[ad_1]

Increase in apartments in the highest taxable section

Expert “Taxation will be more intense”

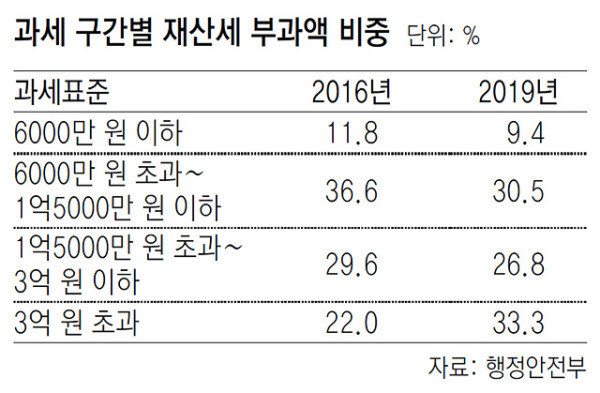

Last year, homeowners, the top 6% of property tax, paid a third of all property taxes. This is because, along with rising house prices, the official price of high-priced homes continued to rise. If the public price rises to 90% of the market price, but the property tax is lowered for medium to low priced homes, the taxes are expected to be more severe.

As a result of the analysis of the performance of the imposition of home property tax from 2016 to 2019, the number of cases imposed on homes exceeding 300 million KRW, which is the highest property tax rate in the Last year, it was 109. There were 6,821 cases. The property tax applied to these houses was 1,6905 trillion won, which was 33.3% of the total property tax (5.8 trillion won). If the target is 300 million won, the official price is about 500 million won and the market price is about 700 million won (depending on the apartments).

The property tax is divided into four sections ranging from less than 60 million won to more than 300 million won, and is levied at a rate of 0.1 to 0.4%. The amount of tax levied on homes below the 60 million won target, which accounted for 39.7% of the total last year, was 9.4% of the total.

While the tax burden of homes in the highest target segment gradually increases, the share of those of the rest of low and medium priced homes tends to decrease. In 2016, the share of tax collected on the highest target home was 22% and the lowest part of the tax was 11.8%. It is also attributable to the increase in the total number of houses, such as relatively expensive new apartments in the last three years, but is largely influenced by the increase in the number of new houses included in the highest target segment due to an increase in housing prices and an increase in the official price of high-priced houses. The government is pushing for a plan to gradually increase the official house price, which is 69% of the current market price (based on apartments), to 90% in stages. As there is concern that this will increase the tax burden for ordinary people, only mid to low priced houses are considering a plan to reduce property tax. Experts worry that the government and ruling party, mindful of the political vote, are distorting the tax system by imposing taxes arbitrarily. The way to impose increasing burdens on minorities is that it not only violates the tax principle of “broad tax sources, low tax rates,” but also does not conform to tax fairness. Park Ki-baek, a professor in the Tax Department at Seoul University, noted, “As we move closer to politics with the purpose of stabilizing house prices, we are moving away from general tax principles as reflect factors of consideration. “

Sejong = Reporter Joo Aejin [email protected] Go to reporter page>

Copyright by dongA.com All rights reserved.