[ad_1]

Disclosure price 發 ‘fiscal bomb’

Only 600 million or less from disclosure of property tax cuts

Temporary application for 3 years … Controversy expected

Raemian Daechi Palace, Daechi-dong, Gangnam-gu, Seoul / Reporter Eun-gu Kang [email protected]

The government has confirmed a plan to raise the official price of apartments and flats to 90% of the market price by 2030. Land will reach 90% in 2028 and single-family homes in 2035. If the public price rises, the burden increases of various taxes such as the possession tax (property tax + comprehensive property tax). The government decided to lower the property tax rate for a homeowner with a public price of 600 million won or less starting next year to partially ease the tax burden.

On the 3rd, the Ministry of Lands, Infrastructure and Transportation and the Ministry of Public Administration and Security announced plans to increase the reflective rate of published property prices and ease the burden of property taxes. The reflection rate is the ratio of the published price to the real estate market price.

Currently, the rate of reflection of the published real estate price is 65.5% for land, 53.6% for single-family homes and 69.0% for homes. According to the Ministry of Land, Infrastructure and Transport, the reflection rate increases by an average of 3 percentage points each year. The period to achieve the 90% reflection rate was suggested differently: 10 years for apartment houses, 15 years for single-family houses, and 8 years for land. The price was also differentiated. Apartment houses with more than 1.5 billion won will rise to 90% in 2025. Less than 900 million won will be 90% in 2030, five years later.

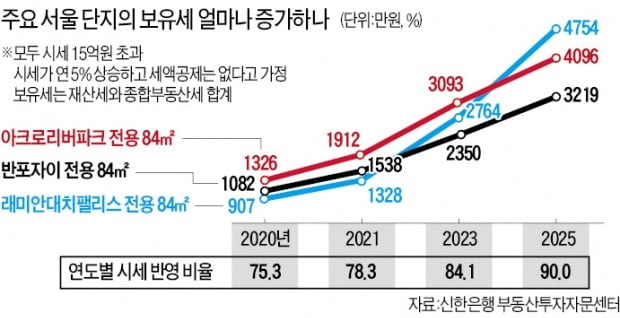

Due to the increase in the quoted rate, the property tax burden for high-priced apartments is snowballing. As a result of the request of the Korea Economic Daily to the Shinhan Bank Real Estate Investment Advisory Center, a homeowner who owns 84㎡ of exclusive area for the Raemian Daechi Palace in Daechi-dong, Seoul, with a market price of approximately 3.3 billion of won, 47.5 million won in 2025, when the property tax rises to 90% from 9.07 million won this year. It was found to increase about five times.

In line with the increase in the public price, the party government decided to reduce the property tax for a home and owner with a public price of 600 million won or less. The ruling Democratic Party and the Democratic Party were in the position that the target should be expanded to “less than 900 million won”, but after discussion, it was finalized to less than 600 million won. It was decided to reduce the tax rate by 0.05 percentage points for each section of the tax base. The property tax reduction benefit through this tax rate cut is up to 180,000 won per person. The government decided to review the reduced tax rate after applying it for three years from next year to 2023.

The disclosure price increases to 90% of the market price

On the 27th of last month, the government presented three scenarios in an annual public hearing organized by the Institute of Land, Infrastructure and Transportation in which the reflection rate of the public price is applied at 80%, 90% and 100%. Of these, since 90% of the proposal was finalized after consultations with the party government, the burden of property tax and comprehensive property tax combined with property tax for one owner is expected to increase significantly. The government decided to reduce the property tax for a homeowner with a public price of 600 million won or less. However, controversy is expected as it will be applied temporarily for only three years.

On the 3rd, the Korean Economic Daily commissioned Shinhan Bank’s Real Estate Investment Advisory Center to calculate the annual tenure tax for major apartments in Seoul.

One owner, who owns 84㎡ of the exclusive area of the Raemian Daechi Palace in Daechi-dong, with a market price of approximately 3.3 billion won, pays 9.07 million won in property taxes this year. As the reflection rate, which is currently 71%, increases year over year, the tenure tax due in 2022 will double to 19.08 million won. In 2025, when the reflection rate reaches 90%, the tax amount will increase almost five times to 4.754 million won. During the same period, the tax amount for an owner who owned 84㎡ for Banpozai also increased from 1,082 million won to 3,219 million won. Woo Byung-tak, manager of Shinhan Bank Real Estate Investment Advisory Center (tax accountant), said: “The possession tax has increased significantly, so retirees or seniors with no income will have to worry about getting rid of their homes “.

The government decided to apply the tax rate, which was reduced by 0.05 percentage points from the previous one, only for houses with an official price of 600 million won or less. The government explained that the scope of the target housing and the scope of the tax rate cut were set in line with the purpose of slightly easing the tax burden resulting from the increase in the published price reflection rate.

Based on the property tax reduction, the official price △ Maximum 30,000 won for houses less than 100 million won △ 30,000 to 75,000 won for less than 100 million to 250 million won △ 75,000 to 150,000 won for less than 250 million to 500 million won △ 5 For less than 100 million won to 600 million won, 150,000 to 180,000 won will be exempted. Specifically, for an apartment in Jongno, Seoul, officially priced at 400 million won this year, the property tax will be reduced by 9,280 won to 22.5670 won from 31.5950 won next year.

The government estimates that the number of households that will receive the tax cut will reach 10.3 million. Among the 18.73 million houses in total, 1.86 million households are a house, of which 94.8% of the public price is less than 600 million won. An official from the Ministry of Public Administration and Security said, “It is expected that there will be an annual fiscal support effect of 477.5 billion won through the reduction of property tax.”

This tax rate cut will be temporarily introduced for three years from the next year’s property tax imposition through 2023. The quoted price reflection rate will remain at 90% after 2030, but reductions in consequence do not continue.

Reporter Jinseok Choi / Jinkyu Kang / Hyungjin Jeon [email protected]