[ad_1]

Citizens visiting the Seoul Workplace Welfare Center Plus in Jung-gu, Seoul, are receiving information about the Corona 19 Emergency Employment Security Scholarship. News 1.

For workers with special employment (special high school) and self-employed, monthly earnings decreased 69.1% from the average of last year after the spread of the new coronavirus infection (Corona 19). The smaller the income group, the greater the rate of income decline. This is the result of the analysis of the details of the support for the emergency subsidy to job security from the Ministry of Employment and Labor.

According to the Ministry of Employment and Labor on the 2nd, a total of 1,756,000 people applied for the first emergency subsidy for occupational safety from June 1 to July 20, of which 1.49 million who met the requirements received the support for. The Emergency Job Security Support Fund is a system that selectively supports the vulnerable, such as special high schools, the self-employed, small business owners and people who leave without pay, for up to three months (1.5 million won) each month for 500,000 won. Choose a person whose income has decreased by 25% or more compared to before the spread of Corona 19. Since applicants submit personal income data during this process, it is possible to identify the decrease in income due to the spread of infectious diseases.

When observing the status of applications by type of work, the small self-employed represented the highest proportion with 1,098,000 (62.5%). Next, there were 587,000 (33.4%) from special high school and self-employed, and 71,000 (4%) unpaid graduates. By gender, women account for 53.5%, 7 percentage points more than men (46.5%). This is because the proportion of women is large in the special high school industry where there are many applicants, such as insurance planners, teachers of the branch of studies and visiting salespeople. By age, the proportion of people aged 40 (25.6%) and 50 years (28%) was large.

How much has the monthly income of the special high schools and the self-employed decreased?

Among grant applicants, special high school and freelancers saw their median monthly income decline 69.1% from last year’s average after Corona 19’s spread (March to April this year). Insurance planners decreased 56.1% on average and workbook teachers decreased 49.1%. Attached items decreased 58.9% and door-to-door salespeople decreased 56.4%.

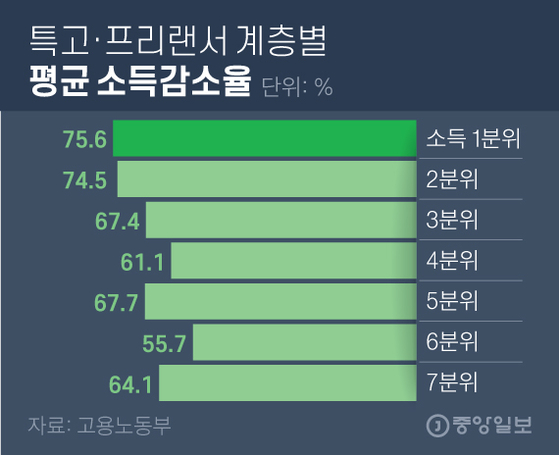

The decline in income from the coronavirus was greatest for the low-income group. The rate of decline in income for the first quintile (bottom 10%) reached 75.6%. The higher the range of income, the lower the rate of decline, and the rate of decline of the sixth quintile (55.7%) of income registered the lowest.

Average income reduction rate for each self-employed and special high school class. Graphic = Reporter Kim Young-ok [email protected]

What is the effect of emergency grants and ‘selection support’?

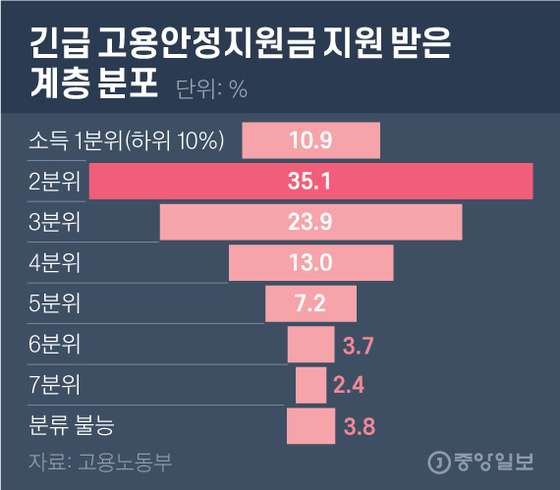

As a result, the subsidies were concentrated in the low-income class, which was hit the hardest by Corona 19. About half (46%) of all recipients were in the bottom 20% of their income. 83% of beneficiaries went to the bottom 40% of their income. This means that, compared to the “universal welfare” type of primary disaster subsidy, which provides the same amount to all classes, the employment subsidy using the selective support method has the effect of boosting financial support to the vulnerable.

Going forward, the task to increase the efficiency of screening support is to establish a fast and accurate revenue identification system. In the case of this subsidy, an employee of the Ministry of Labor carried out a manual income verification process. It was possible to quickly identify the types of businesses in which companies filed bonuses and sales statements, such as learning branch masters and taxi drivers. However, workers with unclear affiliations recognized a copy of a savings passbook or an image captured on the payment screen of a card terminal as income documents and were manually counted. Lee Ji-young, manager of the Employment Security Emergency Support Group of the Ministry of Employment, explained: “It seems that there are almost no cases where excessive or insufficient income is reported, but there may be a clear difference between income and the actual income in the documents presented. ”

Distribution of the class that received emergency job safety support. Graphic = Reporter Kim Young-ok [email protected]

Quick support for low-income families, ‘universal tax’ essential

Experts point out that to accelerate the government’s financial assistance to low-income families, structural foundations must be laid that include “universal tax increases.” This is because if it is difficult to determine overall income, it is difficult to provide quick support during a crisis. Kim Dong-won, a former economics professor at Korea University, said: “There are a lot of low-income people who cannot understand their income, and even after Corona 19, the number of platform and non-contact workers will increase even more. ” We have to make sure we don’t become subordinate. ”

Sejong = Reporter Kim Do-yeon [email protected]

[ad_2]