[ad_1]

With the death of Samsung Electronics Chairman Lee Kun-hee, the expectation of a governance restructuring following the inheritance of the late Chairman Lee Lee’s stake in Samsung Life, Samsung C&T and other Samsung Group shares showed strong performance. The increases in the share price include the expectation that the dividend policy of each subsidiary will be strengthened to prepare the inheritance tax, and the scenario of reestablishing the governance structure in the exchange of shares.

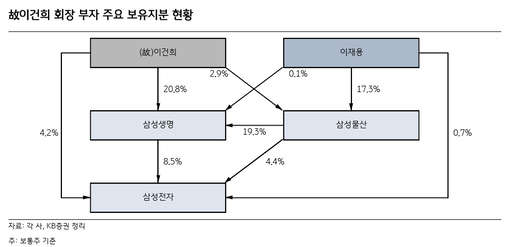

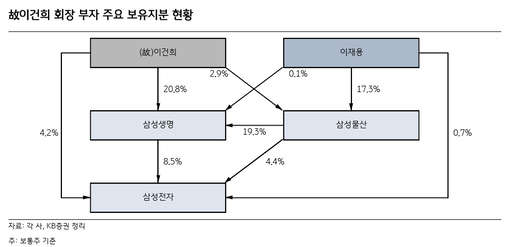

According to the Korea Exchange (KRX) on the 26th, Samsung C&T closed at 118,000 won, an increase of 13.46% (14,000 won) from the previous trading day. The preferred stock, Samsung C&T Woo B, closed at the upper limit. In addition, Samsung Life Insurance (3.80%), Samsung Electronics (0.33%), Samsung SDS (5.51%) and other shares of the Samsung Electronics group finished higher. In particular, Samsung C&T, whose vice president Lee Jae-yong is the largest shareholder (17.3%), saw the largest increase in share price. It is difficult to predict what kind of governance restructuring will be attempted, but in fact, it is unlikely that a decision will be made that will undermine the corporate value of the parent company, Samsung C&T.

◆ How is the largest ‘inheritance tax’ prepared?

According to the Electronic Disclosure System of the Financial Oversight Service, the value of the listed shares held by President Lee is 18,225 trillion won in total at the closing price on the 23rd. Simply put, if the highest tax rate is 50% and the largest shareholder has a premium of 20% to 18.2251 billion won, the amount of inheritance tax to be paid is 10.900 billion won. Even if the annuity is used, it is necessary to prepare an inheritance tax resource of more than 1.8 trillion won annually for up to five years.

Securities industry experts predicted that Samsung Electronics and Samsung C&T will strengthen dividends to raise financial resources for Lee’s estate.

Nam-gon Choi, a researcher at Yuanta Securities, said: “After the inheritance, the annual pre-tax dividend income of the family of the largest shareholder is 6.43% of the inheritance tax amount, or 702.2 billion won.” . It’s 100 million won and it will be able to cover about 32% through dividends. ”Samsung Electronics is expected to introduce a new shareholder return policy from 2021 in the second half of this year, but the industry hopes to introduce a policy. shareholder return policy expanded than this year. Samsung C&T is also promoting a policy of withdrawing treasury shares and expanding the redistribution to 70% of affiliate dividend income as a new dividend policy for the three years of 2020 to 2022.

However, some believe that the expansion of the dividend payment rate will be limited. A securities industry official said: “The dividend payment ratio of Samsung Electronics, Samsung SDS and Samsung C&T is already quite high.” I could do it, ”he worried.

In the case of Samsung Life Insurance and Samsung SDS, the prospects for the value of their holdings to stand out in the inheritance tax financing process has shown an upward trend, but the fact that they can raise funds with their Stock acts as a material for the downfall. This is because since the group has sufficient stakes in Samsung Life Insurance and Samsung SDS, even if the owning family sells the stakes, it is not too difficult to exercise the management rights.

Jeong-daero, a researcher at Mirae Asset Daewoo, said: “If Samsung SDS sells a significant part of its inheritance tax resources, it will be able to fully reassess its corporate value.” “Because the element disappears.”

◆ Excessive inheritance tax and ‘controversy’ insurance business law amendment

With the death of President Lee, Korea’s excessive inheritance tax has risen again. Currently, the highest gift / inheritance tax rate for large shareholders of Korean companies is 65%. It is more than double the average (26%) of the member states of the Organization for Economic Cooperation and Development (OECD). To inherit President Lee’s assets of 18 trillion won, he has to pay 11 trillion won in taxes. This is a scale that far exceeds the estimated amount of the 8 trillion won securities transaction tax this year.

Furthermore, the revision of the insurance industry law is expected to challenge the corporate governance reform of the Samsung Group. Current commercial insurance law allows insurers to own shares of major shareholders or open companies in an amount of 3% or less of total assets based on “acquisition cost” to avoid the risk of asset loss. An amendment to change from ‘cost’ to ‘market price’ has been proposed to the National Assembly.

If the bill passes as is, the excess of more than 3% of Samsung Life’s 8.5% of Samsung Electronics shares should be sold. If Samsung Fire & Marine Insurance (1.5%) is included, the sales volume will exceed 20 trillion won.

On the 26th, KB Securities researcher Chung Dong-ik said: “After selling the Samsung Biologics stake held by Samsung C&T, acquiring a stake in Samsung Electronics held by Samsung Life, and a plan to merge the investment with Samsung C&T after dividing Samsung Electronics into investment and business sectors. It is being discussed. “

In this process, huge corporate taxes are expected to be levied. When Samsung Life Insurance and Samsung Fire & Marine Insurance acquire Samsung Electronics, the acquisition cost is 800-1100 won. When selling stocks, you should consider a 22% corporate tax on capital gains. Only 5 trillion won is expected to be borne by various taxes, including corporation tax.