[ad_1]

Hwang Cheol-seong, Senior Lecturer at Seoul National University. Hankyung DB

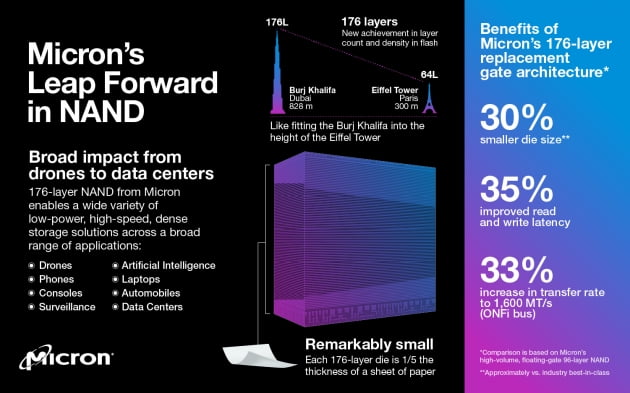

On the 10th, shocking news reached the Korean semiconductor industry. Micron, an American memory semiconductor company, announced that “the world’s first 176-layer NAND flash (semiconductor that stores data even when turned off) has been produced and delivered to customers.”

Recently, NAND flash companies are competing to create high-capacity products by vertically stacking ‘cells’, which are data storage spaces. Samsung Electronics and SK Hynix are focusing on 128-layer products and developing 176-layer products. Compared to a building, Samsung Electronics and SK Hynix are building 128-story buildings, but Micron is the first in the world to complete and sell a 176-story building.

In the semiconductor industry, there is a “I was listening and had a drink” reaction. In the DRAM market (semiconductors where data disappears when the power is turned off), Micron ranks ‘Third’ in the world third (22.2%) after Samsung Electronics (42.1% share) and SK Hynix ( 30.2%) in the second quarter, but NAND In the flash market, Samsung Electronics (33.8%), Japan Kioxia (17.3%), US Western Digital (15.0%), Intel (11.5%) and SK Hynix (11.4%) are in sixth place (10.2%). Why.

Introducing Micron’s 176-layer NAND flash in the USA The performance difference between the existing product and the 176-speed product is emphasized compared to the Burj Khalifa in Dubai (828m) and the Eiffel Tower in Paris (300 m). Micron Home Page

On the afternoon of the 13th, we heard the significance and wavelength of Micron’s 176-layer NAND flash mass production from Hwang Chul-sung, Senior Lecturer at Seoul National University (photo). Professor Hwang has served as a professor in the Department of Materials Science and Engineering at Seoul National University and as the director of the Semiconductor Research Institute. As a regular fellow of the Academy of Science and Technology, he is an expert in the semiconductor field who has published more than 630 articles on Scientific and Technical Citation Indexes (SCI). Prior to his appointment as a professor, he worked at Samsung Electronics’ Research and Development Research Center, which is evaluated not only for research and education, but also for industry.

Professor Hwang said: “In the field of NAND flash, Micron’s technological prowess has surpassed Samsung Electronics, or at least has been matched.” Regarding the DRAM market, he explained: “The technology gap between Samsung Electronics and Micron in the past was at the level of ‘three years’, but recently it has narrowed to ‘half a year'”. He explained, “Micron, who walked after three steps, is half a step behind.” did. Below is a summary of the questions and answers.

▶ Has Micron really succeeded in mass production of 176 layer NAND?

“I don’t think it was mass produced once, but it is a prototype.” (For reference, Micron used the expression that they were successful in mass production.)

▶ Micron’s technology is considerably more than you thought.

“There is nothing special about the working principle of NAND flash (compared to other semiconductors).”

▶ Why can’t Samsung Electronics do it?

“I have to stack cells and make a hole in the middle, but as the number of levels increases, it becomes increasingly difficult to drill holes. Samsung Electronics is the only company in the world that drills holes up to 128 levels at a time. (single stack). The technology was excellent. Since it was technically impossible for Samsung Electronics to penetrate at the same time from 176, it was a situation that it had to penetrate twice (Double Stack). It takes time to do what it did not. Mass production of the world’s first 128-layer NAND was also slower than SK Hynix. I am. “

▶ What is the situation at SK Hynix?

“SK Hynix originally drilled holes twice. For example, if Samsung Electronics built a 100-story building at a time, SK Hynix built 50 stories first and then placed 50 stories on top. 128-layer NAND was built at SK Hynix. mass produced for the first time in the world, it was also made with a double perforation (double stack) method. SK Hynix is also working hard to develop a 176 layer product. “

▶ How many times will one micron make a hole?

“I have penetrated twice since early.”

▶ What is the atmosphere of Samsung Electronics or SK Hynix right now?

“Samsung Electronics in the NAND field would have struggled due to SK Hynix’s takeover of Intel’s NAND division, but it was hit again. We can overcome the technical difficulties. I don’t think it’s a big difference. Probably late. this year or early next. “

▶ If that’s the case, wouldn’t you be very concerned?

“The problem is that it is important that Micron appears first, even for a month.”

▶ It appears that Micron has not been a company that has been affected by technology.

“I felt a sense of disparity. Micron is actually a conservative company. Even when it comes to making DRAMs, Samsung Electronics uses good equipment to make good products in bulk first. Micron says, ‘We are FirstMover’s negligence when Samsung Electronics lead the way. It was a ‘take’ and ‘eat fruit’ strategy. “

▶ Has the strategy been changed?

“Yes. It was an operation like ‘Let’s go slowly even if we eat less money’, but when we see the product launched first, you can tell that it has changed to ‘aggressive.

▶ Why did the micron change?

“If you launch a product six months first, it has a great effect of worrying the market and making money. Until now, if Samsung Electronics developed and launched ‘first’ and eats fruit from a new market, SK Hynix eats it as a second tier. , and then Micron. It was a structure like this to eat in. I’m worried. “

▶ What do you think is the driving force behind the hit and the micron output?

“The positive effects of the acquisition of Elpida by the Japanese company DRAM are coming to light. The acquisition of Elpida by Micron has suffered many financial difficulties. Now, the organization has stabilized. In particular, it absorbs the workforce of Elpida’s R&D and growing in size, so it’s about technology Now it works. “

(Micron, which was the fourth largest DRAM market at the time in 2013, acquired Japan’s Elpida, which is the third largest in the world. Despite the combination of third and fourth positions, it did not reach second place in the DRAM market. It was said it was a mistake “, but Professor Hwang thinks the acquisition was good in terms of R&D).

▶ How should Korean semiconductor companies respond?

“It’s a workforce in the end. Getting an R&D workforce is not easy. Micron’s largest acquisition of Elpida was Elpida’s skilled R&D workforce.”

▶ Will Micron reach DRAM?

“In the past, the technology gap between Samsung Electronics and Micron was ‘three years.’ When Samsung Electronics manufactured the first generation of 10nm (nanometer, billionths of a meter) DRAM, Micron followed long after. But now, the gap is ‘half a year’. Years (6 months). Now I don’t know when this will change. “

(Actually, Samsung Electronics, SK Hynix and Micron are mass-produced 1z products called 3rd generation 10nm products)

▶ Was there also a role for the United States government?

“The memory semiconductor market is growing. The memory semiconductor share of the total semiconductor market has expanded from about 15% to 30%. To match the size of the market, the US government also support for local semiconductor companies has increased. The Donald Trump administration has said, “” American Great Again “cried out and supported the manufacturing industry in their own country. Those things were followed at a rapid pace on their backs. “

▶ Will EUV be a game changer in the DRAM market?

“Injecting EUV equipment into DRAM production is a ‘fill the market first and sell out’ strategy. It is true that using such expensive equipment is expensive because DRAM is cheaper than CPU, etc. It is a cost battle. If the cost increases through the use of expensive equipment, price competitiveness will not be achieved. The use of expensive EUV equipment is because there is still enough merit to offset the increased costs by increasing process efficiency. “

▶ How do you see the DRAM market going forward?

“In the past when we went from 40nm to 30nm and 20nm, we quickly reduced it by 10nm. But as we go to 10nm, it becomes difficult to reduce by 1nm in DRAM. I don’t know if Micron can resolve DRAM. faster than Samsung Electronics or SK Hynix. Samsung Electronics has profited by making preemptive investments based on scale superiority so far. Using EUV in DRAM is a game-changer. EUV equipment is expensive, so the equipment is expensive, but money to maintain and operate equipment is a lot. Since Samsung Electronics is doing it, SK Hynix is also following it.

Professor Hwang told reporters in the past: “The technology gap between Korean memory semiconductor companies, US Micron and Japan’s Kioxia is gradually narrowing,” he said. “China can catch up on NAND flash quickly, so don’t watch out.” I told you. In summing up the interview, he emphasized once again that “The appearance of microns after Samsung Electronics has been reduced to ‘3 steps to semitones’ for DRAM, and NAND is already ‘flipped'”.

That is why Korean semiconductor companies such as Samsung Electronics and SK Hynix currently hold high market share in the global DRAM and NAND flash markets, which is why they are not in a situation where they will be relieved. Even in a tough business environment, Samsung Electronics invests 20-30 trillion won each year in the semiconductor line in Pyeongtaek, Gyeonggi province, and SK Hynix spends 10 trillion won to acquire the Intel NAND division.

Reporter Hwang Jeong-soo [email protected]