[ad_1]

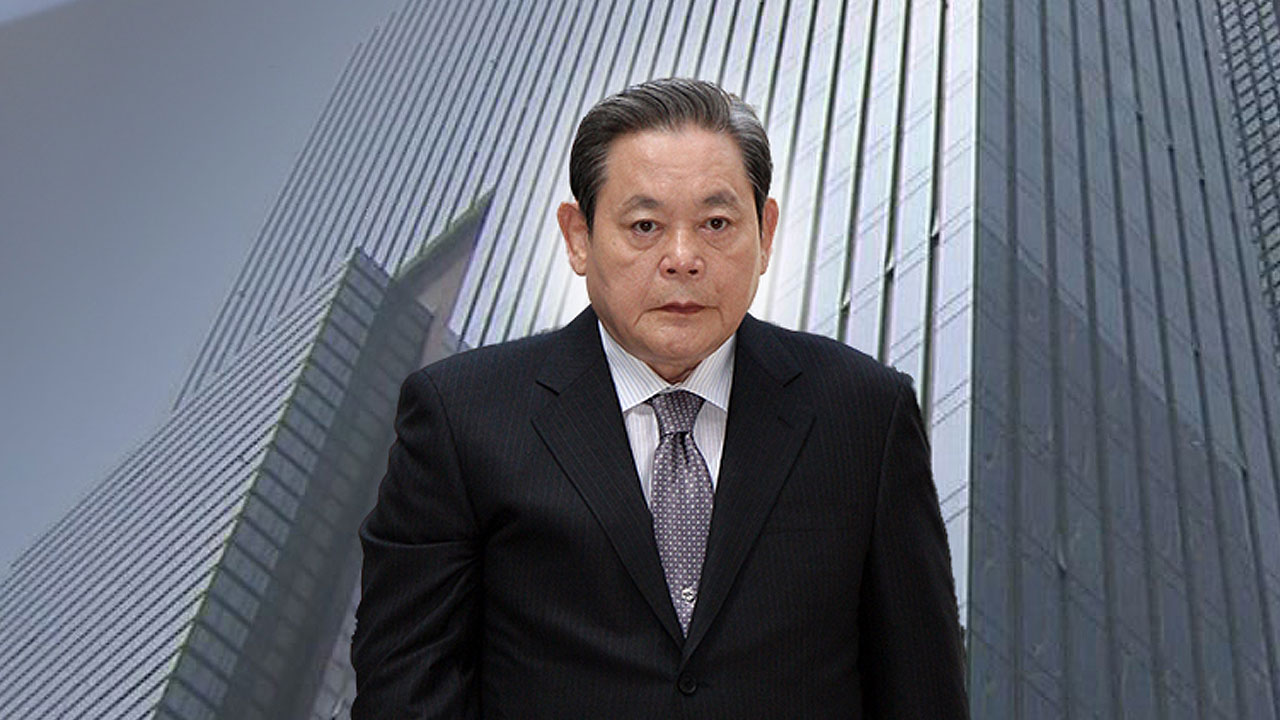

Samsung’s inheritance tax is a hot topic.

The media are very concerned about paying a lot of inheritance tax.

The highest rate of inheritance tax in Korea is 50%, and this is the highest level in the world. Is this correct? There are many questions like this.

Shall we take a look?

Japan 55%, Korea 50%, France 45%, United States 40%. In terms of the highest inheritance tax rate, we are the second largest in the world.

.

No, it is said that the inheritance tax is not a punishment and why it is so high.

The first time the Constitutional Assembly made the inheritance tax, it was 90%.

No, why did the Syngman Rhee government collect inheritance tax so harshly up to 90%?

There are many reasons.

Due to Japanese exploitation, there was no money in the country.

Second, due to lack of administrative power, I was unable to collect income tax while pursuing, so I used a method of collecting all at once from inheritance tax after death in the end.

After that, the government gave preferential treatment to the first chaebol assets that the Japanese left behind, so it should not go into the family’s pocket.

You have to go back to society.

That is why the inheritance tax rate was a bit high.

After that, as the tax system was well established and property and income taxes were lifted, the inheritance tax rate was lowered considerably.

Let’s see the next one.

During the Park Chung-hee regime, I initially lowered it to 30% by asking companies to do industrialization well, and then after the conglomerate system was completed and started to bring money to the middle name account, I won up to 75%.

There are also questions like this.

There are countries where there is no inheritance tax, see.

There are countries where inheritance tax has been abolished or never existed.

Thirteen of the 37 OECD countries are not being implemented.

If so, do you freely pass it on to your children and take it away from their parents?

It can’t be. Let’s see. There is a capital gains tax.

When the family business is successful, inheritance tax is not collected and capital gains tax is severely applied when the factory is sold.

Or, when the shares are inherited, the dividend on the shares is paid and in some cases up to 70% or 80% of the dividend on the shares is taxed.

So in a word, there is a difference between whether you generally pay a lot of property tax or income tax, or whether you pay a lot at once when inheriting.

And the inheritance tax rate varies depending on the historical background of the rich when they formed their property.

It was Byun Sang-wook’s host’s report.

[저작권자(c) YTN & YTN plus 무단전재 및 재배포 금지]