[ad_1]

Sometimes they get scammed after investing … The remaining 160 billion won cannot be due to misappropriation of funds.

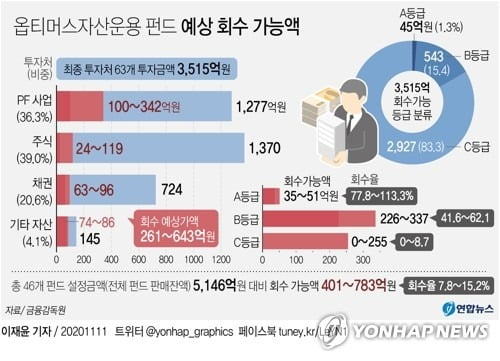

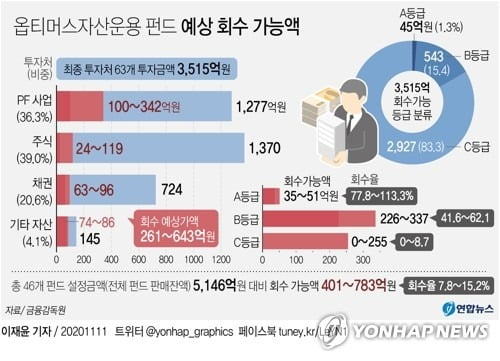

A due diligence result was found that the recoverable amount of the Optimus Asset Management Fund, where investors’ 500 billion won money was tied up, was less than 10%.

The Financial Supervision Service released the Optimus Fund due diligence report held by the accounting firm Samil on the 11th, and announced that the expected recovery rate compared to the principal amount of KRW 514.6 billion entered by subscribers to the fund was only 15.2% (783 billion KRW) from a low of 7.8% (40.1 billion KRW). .

It means that up to 470 billion won of investor funds can be disposed of.

Samil Accounting Corporation estimated the rate of recovery through due diligence on the possibility of bond preservation measures, whether to guarantee collateral or not, and by analyzing business progress and recovery risks, targeting 63 final investment destinations. where 351.5 billion won were invested in the fund’s capital.

By type of investment, Real Estate Project Finance (FP) business is 127.7 billion won, stocks 137 billion won, bonds 72.4 billion won, and another 14.5 billion won.

An official from the Financial Supervision Service explained: “Some of FP’s real estate investments have themselves been fraudulent.”

It turned out that most investments in stocks, futures and options also lost money.

Most of the listed companies in which they currently invested are delisted or suspended.

As a result of due diligence in these investment destinations, Grade C, which is questionable for recovery, accounted for the majority at 2.927 billion won (83.3%).

A fully recoverable rating (4.5 billion won) and a partially recoverable B rating (54.3 billion won) accounted for only 16.7%.

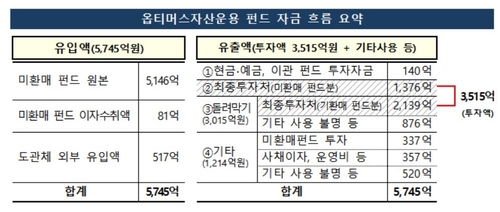

From the capital of the fund, subtracting KRW 351.5 billion, which was invested in the final destination of the investment, the remaining KRW 160 billion was used by the subjects and conduits (transfer companies) who committed the Optimus fraud by embezzlement, forgery and operating expenses, making due diligence impossible. .

It means that the money has disappeared.

The Financial Supervision Service announced that it plans to actively cooperate with ongoing prosecution investigations into assets whose use is unclear.

Including the due diligence report and FSS explanation, the 46 Optimus funds included investor equity (514.6 billion won), as well as external conduit inputs (funds deposited into the fund by affiliates who participated in the fraud of Optimus) 55.1 billion won and interest on the fund’s investment assets 81 A total of KRW 574.5 billion was entered, including KRW 1 billion.

The Financial Supervision Service decided to establish a voluntary advisory body related to the calculation of the standard price reflecting the results of due diligence.

However, it was emphasized that it is difficult to adjust the fund’s base price immediately, reflecting the results of due diligence, as the relationship between the fund’s rights to the underlying assets is unclear.

It is expected that it will take a considerable period of time to determine the amount of damage, but he has announced that he will develop a dispute resolution plan to relieve the victims.

Meanwhile, NH Investment & Securities, the Optimus Fund’s largest seller, said on the day that “the objectivity of the conservative results of due diligence is recognized” and “If the company’s client asset recovery task force applies His own estimation, the total amount of the collection will be more than 110 billion won. It is even possible, “he said.

NH Investment said: “The direct correlation between the amount of compensation the actual client will receive and the asset recovery rate is not great,” and said: “The final compensation amount will be determined after covering the liability issue through claim or the result of an adjustment of the complaint to the FSS, not the asset recovery rate. ” .

NH Investment has decided to provide financing to Optimus sales subscribers varying the amount of the investment between 30% and 70%.

However, many investors are demanding full compensation and are preparing for FSS dispute resolution and subsequent damage claims.

The non-repurchased Optimus funds sold by NH Investments represent 84% (432.7 billion won) of the total.

/ yunhap news