[ad_1]

Development Bank of Singapore (DBS) (Photo = EPA)

The daily transaction volume of the global virtual asset (cryptocurrency) market has exceeded 102 trillion KRW. It is 9 times higher than the KOSPI market’s daily trading volume on the 30th of last month (11.4583 billion won). This is a phenomenon that occurred as the demand for virtual assets gradually spread, focused on global financial companies.

Singapore Development Bank, the largest bank in Southeast Asia, recently owned by Temasek, a Singapore sovereign wealth fund(DBS, photo)Financial companies dealing with virtual assets are on the rise, such as creating this virtual asset exchange ‘DBS Digital Exchange’ and allowing the world’s largest online payments company PayPal to pay for virtual assets.

Consequently, the bitcoin market also continuously updates the highest point of the year. According to Bithumb, a virtual asset exchange, the market price of bitcoins on the 31st of last month was 15.6 million won, an increase of about 25% from the previous month.

Domestic exchanges that fought for ‘1st and 2nd place’ in the world are ‘silent’…The alien is ‘flying’

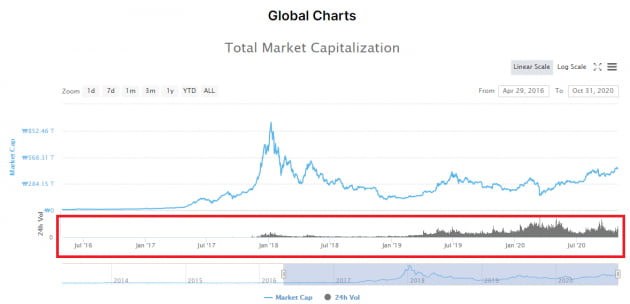

On the 31st, the total amount of virtual asset transactions registered 100.2 trillion won. It’s roughly twice the highest daily transaction amount (52 trillion won) at the time of the 2017 virtual asset crisis (Photo = CoinMarketCap.com).

According to CoinMarketCap.com, a virtual asset statistics website on the 31st of last month, the total amount of virtual assets traded during the day amounted to 100.2 trillion won. At the time of the virtual asset crisis of 2017, it already exceeded the highest daily transaction amount (52 trillion won).

Unlike 2017, when speculative transactions between individuals prevailed, these are showing abundant transaction volumes as the demand from institutional investors and real users is supported. With the rapid increase in virtual asset trading, the daily trading volume of global exchanges is also breaking the highest every day.

On the other hand, home virtual asset exchanges are relatively quiet. Although the volume of transactions has increased, it seems that it has ended in a ‘typhoon in a teacup’. This is because the national industry has collapsed to an irretrievable level when the government implemented a policy of virtual prohibition of trading virtual assets since 2017.

Korean exchanges, such as Bithumb and Upbit, which competed for world first and second place in the past, fell as newcomers, and their positions were filled by Chinese global exchanges Binance and Huobi, which were far behind exchanges nationals in 2017.

31 last month The amount of virtual assets traded on Binance and Huobi in one day amounted to 22.328 trillion won. Virtual asset transactions that double the size of the KOSPI market happen every day on both exchanges. On the other hand, virtual assets worth 262 billion won on Bithumb and 2365 billion won on Upbit were traded on the same day. Compared to Binance and Huobi’s trading volume, At the 2% level It’s just.

If the state of the national exchange was maintained at that time in 2017, the tax of ’20 trillion ‘is secured

Photo = Hankyung DB

What added value could have been created if the government had established the virtual asset industry in the institutional zone and domestic exchanges had been able to maintain their status at that time (first and second in the world)?

First, the contribution to the country’s finances through the payment of taxes. For simplicity, let’s assume that the stock market is subject to a 0.25% business tax.

If you multiply the daily transaction amount of 22.32 trillion won and the 0.25% transaction tax on Binance Huobi Exchange, which is currently ranked first and second in the world, the number is approximately 55 thousand. million won. If Bithumb and Upbit maintain their status in 2017, even if they collect transaction tax, they will pay 55 billion won per day.You can assure it.

The virtual asset market is open 24 hours a day, 365 days a year, so it offers you daily taxes on transactions, regardless of weekends and holidays. Even if the transaction volume of virtual assets is kept at the current level, about 20 trillion won (55 billion won * 365 days) of taxes are incurred per year. It is possible to secure national funding of 20 trillion won per year with just two exchanges.

Of course, it can be difficult to apply a transaction tax equivalent to the stock exchange tax right away due to the nature of a virtual asset exchange where competition to attract borderless users is fierce. With this in mind, even if the tax rate is phased in from as low as 0.025%, a minimum annual tax revenue of 2 trillion won will be guaranteed.

Also, the amount is purely the amount calculated solely by the transaction tax. In the operating profit generated by the exchange, 20% of the corporation tax goes to the treasury. Additionally, the presence of the No. 1 and No. 2 world exchanges in Korea creates numerous ancillary economic effects. World-class blockchain developers, various virtual asset projects, and venture capital (VC) will flow naturally, and the resulting effect of job creation and a huge inflow of capital could have been expected.

The government can ensure stable finances only when the market and industry are saved

Sang Sang Park, former Minister of Justice (Photo = Yonhap News)

In 2017, instead of recognizing the virtual asset industry, △ Ban ICOs △ Ban foreign investment △ Ban linking to bank accounts of new Virtual Real Estate Exchange subscribers △ Comments from government officials to shut down the exchange △ Apply a crime to open gambling venues for real estate margin trading virtual We have strong policies in place to suppress virtual asset transactions such as. As a result, the domestic virtual asset industry, which remained number one in the world, declined rapidly and most of the related funds and talents went abroad.

However, the National Assembly approved the amendment to the Special Special Law (Law on Reporting and Use of Specific Information on Financial Transactions) that stipulates the scope and obligations of virtual asset operators (VASP) in March, and the Ministry of Strategy and Finance announced the amendment to the 2020 tax law in July. The mood has changed a bit and allows you to pay legal income taxes on your virtual assets.

However, complaints from the industry have not abated. This is because, in a situation where the national virtual asset industry base has completely collapsed due to the negative stance of the government, only tax obligations and regulations are imposed without mentioning the promotion or promotion measures of the industry.

In particular, the government has announced that it will impose a 20% capital gains tax on virtual asset transactions in a situation where the infrastructure related to virtual asset taxes is not immediately insured. The domestic virtual asset industry is also in a deteriorating day as funds are running low overseas. Contrary to the government’s intention to secure tax revenues, the market is moving in the direction of decreasing total tax revenues.

Experts agree that “if the government does not want to repeat the mistakes of 2017, it should introduce a gradual tax policy in line with the growth of the industry.” Instead of dividing the belly of a goose that lays golden eggs, it is to induce the goose to continuously lay golden eggs.

Kim Yong-min, former head of the tax office of the Ministry of Finance and Economy (formerly the Ministry of Finance), head of the Korean Blockchain Association, said: “The capital gains tax is valid in terms of tax principles and meets international standards. There it is. “

He explained: “In view of this reality, it is desirable to introduce a low level of transaction tax to improve the taxable infrastructure and ensure tax revenue, and to switch to the capital gains tax at the time the taxable infrastructure is improved. in the future”.

≪This article is on November 1 (01:31) Virtual real estate information platform and blockchain (application) ‘Blooming Beat’This article was published in »

Reporter Kim San-ha, Hankyung.com [email protected]

Article Reports and Press Releases [email protected]