[ad_1]

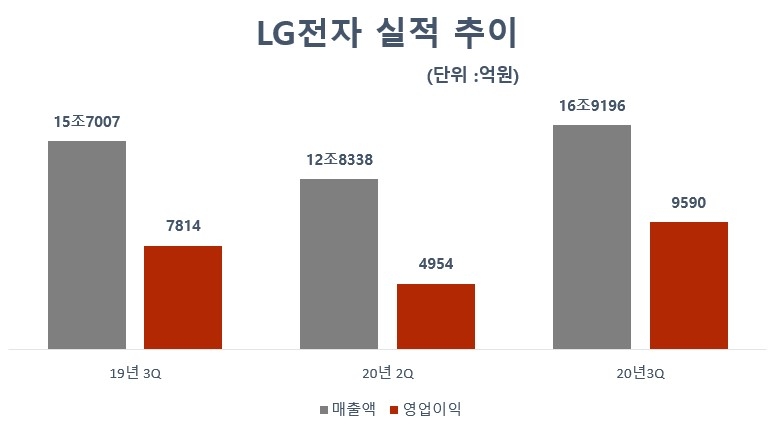

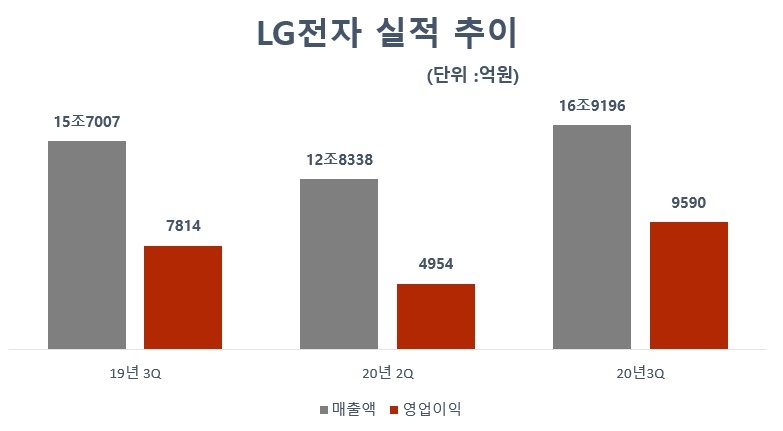

LG Electronics performance trend / data = LG Electronics

Magnified view of the image

LG Electronics announced on the 30th that it posted a consolidated operating profit of 959 billion won in the third quarter. This is a 22.7% increase over the previous year.

Sales amounted to 16,919,600 million won, up 7.8% year-on-year and 31.8% year-on-year. These sales were the highest in the third quarter and the second highest in the prior quarter.

Net income was 649.2 billion won, an increase of 87.8% from the previous year.

This performance improved due to strong consumer demand (a suppressed demand explosion phenomenon) due to the new coronavirus infection (Corona 19) and sales of home appliances and OLED TVs in line with the Zipcock trend.

Auto parts and smartphones, respectively, saw a sharp decline in losses due to normalization of operations by automakers and the expansion of sales of mid-range to low-end products.

By business division, the H&A (Household Appliances) division recorded sales of KRW 6,155.8 billion and an operating profit of KRW 6,715 billion. H&A sales posted a quarterly record and operating profit was the highest in the third quarter. Furthermore, the cumulative operating profit in the third quarter of this year exceeded 2 trillion won for the first time.

In the third quarter, the amount of time spent at home increased due to telecommuting and online education, and the demand for steam appliances such as irons, dryers, dishwashers, and domestic and foreign appliances increased, and sales and operating profit grew uniformly.

The HE (monitor) division recorded sales of KRW 3.669.4 billion and an operating profit of KRW 3.266 billion. Sales increased as demand increased in advanced markets such as North America and Europe and premium products such as OLED TVs and nano-cell TVs increased. Although the price of LCD panels increased, operating profit increased from last year as sales of premium products increased.

The MC (mobile) division posted sales of 1,524.8 billion won and operating loss of 144.8 billion won. Sales increased as sales of mid-to-low-end smartphones increased in North America and Latin America, but operating profit declined due to continuous improvements in business structure such as efficient global production sites, ODM (development and manufacturer production) expanded and increased cost competitiveness.

The VS (e-business) division posted sales of 1,655.4 billion won and an operating loss of 66.2 billion won. Sales increased thanks to the normalization of the operations of the automakers in North America and Europe and the recovery of the global demand for auto parts. Operating losses also declined sharply due to increased sales and efforts to improve the cost structure.

The BS (Business-to-Business) division posted sales of 1,482.8 billion won and an operating profit of 77 billion won. B2B business sales declined due to the prolonged Corona 19 and operating profit declined as price competition intensified.

LG Electronics predicted that market competition will intensify as the electronics and television markets enter peak season in the fourth quarter. In addition, there is uncertainty about the reproliferation of Corona 19, so it is believed that risk factors will continue to exist.

LG Electronics said, “We plan to focus on strengthening global brand awareness,” and said, “We will continue to expand sales of health care appliances and OLED televisions by strengthening the online business.”

The H&A division plans to maintain double-digit sales growth or more after 3Q, led by new appliances, and optimize the inflow of resources to ensure profitability higher than the same period last year.

The HE business division plans to increase sales of premium products such as OLED televisions, nano-cell televisions and large televisions. In addition, the goal is to achieve higher profitability than the same period last year by expanding online sales and efficient management of resources.

MC’s business division believes that the global 5G smartphone market will grow seriously and plans to expand sales by strengthening the 5G entry-level line focused on major markets such as North America and Central and South America, and constantly promote improving the commercial structure.

VS Business Division plans to ensure profitability by maximizing sales and improving the cost structure through comprehensive supply chain management, taking into account the recovery of the finished vehicle market and the high growth in the automotive sector. connectivity and the spare parts business for electric vehicles.

BS’s Business Division predicted that demand for laptops, monitors and IT products will continue due to the spread of non-face-to-face trends, but investment in information displays and solar modules is expected to decline and price competition to slow step up. Accordingly, it plans to actively respond to IT product sales opportunities, expand sales of strategic products such as premium digital signage, and strengthen the competitiveness of solar module products.

Reporter Jeong Eun-kyung [email protected]

[ad_2]