[ad_1]

LG Chem(666,000 + 3.26%)The aftermath of the decision to spin off the Korean battery business is strong. This is because individual investors are protesting that LG Chem’s battery business has been seen and invested, but it has not been able to maintain a stake in the newly established (battery) company. The company immediately announced a plan to improve shareholder value and began taking action. It is evaluated as an incident that showed the power of the ants that emerged as the mainstream of the stock market after the new coronavirus infection (Corona 19).

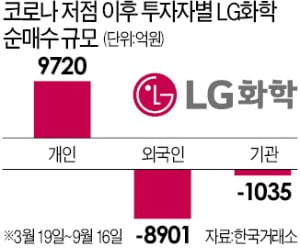

According to the Korean Stock Exchange on the 18th, individual investors bought LG Chem worth 968 billion won from March 19 to 16 this month, when the Korean stock market bottomed out this year. During this period, both foreigners and institutions threw stocks. It was a belief in LG Chem, the world’s number one shipment of batteries for electric vehicles. When the age of the electric car arrives, Tesla in the US and LG Chem in Korea will be the dominant market.

On the 16th, the news came out as ‘Thunderbolt’. LG Chem announced that it would split the battery business. Unlike the human division, the physical division does not give existing shareholders a share of the shares of the new company. Some terrified investors flipped stocks. Investors were not sitting still after seeing the stock price drop. LG published articles in various places in the Internet community. A petition was also posted on the Blue House notice board asking “to avoid harm to individual investors due to the division of LG Chemicals.” The 2030 generations that jumped into the stock market with Corona 19 as an opportunity were more serious. An anonymous bulletin board app for office workers and various value communities has posted a message saying “I will boycott LG.”

As the backlash spread, the company was forced to move. On the 17th, an emergency conference call for analysts was held and it was promised: “Even if we include a subsidiary, we will keep the stake in LG Chem at a level of 70-80%.” The following day, the conference call was infrequently released to the media. An LG Chem official said: “We are reviewing various measures to alleviate shareholder complaints.” The stock price was in the mood for stability. This day LG Chem’s share price increased 3.26% to 6,000 won.

“I bought the Big Hit Entertainment stock, but BTS pulled out.”

This is an article posted by LG Chem shareholders in the securities community. After seeing the future value of the battery, he invested in LG Chem, but when the battery business was spun off, he expressed his feelings that the shares were not received. We summarize why LG Chem made this decision and what are the complaints from individual investors.

(1) What is the materials division?

LG Chem decided to eliminate the battery business using the “split materials method”. People threw 260 billion won worth of LG Chem shares over two days from the 17th until this news.

The division of the company is divided into human division and material division. When the division of persons is carried out, the composition of the existing or separate companies or shareholders becomes the same. Shareholders who own 10% of Company A shares will have both 10% of surviving Company A and 10% of Company B divided after the spin-off. However, if the stock split is done, the shares of the new company are not provided. LG Energy Solutions (tentative name), which operates the battery business, becomes a separate subsidiary, and existing LG Chem shareholders remain only shareholders of companies in the petrochemical sector. That is why minority shareholders are opposed.

The battery business is a business that requires an investment of more than 3 trillion won a year. LG Chem’s initiative to supply Tesla, Volkswagen and Hyundai Motor Company is to attract these automakers as shareholders in spin-offs.

The company decided that the physical division was efficient in attracting investment. When LG Chem splits the battery business through a spin-off, the two companies will split and go public again. The entry of new funds through a separate IPO becomes impossible.

(2) Stock price outlook after the IPO

The concern of individual investors is after the listing of LG Energy Solutions. In the Korean stock market, even a parent company with a good subsidiary rarely gets 100% of its value. The individuals realized this, as the share price of Samsung C&T, which owns 43% of Samsung Biologics, and SK Co., Ltd., which owns 75% of SK Biopharm, was slow. On the other hand, there are arguments against the fact that SK Corp. is a holding company unlike LG Chem, and that Samsung Biologics is difficult to compare simply because Samsung C & T’s holdings are less than 50%. The securities experts said: “The key is the margin of the battery business rather than the division method,” and said: “As a shareholder, it is only necessary to determine whether the physical division will result in an increase in corporate value.”

(3) The value of the business that remains in the parent company.

Analysts are positive. This spin-off is seen as an opportunity for LG Chem’s battery business to be reassessed. LG Chem, the parent company, is also seen as being competitive in the field of advanced petrochemical materials and life sciences.

Chai Chai-seok, CFO of LG Chem, said: “We will actively utilize the business division growth opportunities that have been hidden by the battery business, such as improving the petrochemical business, expanding the battery materials business as materials of cathodes and invest in the development of new drugs and vaccines. ” In the past, money from petrochemicals etc. had to be invested in batteries, but now it means that intensive investment is possible in the rest of the business units. Jeong Yong-jin, researcher at Shinhan Investment Corp. said: “If LG Energy Solutions can grow independently, the hidden value (hidden value) in its parent company, LG Chem, will shine.”

(4) What to choose for the national pension

LG Chem decided to hold a general shareholders meeting on the 30th of next month to approve the spin-off plan. The separation of the company requires the consent of at least two thirds of the shareholders present and one third of the total number of shares issued. As LG Chem’s largest shareholder is LG Corp. (33.34%), it is unlikely that it will be rejected. The variable is the national pension. The National Pension Service has a 9.96% stake in LG Chem. The market assessment is that the situation may change if the National Pension Service announces its intention to cast a vote against it with the cause of “harming the value for shareholders ”.

Shares held by the National Pension System (valued at 4.4 trillion won) also affect supply and demand. This is because there is a possibility that the National Pension Service will reorganize some of its shares in LG Chem to invest directly in LG Energy Solutions, which has just been publicly traded. This is a great burden for LG Chem shareholders.

Reporter Jaeyeon Ko / Mansu Choi / Gyeongmin Kang / Beomjin Jeon [email protected]