[ad_1]

|

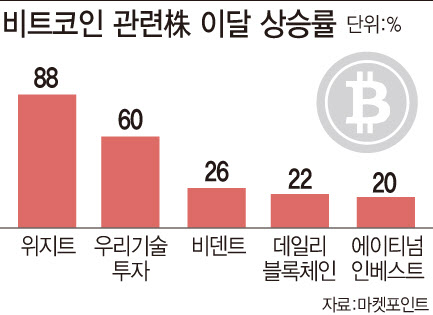

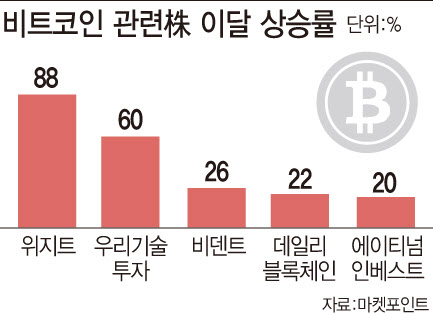

Based on the market point of 19, the stock price soared about 88% this month. The stock price of 680 won jumped to 1200 won. On this day, the upper limit was recorded. It was up 60% this month and (26%), (20%) and (22%) showed a 20% increase.

As the price of bitcoin hits a three-year high, related stocks are shaking. According to the cryptocurrency exchange Upbit, bitcoin rose to 1984 million won on the 19th and skyrocketed 2.4 times since the beginning of the year. In the US, it was trading at $ 18,172 on the 18th (local time) and reached the highest point since December 2017.

Stocks that rise in bitcoin-related stocks share in common that, either directly or by affiliates, they are investing in cryptocurrency exchanges. Wizit owns about 24% of its subsidiary, T Scientific, which invests in Bithumb Korea, which operates the # 1 cryptocurrency exchange, and owns about 8%. T Scientific changed its name to Omnitel in August. T Scientific’s share price rose this month, but it was up 7% and the share price rallied less than Wizit. Bident owns 10% and 34% stakes in Bithumb Korea and Bithumb Holdings, respectively.

Woori Technology Investment and Atineum Invest have stakes of 8% and 11% in Dunamu, which is operated by Upbit, respectively. It is an action related to the Coinone cryptocurrency exchange. This is the influence of Yellow Mobile, the largest shareholder in Daily Blockchain, having a special relationship with Shin-Dong Shin-D, the largest shareholder in Coinone (formerly Daily Financial Group). However, it was classified as a related stock due to bitcoin’s rapid rise in 2017, but it sold all of its shares on cryptocurrency exchange JPInet (formerly Escoin) in April. The share price also fell nearly 7% this month.

These stock price flows depend on how much cryptocurrencies like Bitcoin will rise. This is because if the price of bitcoin increases, the transactions will naturally increase and the transaction fees will also increase.

The market predicts that this bitcoin surge will not decline in such a way that the bitcoin surge rises in an instant, as in 2017, and then plummets in 2018 as the bubble collapses. In January 2018, Bitcoin soared to about 26 million won and then fell below 8 million won in a month. Consequently, investment in Woori technology also increased by 87% in January 2018, then fell by 15% and 21% in February and March. Bident rose 108% during the same period, then fell 21% and 12% for two consecutive months.

The biggest difference between this growing period and the rise of bitcoin in 2017-2018 is that payment service provider PayPal announced that it will support cryptocurrency payment services like bitcoin by the end of the year, and the reality of cryptocurrencies has become visible. , such as the issuance of digital currency in China. It is an analysis that has become clearer. Overseas investment banks (IBs) are also showing a friendly attitude, with Citi calling Bitcoin ‘gold’ in the 21st century and forecasting it to rise by $ 318,000 by the end of next year. Park Sang-hyun, a researcher at Hi Investment & Securities, said: “Bitcoin is gradually attracting attention as an asset” and predicted that “interest in Bitcoin will be high for the time being due to the digital economy and excessive liquidity.”