[ad_1]

The government and the ruling party entered into last-minute negotiations on the large shareholders standard, which imposes a tax on capital gains. This is because ‘Donghak Ant’ is stepping up against the change from the current standard of 1 billion won to large shareholders to 300 million won next year. On the night of the 1st, a high-ranking meeting of the party, government and government will discuss a plan to reduce the property tax and whether to change the standard of 300 million won to the largest shareholder.

On the 23rd of last month, members of the Korea Equity Investors Association (Han Tu-yeon) held a press conference in front of the Blue House Fountain in Jongno-gu, Seoul. News 1

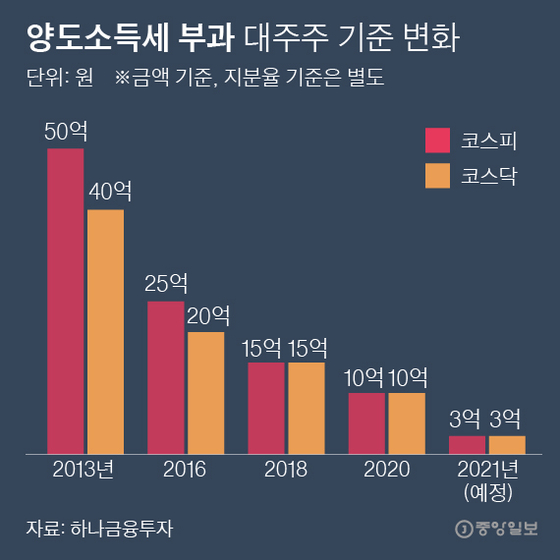

Currently, the stock transfer tax only pays large shareholders with a holding amount per item (based on market price) of 1 billion won (1% KOSPI, 2% KOSDAQ) or more. The Ministry of Strategy and Finance decided to lower the standard for large shareholders to 300 million won from 2021 in the ‘2017 Tax Reform’. At the time of 2017, there was no great controversy. This is because there was a grace period of about three years, and I was not expecting a ‘boom’ in people-centered equity investing like now.

This year the controversy began to spread. In July, the Ministry of Science and Technology released a ‘financial fiscal restructuring plan’ that even small investors are subject to the share transfer tax. Although the implementation date was 2023, there was a strong reaction, mainly from individual investors.

In addition, starting next year, the standard of major shareholders subject to the stock transfer tax will be changed from 1 billion won to 300 million won, and the fact that family holdings are summed up, increased the anger of Donghak ants. When the standard for large shareholders is lowered, the number of targets to pay the share transfer tax increases. In addition, concerns have spread that the variable based on large shareholders will lead to an ‘explosion’ of share sales by the end of the year.

Changes in standards for major shareholders subject to capital gains tax. Graphic = Reporter Park Kyung-min [email protected]

In response to the backlash from individual investors, the Ministry of Science and Technology decided to change the use of all shares held by the family so that they are calculated as the principal shareholders of each individual. However, the Donghak ants’ anger did not go away. This is because the Ministry of Knowledge Economy adheres to the policy of lowering the standard from 1 billion won to the largest shareholder to 300 million won.

As public opinion deteriorated, the ruling Democratic Party, the ruling party, raised the bar for large shareholders to 300 million won from next year or delayed the implementation time. Of course, the base part is the key point. They even gave the family standard, but they are in a position where they cannot retreat anymore. On the 7th, Vice Premier and Minister of Equipment Hong Nam-ki emphasized: “It is desirable to maintain consistency” in the Planning and Finance Audit Committee of the National Assembly of the National Assembly.

The Democratic Party, which faces the by-election of the mayors of Seoul and Busan in April next year, worries that public opinion focused on individual investors will worsen. This is the background to the last minute persuasion of the Ministry of Information and Technology through a high-ranking meeting of the party, the government and the government.

Together with Democratic Party representative Lee Nak-yeon, they are all speaking at the Korea New Deal Party, Government and Office workshop held at the National Assembly in Yeouido, Seoul, on the afternoon of April 25. last month. 2020.10.25 / News 1

There are more reasons why the party and the government should speed up the negotiations. As of the first, 229,000 people accepted the Blue House’s request to “vigorously request dismissal” addressed to Vice Premier Hong, who adhered to the 300 million won standard. The number of consents (200,000 cases) to which the Blue House or the government must respond has already exceeded. When Vice Premier Hong’s impeachment petition became controversial, a national petition (‘Support for Vice Premier Hong Nam-ki’) appeared on the 29th of last month, and as of 1, 12,000 people agreed.

In the market, the current 1 billion won is expected not to be maintained, even if the standard for major shareholders of 300 million won may be partially improved or the timing of implementation may be delayed depending on the results of political-partisan negotiations. .

Yeom Dong-chan, Researcher at EBEST Investment & Securities, said: “There is a possibility of an adjustment (based on 300 million won) considering the fact that the scope of the income tax deduction for financial investments was expanded by the July tax reform plan, coupled with the view that the rate of expansion of the range of large shareholders is too rapid even within the ruling party. It will be difficult to maintain the current KRW 1 billion. ”

Sejong = Reporter Cho Hyun-sook [email protected]

Graphic = Reporter Park Kyung-min [email protected]

[ad_2]