[ad_1]

Since the re-election of President Donald Trump is predominant in the United States, the counting situation in the United States has been reported and the national stock market has also been fighting for the industry.

US President Donald Trump delivers a speech on the 1st. AFP = Yonhap News

On day 4, the KOSPI finished the market at 2357.32, an increase of 14.01 points (0.6%) compared to the previous day. The index fell to 2339 at one point in the morning when news broke that a large invasion limit had been set on the eastern front of Gangwon-do, but Trump’s propaganda news showed an uptrend, mainly in the beneficiary industries.

Initially, the mayor predicted a ‘blue wave’ in which Joe Biden will win and the Democratic Party will occupy the Senate. The day before, stocks known as “biden beneficiaries,” such as industrial goods and healthcare, also rose on the New York Stock Exchange. However, the situation was reversed when President Trump’s victory in close battles like Florida was confirmed.

‘Biden beneficiary’ crying and ‘Trump beneficiary’ laughing … Stock market fluctuating together

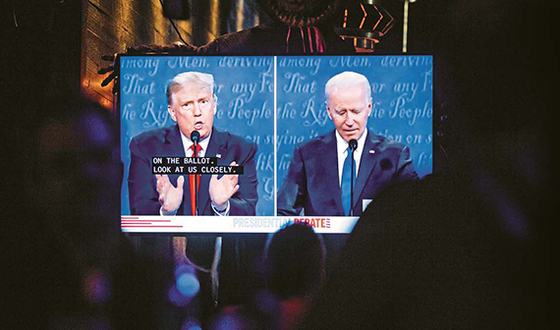

On the 22nd of last month, President Donald Trump (left) and Democratic candidate Joe Biden during the second presidential debate. EPA = Yonhap News

On this day, the solar, wind and hydrogen related industries saw a huge drop in share prices. In the KOSPI market, OCI (-8.29%) Shinsung ENG (-8.58%) and Hanwha Solutions (-8.86%), while in KOSDAQ, Osung Advanced Materials (-22.09%), S Energy (-7.97%), Taewoong (-9.93%)) and Unison (-8.9%) had a big drop. Biden has committed to investing $ 2 trillion in clean energy for four years. The sports that had joined in their anticipation for the elections had been scaled down.

The Korean Stock Exchange assessed the stock market on the day: “Amid the unexpected dominance of Trump’s candidate during the week, the surge in Nasdaq overtime futures led to a surge in Asian stock markets generally, and institutional purchases continued, mainly in the service industry, which is Trump’s beneficiary. ”

The internet and semiconductor industries benefited this day. Among the top stocks by market capitalization, Naver (+ 5.48%), Kakao (+ 6.84%) and NCsoft (+ 7.03%) were up sharply. The traditional IT and energy sectors are known as Trump beneficiaries. Park Seung-young, a researcher at Hanwha Investment & Securities, interpreted that “big tech companies could be at a disadvantage when Biden came to power, but this was diluted when Trump was re-elected, which was positive for the stock market.

Trump gains good news in the short term in domestic stocks … The conflict between the United States and China is a variable

President Trump is known to be more market-friendly than Biden. This is because they are less aggressive and demand lower corporate taxes. Many believe that the possibility of an economic lockdown following the reproliferation of the crown is also small.

The problem is relations with China. Experts say that because of this, Trump’s election is ultimately not positive for the national stock market. Pyeon Deuk-hyun, head of asset management strategy at NH Investment & Securities, said: “It can be market-friendly because President Trump is tolerant of tax matters. He analyzed that “if the tension with China remains as before, it will be difficult for Korea.” It is good news in the short term, but it is not said to be good in the medium or long term.

Kim Seong-geun, Principal Investigator at Korea Investment & Securities, said: “The US fiscal deficit is likely to continue into Trump’s second term, so the dollar will weaken, but foreign policy with high uncertainties will continue.” . The winger is strong, ”he explained.

Reporter Moon Hyun-kyung [email protected]

[ad_2]