[ad_1]

Mediatech Dimension City AP. Mediatek home page screenshot

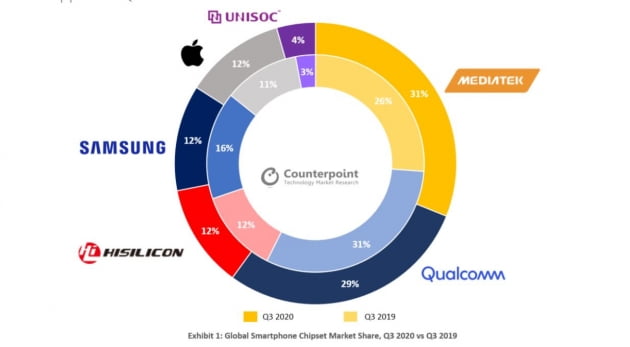

In the third quarter, the global smartphone AP (application processor) market had an unusual turnaround. MediaTek, Taiwan’s specialty semiconductor design company, overtook Qualcomm in the US and climbed to the top in AP’s global market share (based on shipments). Samsung Electronics, which produces AP’Exynos’, fell 4 percentage points from the same period last year and tied for third place with Apple and Hi-Silicon. What happened to the global AP market in the third quarter?

First in the world with 31% of the smartphone AP market share

On the 24th, a market research firm Counterpoint Research announced that “Mediatek became the world’s number one smartphone chipset company for the first time in the third quarter of 2020.” Mediatek’s share of AP shipments based on AP shipments was 31%, with Qualcomm (29%). And Samsung Electronics, Apple and Hi-Silicon (over 13%) In the third quarter of last year, Qualcomm ranked first with 31%, MediaTek ranked second with 26%, and Samsung Electronics ranked third with 16% and a quarter. High Silicon (12%) ranked fifth with Apple (11%), while Qualcomm (29%) and MediaTek (26%) ranked first in the second quarter.

AP global market share in the third quarter of 2020. The exterior is the third quarter of this year and the interior is the third quarter of last year. Counterpoint investigation

MediaTek is a Taiwanese company without fables founded in 1997. It started from the design house of UMC, the second largest foundry in Taiwan and the third largest in the world as of the third quarter (a company that acts as a bridge between a company of specialized design semiconductor and foundry company that produces products according to design). The AP smartphone, called ‘Helio’, is its flagship product, but its competitiveness in semiconductors for televisions is assessed as challenging as well.

MediaTek used a niche-market strategy from Samsung Electronics and Apple, which had produced primarily Qualcomm chips in the US and APs used in their smartphones. MediaTek mainly used the strategy of selling low and medium price APs to Chinese companies at low prices.

Enjoy the ‘reflected gains’ of Huawei sanctions

Mediatek’s # 1 surprise in the third quarter is no stranger to recent changes in the smartphone market. First of all, it is the undoing of Huawei. According to Counterpoint Research, Huawei’s global smartphone market share fell to 14% in the third quarter due to the influence of US export regulations.

Even in the Chinese market, it is enduring ‘patriotic consumption’, but it is a difficult situation. According to market research firm Canalis, Huawei’s smartphone shipments in China in the third quarter were 34.2 million units, 18% less than in the third quarter of last year. It is the first time in six years since 2014 that Huawei’s quarterly shipments of Chinese smartphones have fallen year over year.

Chinese smartphone makers like Xiaomi, Oppo and Vivo are among the companies eroding the share that Huawei lost. Xiaomi’s share of the global smartphone market was 13% in the third quarter, it followed Huawei to the bottom of the head, and Oppo (8%) and Vivo (8%) also ranked fifth in the world.

Huawei has a big difference in terms of strategies from Xiaomi, Oppo, Vivo and AP. Huawei mainly used Kirin AP developed by its subsidiary Hi Silicon. However, Xiaomi, Oppo and Vivo do not produce their own APs, they buy them from specialized companies. Due to the characteristics of Xiaomi, Oppo and Vivo, which mainly produce mid to low-end phones, Taiwan’s mediatech was mainly used, whose main focus is mid-to-low range APs.

As Huawei’s sales declined and those of smartphones like Xiaomi increased, MediaTek’s market share naturally increased. An industry source explained: “We know that Xiaomi’s MediaTek AP orders have more than tripled compared to before Huawei’s sanctions,” and said: “Mediatek is enjoying a reflective benefit from the US sanctions. to Huawei “.

Samsung Electronics, which competes with Chinese companies in India and Latin America, where ‘mid and low priced phones’ are popular, is also using MediaTek chips in smartphones to ensure profitability. The Galaxy A31 is a good example. The phone contains the AP Helio P65 from MediaTek.

Actively targeting the 5G AP market

MediaTek’s active AP launch for mid-range 5G smartphones is also a reason for its increased market share. Like Qualcomm’s’ Snap Dragon ‘, Apple’s’ A’, Samsung Electronics’ Exynos and Hi-Silicon ‘Kirin’, MediaTek also has brands. The popular lineup is called ‘Helio’. MediaTek is also developing “Premium” APs, and these products use the “Dimensions” model name. ‘Dimensity 1000’, a 5G AP, is representative.

MediaTek is actively targeting the popular 5G smartphone market with ‘Dimension’. Recently, Chinese companies like Xiaomi, Oppo, Vivo, and Real Me are also aggressively launching 5G smartphones. These smartphone makers mainly use Qualcomm ‘Snapdragon’ APs for premium products marked ‘Pro’ and ‘Plus’, but use MediaTek ‘Dimensions’ APs for general products.

Mediatek’s earnings are on the rise. According to Trend Force, a market research firm, MediaTek’s sales in the third quarter were $ 3.3 billion, up 53.2% from the third quarter of last year ($ 2.154 billion). This greatly outpaced Qualcomm’s sales growth rate (37.6%) during the same period.

‘I need to secure a Chinese client…Samsung Electronics’ Growing Concerns

As MediaTek gets better, concerns mount for Samsung Electronics’ LSI Systems Division, which develops and sells Exynos. This is because the market that Samsung Electronics is paying attention to and the market led by MediaTek overlap. Xiaomi, Oppo and Vivo are customers that cannot be waived from the perspective of Samsung Electronics’ System LSI division, which needs to increase sales.

Samsung Electronics is getting visible results in transactions with ‘Vivo’. Last year, the Exynos 980 AP was delivered to the Vivo’X30 ‘smartphone. The recently launched ‘Exynos 1080’ AP will enter Vivo’s ‘X60’ 5G smartphone, which is scheduled to launch on the 29th.

Samsung Electronics SNS post announcing the launch of premium AP’Exynos 2100 ‘on the 12th of next month. Samsung Electronics SNS Capture

However, the situation is a little different with respect to Xiaomi and Oppo. A senior Samsung Electronics official met with a reporter in October and said: “Next year we will deliver Exynos to Xiaomi and Oppo,” but there is no official announcement on the success of the delivery so far.

Recently, there is also a story that says “Samsung Electronics’ AP smartphone development strategy has changed to focus on ‘developing advanced chips for its own smartphones’ rather than’ expanding external sales. ‘ The System LSI division, which is in charge of Exynos’ external sales, is trying to increase sales and the profit margin by increasing external sales, but Samsung Electronics is hearing a different voice, saying, “As Apple, we should focus on develop premium APs for our smartphones. ” Apple develops APs as ’14’, they are produced by foundries like TSMC and used only for its ‘iPhone’ smartphone.

Reporter Hwang Jeong-soo [email protected]