[ad_1]

Serious consequences such as transfer tax … Leaving a single house in Seoul as a local house for sale

Gimcheon, Muan, Sacheon, etc. 30 to 40 million won’Tuk ‘… Low occupancy rate

Yangpyeong rural houses also fell by tens of millions of won … “The local economy is on the brink of collapse.”

Gangsang-myeon area, Yangpyeong-gun, Gyeonggi province, is piling up for the sale of country houses as the tax burden for people with multiple households increases significantly. Yangpyeong = Jang Hyun-ju’s reporter

In Yulgok-dong, Gimcheon-si, Gyeongsangbuk-do, ads looking for buyers are full of windows. There are places that have put up billboards on the side of the street without worrying about the compliance regulations of the district office. An official at a brokerage firm said: “To avoid multiple homeowners regulation, there are many cases where a son living in Seoul tries to sell a house in Gimcheon where his parents live.”

According to the real estate industry on day 1, after the government significantly increased the tax burden for a home and two owners through the latest ‘710 countermeasures’, sales are piling up at brokerages in small local towns and medium like Gimcheon, Gyeongbuk and Naju, Jeollanam-do. The same applies to rural houses in the metropolitan area, such as Yongin and Yangpyeong.

This is because people with two households who are from the region but now work in Seoul and elsewhere have been getting rid of them. Additionally, sales are increasing in Sokcho and Yangyang, Gangwon, where the demand for cottages with the concept of a second home was high.

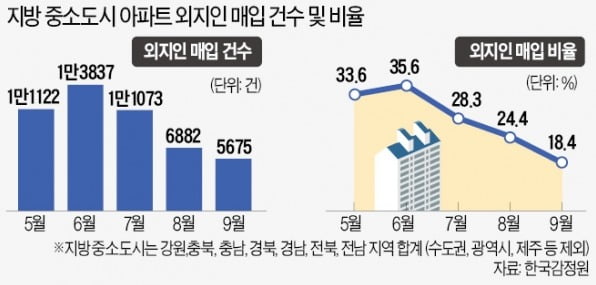

According to the Korea Appraisal Board, the percentage of foreigners who bought apartments in local small and medium-sized cities fell sharply from 35.6% in June to 28.3% in July, 24.4% in August and 18, 4% in September. The number of third-party purchases was also cut in half, from 13,827 in June to 5,675 in September.

The rate of change in the sale price of apartments in Muan for three months, from July to September, was -1.62%. Recorded. Seoul rose 1.97% over the same period, while the metropolitan area soared 2.44%. Strong fiscal policy, which was announced to raise housing prices in Seoul, including Gangnam, is only crashing the housing market in local small and medium-sized cities.

Professor Shim Gyo-eon from Konkuk University’s Department of Real Estate said: “Home sales in local small and medium-sized cities continue not only in Seoul, but also in metropolitan cities like Busan and Daegu.” Currently, only the list price of 300 million won or less is considered low-cost local housing and is not included in the number of houses during the transfer tax.

Let’s Increase The Load Of 1 Home 2 Owners … Direct Local Real Estate Success

“Only the local housing market in small and medium-sized cities was directly affected by heavy taxes for multiple homeowners who offered to pay for a house in Seoul.”

On the 1st, Mr. A, the representative of the brokerage office, met in Gangsang-myeon, Yangpyeong-gun, Gyeonggi-do, sighed. This is because country house sales in Yangpyeong are piling up rapidly after the July 10 measures, which strengthened the tax burden on people with multiple households. The owner who has an apartment in Seoul, who visited a brokerage that day, offered to sell the two-story country house in Yangpyeong, completed in 2018, for just 430 million won, which is the cost of construction. Representative A said, “From May to June, there were an average of four country house purchase inquiries per day, but now only quick sales are accumulating.

Local small and medium-sized towns increase sales and market prices fall

After the July 10 countermeasures, sales openings and market prices have continued to decline in local small and medium-sized cities such as Muan, Jeollanam-do, Gimcheon, Gyeongbuk and Sacheon, Gyeongnam. This is because if you want to reduce the transfer tax, you must first sell the property, not the “smart” one.

The 84th dedicated to ‘Mco Town The Planet’ in Yulgok-dong, Gimcheon, which traded for 275 million won in June, recently sold for 245 million won, down 30 million. The 59th dedicated to ‘Sunrise Town’ in Sineum-dong, Gimcheon sold for 100 million won through February, but the sale price fell to 79 million won last month. The 84th dedicated to ‘Gyeongnam Honorsville’ in Samhyang-eup, Muan-gun, Jeollanam-do, was actually traded at 265 million won in March, and then dropped by 45 million won on the 12th to 225 million won. .

The price of apartments in resorts, where the demand for second homes has disappeared, is also on the rise. The 59th dedicated to ‘Yangpyeong Humanville 2nd’ in Gangsang-myeon, Yangpyeong-gun, was exchanged for 250 million won in June, but was changed to 235 million won this month. The 84㎡ dedicated to ‘Okcho KCC Sweeten’ in Chaoyang-dong, Sokcho-si, changed the reported price to 350 million won in September and was actually traded at 390 million won this month. A Y official in Gangsang-myeon, Yangpyeong-gun, complained, “Owners who bought rural houses cheaply to use them as villas are pouring out their immediate sales for disposal during the year.”

With the disappearance of the shopping tax, the apartment occupancy rate in local small and medium-sized towns also fell. The occupancy rate is the percentage of homes actually occupied during the opening period. According to the Housing Industry Research Institute, the apartment occupancy rate in regions that exclude metropolitan cities fell 5.3 percentage points to 76.0% in July after registering 81.3% in June. In August (77.8%) and September (78.6%) it did not exceed the 70% range. It is estimated that there are quite a few cases where it was thrown away rather than moved out. On the other hand, the apartment occupancy rate in Seoul is 92.2% in July, 93.0% in August and 94.0% in September, maintaining the 90% range.

There are many unsold items, but it increases until they move

Byung-tak Woo, manager of Shinhan Bank’s Real Estate Investment Advisory Center, said: “People with multiple households are very likely to reduce the number of houses during the transfer tax and during the grace period next June.” Expected. Rather than investment value, small and medium townhomes purchased for real needs, such as a family residence, are the “first available.”

In local small and medium-sized towns, there are many unsold items. According to the Ministry of Lands, Infrastructure and Transportation last month, 67.6% of the total 28,309 unsold homes in the country, or 11,143 homes, were located in local small and medium-sized cities. In addition, according to Inmobiliaria 114, next year a total of 63,905 apartments will be occupied in these areas. The sale accumulates, but the supply also increases. An official at a brokerage in Gimcheon, Gyeongsangbuk-do, said, “Even if the price is lowered, there are only four to five calls a day asking you to get rid of the apartment as soon as possible.

Professor Kwon Dae-jung from Konkuk University’s Real Estate Department said: “The real estate market in local small and medium-sized cities is a structure that is difficult to sustain when demand from foreigners falls.”

Yangpyeong = Jang Hyun-joo / Kimcheon = Reporter for Jeong Yeon-il [email protected]