[ad_1]

Credit Loan Regulation … Banknote “Hitting Homeless Shopping”

‘Athletes’ who seem to be crowded before regulation on the 30th

(Seoul = Yonhap News) Banking team = When a home loan management plan was published that ‘regulates with tweezers’ the loans of high-income people, the bank note assessed that the way to buy a house was blocked with’ spirituality’.

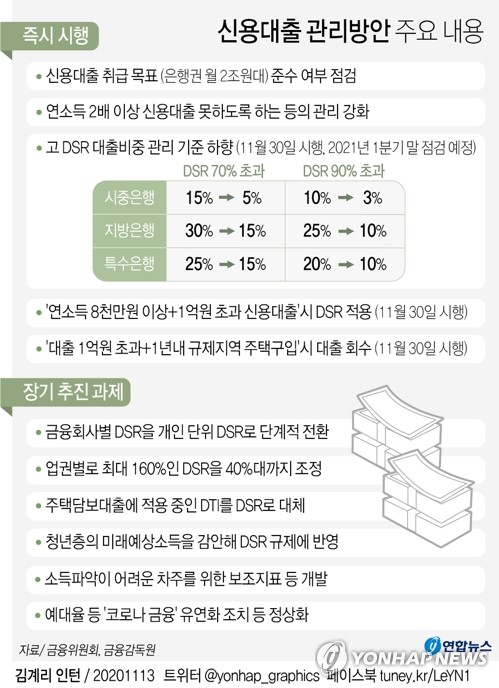

As of the 30th of this month, if a high-income person with an annual salary of 80 million won or more receives more than 100 million won in credit loans, the regulation of the interest payment rate and debt principal Total (DSR) is applied on an individual basis, and if a loan exceeds 100 million won and you buy a home in a regulated area within a year, the loan The key to this plan is to get the product back in two weeks.

In particular, in the banking sector, common concerns were expressed that “it has become more difficult for the homeless to buy houses.”

Once the financial authorities have decided to strengthen the standards for the bank’s “high proportion of DSR loans” and verify whether commercial banks meet the loan lending targets, the credit limit for all borrowers, as well as for those with high income, it will be general. It is observed that it can be reduced to.

[연합뉴스 자료사진]

◇ Ticket “It becomes more difficult to buy a house with a young couple ‘Young Klo’ …

On the 15th, the banknotes showed a common reaction to the government’s announcement on the 13th to administer home loans, saying: “It has become impossible to buy houses through credit loans.”

After receiving a credit loan of more than 100 million won as of the 30th, if you bought a house in a regulated area such as Seoul (speculation area, overheated speculation area, adjustment target area) within a year, you will have to repay the loan within 2 weeks. Failure to pay the loan will lead to arrears and can be recorded as delinquent. However, the collection target is the new loan amount received after 30 days.

A banking industry official said, “There are evaluations that a DSR of 40% for those with an annual salary of 80 million won and a credit credit greater than 100 million won will have a considerable impact.” You can say that buying a house with billions of dollars is now impossible. “

A senior bank official said: “In a situation where it is difficult for ordinary people to buy a house without a loan in a situation where house prices are actually going up, in addition to the DSR regulation, the fact of That credit and home loans cannot be doubled is even more so for the homeless who want to buy a real home. “I am concerned that it may be making it difficult to buy a home.”

Other bank officials also said: “I agree with the policy, but it is said that it is too much to block the way that even homeless people use loans to buy houses in a situation where house prices have risen a lot. “. There is also a saying: “You need to make a plan to make exceptions in the event that a homeless person becomes a single homeowner.”

If a credit loan of more than 100 million won has already been received before the 30th of this month, it is excluded from the regulation. Therefore, it is observed that loan consumers can flock before 30 days, the effective date of the measures, to get on the ‘last train’ before regulation is strengthened. This countermeasure also includes content that requires the entire limit to be viewed as the loan amount, not the amount actually used in relation to the “minus bank book,” a type of credit loan.

The financial authorities set the execution deadline at the end of this month taking into account the need for time to reorganize the computer system of each bank. “We will seek cooperation so that financial institutions can autonomously apply DSR to each borrower even before the system is implemented, so that there is no prior demand.” Said.

![[그래픽] Main content of the credit loan management plan](https://img8.yna.co.kr/etc/graphic/YH/2020/11/13/GYH2020111300170004400_P4.jpg)

(Seoul = Yonhap News) Reporter Kim Young-eun = As of the 30th of this month, if the total amount of credit loans received by high-income people exceeding 80 million won per year exceeds 100 million won, 40% of the regulation of the total debt repayment rate (DSR) per borrower (non-bank sector 60%) Apply.

If a borrower who received a credit loan of more than 100 million won purchases a home in a regulated area within one year, the loan is recovered.

On the 13th, the Financial Services Commission and the Financial Supervision Service announced plans to manage home loans.

[email protected]

Facebook tuney.kr/LeYN1 Twitter @yonhap_graphics

◇ Strengthening the proportion of bank loans with high DSR … “The overall impact of family loans is inevitable”

Through this measure, the financial authorities decided to strengthen the regulation of the ‘high participation of DSR loans’ by banks, and it is observed that the global effect of loans to households will be inevitable in the future.

Commercial banks take loans that exceed 70% of the DSR from ‘15% or less’ to ‘5%’ of the total loan amount, and loans that exceed the DSR of 90% are currently ‘less than 10%’ to ‘3%’ must be lowered to each. The deadline set by the financial authorities to meet the target number is until the first quarter of next year. DSR is the repayment of principal and interest on all loans owed, divided by annual income.

A commercial bank official said, “The government is willing to limit household debt. This measure will inevitably reduce not only personal credit loans, but also household loans, such as home loans,” and said: “The bank has managed to manage its own high DSR. So in the end, it will affect the entire household loan.”

Another commercial bank official noted: “If the recipient has already received all the loans, and if the total amount of DSR is adjusted high, there is a risk that the general public should receive the loan from the bank up to the limit at end suffers a major blow.

Some of the banking sectors also expressed concern that the DSR regulations for the second financial sector are not clear to this extent, which could lead to the ‘balloon effect’ of demand shifting to the second financial sector.

In addition, in relation to the decision to verify whether the financial authorities are meeting the objectives for bank loan management, it is observed that the limit on credit loans can be lowered not only for people with high income but also in general.

Banks will first lower their credit limit, targeting high-income people, but if they cannot meet the targets set by the authorities, they will lower the overall limit and affect some low-income people.

[연합뉴스TV 제공]

◇ Banks “I need to admit insurance rates as proof of income” … “Review” authority

Before the implementation of the new system on the 30th of this month, a common request emerged in the banking sector to add a ‘health insurance premium’ as a document to determine annual income of 80 million won when examining credit loans for workers. office.

In this sense, in a meeting attended by the Financial Supervision Service and the main banking professionals on the 13th, several banks suggested this issue and the FSS responded: “I will review it.”

A bank official said: “Initially, the FSS only accepted two types of income vouchers and earned income withholding receipts when managing loans. However, if participants only provide income vouchers for two types, loan advice , especially non-face-to-face loans As the difficulty is great, it was suggested that the amount paid for health insurance could be converted into income for office workers, ”he said.

In the case of health insurance, insurance premiums are calculated based on the amount of income, so the banks explain that it is not unreasonable to show annual income.

In addition, the banks noted that if a person with a credit rating greater than 100 million won buys a house in a regulated area within a year, it seems difficult to manage the loan in practical terms in terms of IT application and individual management. , and you need to prepare a system to confirm it. did.

In this regard, the financial authorities indicated that “banks will be able to share lists of people with credit credits greater than 100 million won through the system and connect them with the computerized registration system to select those who are subject to regulation.” Banking professionals were reported to have been told that “it will be checked every six months.”

<저작권자 (c) 연합 뉴스,

Unauthorized reproduction-redistribution prohibited>

2020/11/15 06:03 shipped