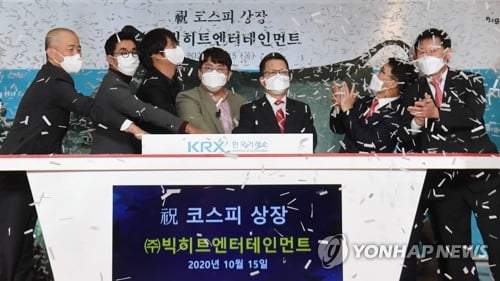

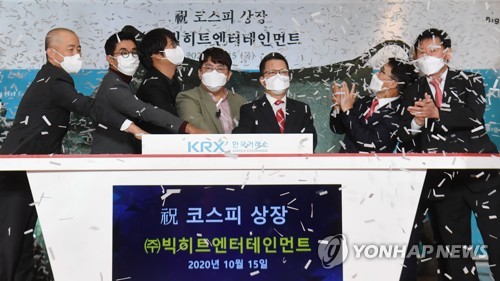

The stock price of Big Hit Entertainment, the agency of BTS group (BTS), rebounded after six days of trading on the 22nd.

On this day, on the stock market, Big Hit ended up trading at 180,000 won, 0.56% more than the day before.

At the beginning of the market, the stock price fell to 175,000 won and fell below the market capitalization of 6 trillion won, but turned upward and maintained an uptrend.

Big Hit has attracted a lot of attention as an initial public offering in the second half of the year, but the share price declined until the day before after listing.

The day before, Big Hit’s stock price fell 30.62% based on the closing price for four days after closing at 179,000 won.

This appears to have affected the sales volume of institutions and other corporations.

According to the Electronic Disclosure System of the Financial Monitoring Service (DART), Mainstone Co., Ltd. sold 1.2 million shares on the market from 15 to 20.

Mainstone’s special officer, Easton No. 1 private equity joint venture, also sold 381,112 shares during the same period.

In terms of amount, a total of 366.4 billion won (1,581,881 shares), and the average sale price was approximately 230,000 won.

Another major shareholder, Stik Special Situation Private Equity Joint Stock Company, also announced on the 15th that it sold 196,000 shares on the market.

The average sale price was approximately 313,000 won and the sale amount was 61.4 billion won.

As a consequence, Mainstone’s stake in Big Hit decreased from 6.97% (2,482,992 shares) to 3.60% (1,282,223 shares).

Easton’s ownership decreased from 2.19% (78,176 shares) to 1.12% (3,996.64 shares).

The stake in Styx Special decreased from 9.72% (3462880 shares) to 9.17% (3266,000,703 shares).

Big Hit’s stock price, which was 258,000 won based on the closing price on the 15th, fell to 182,500 won on the 20th, down 29.26%.

On the other hand, the agency bought 9.4 billion won that day and turned it into a net purchase in six days.

Other corporations bought 500 million won net.

However, there is a possibility that share price volatility will continue due to the flow of orders from institutions that are tied to the hedge deposit.

Previously, Kakao Games also had a share price flurry, as more than 4.45 million shares (including a 15-day mandatory holding period), representing approximately 30% of the first available shares, were launched during the month of listing.

In Big Hit’s case, if you add exchangeable convertible preferred shares, the total number of new shares that can be released in the next month is 24.16 thousand shares.

Currently, it is approximately 32% of available shares and 6.96% of all ordinary shares.

/ yunhap news