[ad_1]

“The Korean Development Bank and Hanjin Group are taking the first step in reorganizing the domestic aviation industry by integrating the two major airlines, Korean Air and Asiana Airlines. It is expected to have positive effects on the economy. national, helping to ensure the international competitiveness of the aviation industry in the post-crown era. ” do.”

The president of the Korean Development Bank, Lee Dong-geol, announced on the 16th that he is promoting a merger between Korean Air and Asiana Airlines. As the aviation industry in general is expected to be difficult due to the prolonged Corona 19, it is a plan to prepare for the future through a preventive industrial reorganization and to rehabilitate Asiana Airlines by entrusting the management to experts from the aviation industry. instead of creditors.

However, as the main shareholders of Hanjin Group oppose the acquisition of Asiana Airlines, and the unions of the two companies have also started to respond, attention is drawn to the management.

Korea Development Bank to Invest 800 Billion Won in Hanjin Kal … Asiana Acquisition Support

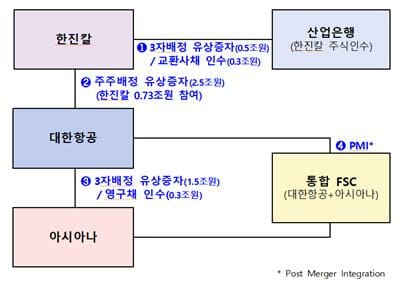

The integration between Korean Air and Asiana Airlines begins with the Korean Development Bank. When the Korean Development Bank invests a large amount of money in Hanjin Kal, the parent company of Korean Air, Hanjin Kal will use it to acquire a stake in Asiana Airlines.

First, the Korea Development Bank signed an investment contract worth KRW 800 billion with Hanjin Kal, and then decided to acquire KRW 500 billion in new shares issued by Hanjin Kal by allocation to a third party and KRW 300 billion in exchange bonds using Korean Air shares as underlying assets. .

Since then, Hanjin Kal participated in Korean Air’s paid-in capital increase (2.5 trillion won), and Korean Air reinvested 1.8 trillion won to acquire new shares (1.5 trillion won) and bonds. permanent (300 billion won) of Asiana Airlines. It is expected to become the largest shareholder in Asiana.

When the transaction is completed, Hanjin Group will complete the governance structure of Hanjin Kal → Korean Air → Asiana Airlines.

Furthermore, the integrated national carrier of Korean Air and Asiana Airlines is expected to be competitive in the top ten in the global aviation industry.

A Korean Development Bank official said: “Over the past 20 years, airline consolidation has been actively carried out in the United States and Europe, and most of them have been reorganized into a ‘one country, one system National Airlines’ “. “Recently, discussions between airlines in Japan, the United States and China have progressed. It is coming back,” he said.

He added that “Korean Air ranked 19th and Asiana Airlines 29th based on IATA (International Air Transport Association) passenger and cargo performance in 2019.” He added: “If both companies are summarized, they will rise to the top 7 in the world.”

“Improving competitiveness by reorganizing the domestic aviation industry … will increase convenience for consumers.”

The attempt to integrate Korean Air and Asiana Airlines stems from the perception that normalization of the management of domestic airlines without fundamental efforts such as structural restructuring is uncertain.

The Korea Development Bank is expected to achieve economies of scale and induce the reorganization of low-cost airlines (LCCs), as well as reduce policy spending.

The Korea Development Bank believes that it can achieve top-of-the-line growth based on an increase in the market share of Incheon Airport’s hub airport (aircraft take-off and landing capacity) and increase profitability by streamlining routes, reducing costs. operating costs and reducing interest expense.

Korea Development Bank Vice President Choi Sang-hyun said: “If the two major airline systems are maintained while the possibility of normalization of the aviation industry is uncertain due to the prolonged crisis in the crown, it is inevitable. invest an additional KRW 4.8 trillion in policy funds for both companies by the end of 2021. “A large loss was expected for creditors due to the additional potatoes and debt cancellation during the sale.”

“If the investment in Hanjin Kal is implemented as early as possible during the year, Asiana Airlines’ liquidity and capital expansion problems can be resolved by the end of the year,” he said. “It is possible to minimize the amount of policy fund contributions by acquiring market funds early.” Revealed.

Regarding the reorganization of the LCC, “Hanjin will integrate Jin Air with Busan and Air Seoul step by step, simplifying aircraft types and increasing consumer efficiency,” he said. “Activating local airports such as expanding and integrating national and international routes and developing night schedules. · I think it will be promoted together,” he said.

At the same time, Vice President Choi Choi drew a line on some concerns that the birth of a giant national airline would be disadvantageous for consumers. It is diagnosed that phenomena such as increased freight rates or poor service quality will not occur due to fierce competition in the global aviation market.

Vice President Choi Choi dismissed: “In the case of mileage integration, we know it will be integrated after reviewing the use value in the future.”

Hanjin Group’s Self-Proclaimed ‘Ethical Management’ Promise

The Korean Development Bank said Hanjin Group was selected as the new owner of Asiana Airlines because those in the aviation industry were the most active and ensured faithful implementation of integration work.

Vice President Choi Choi said: “After the final breakdown of the sale of Asiana Airlines with HDC Hyundai Industrial Development on September 10, we decided to undertake integration work against Hanjin Group.” We asked other companies in the group for their opinion, but they all expressed their position that they were not interested due to financial difficulties and uncertainty about the industry ”.

Above all, “Hanjin Group Chairman Cho Won-tae will be responsible for providing the shares held by Hanjin Kal and the shares of Korean Air to be acquired by Hanjin Kal as collateral, and will resign from the first line of management in case of insufficient commercial performance. ” “It evaluates the performance every year through the Management Review Committee, and if the grade is low, management measures such as dismissal can be taken.”

In addition, he said, “We will share opinions with other shareholders to improve corporate value and ensure management transparency.” I decided not to participate, ”he said to ease external concerns.

Hanjin Group shareholders and union opposition is an obstacle

However, the reluctance of major stakeholders to acquire Asiana Airlines by Korean Air is expected to be a task for the Korea Development Bank and the Hanjin Group.

After KCGI, an activist private equity fund (PEF) that faces President Cho Won-tae over the management of the Hanjin Group, objects, the Korean Air and Asiana Airlines unions also object.

In particular, KCGI is known to be displeased that Chairman Won-Tae Cho can take advantage of the dispute over management rights by making the Korea Development Bank a favorable shareholder.

KCGI said: “Chairman Won-tae Cho’s attempt to take over Asiana Airlines is forcing a one-sided sacrifice without considering the interests of Hanjin Kal and Korean Air shareholders and general employees,” KCGI said via position data. .

The same goes for unions. They are concerned that the merger could lead to a large-scale restructuring. They also insisted, “this merger is a unilateral thing that excludes the opinion of the workers,” and insisted that “they constitute a worker-employer council and discuss it again from the beginning.

Related Posts

Korea Development Bank to Invest 800 Billion Won in Integration of Korean Air and Asiana Airlines

Asiana IDT, Wireless Magnetic Sensor Tag Marketing Development

Korea Development Bank considers selling Asiana Airlines to Korean Air

Asiana Sales Breakdown … Creditors “Improved Constitution by Investing 2.4 Trillion Won in Project Fund”

In this regard, Vice President Choi Choi dismissed, “Considering the purpose of the transaction to restructure the national aeronautical industry and strengthen competitiveness, we believe that there will be no obstacles to continue with the integration process as a procedure.”

Furthermore, he said, “there are an estimated 1,000 overlapping templates in the indirect sector as managerial positions, but there will be no artificial restructuring considering the annual decline in nature,” he said. “Hanjin Group has also confirmed this,” indirectly requested the union’s cooperation. .