[ad_1]

Ticket 2020-10-21 03:08 | Revision 2020-10-21 03:09

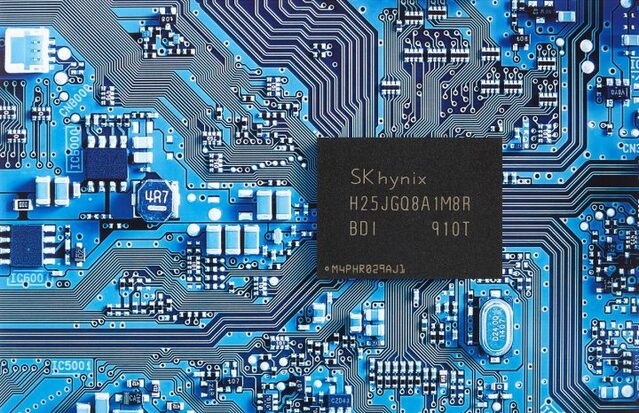

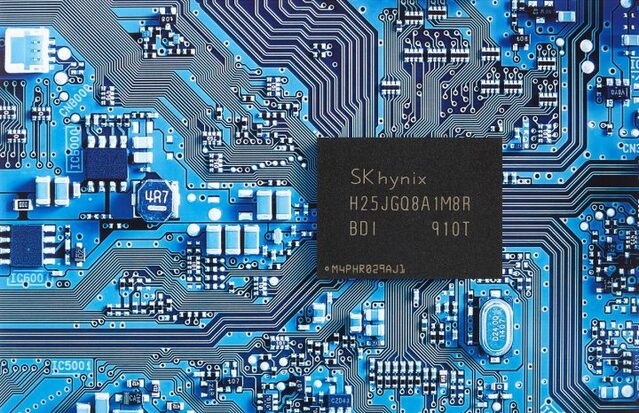

▲ SK hynix 96 layers 4D NAND high performance 1Tb QLC ⓒSK hynix

SK Hynix is expected to set the fourth largest M&A record in the global semiconductor market this year by promoting the acquisition of Intel’s NAND flash business in the US This year is expected to be the largest market in the semiconductor industry in five years, and SK Hynix is assessed to have promoted a large-scale deal worth more than 10 trillion won and made a name for itself for the transformation of the semiconductor market that almost ended in one ‘other part’.

According to the semiconductor industry on the 20th, SK Hynix will take over control of Intel’s entire NAND flash business and will be named in the semiconductor industry’s ‘Big 4’ M&A deal this year. Although the approval process of the relevant authorities remains, it is expected to register as one of the best in the semiconductor M&A industry this year.

The scale of this deal promoted by SK Hynix is $ 10 billion (10,310.4 billion won). Focusing on the SSD NAND business, Intel’s 3D NAND flash production facility in Dalian, China is included, and only Optane’s business is excluded.

SK Hynix’s acquisition of the Intel NAND business is special because it is a big deal that marks a milestone in Korea’s semiconductor M&A history as it participates in the massive wind M&A for the semiconductor industry this year. .

In particular, this year is more attention as the global version of semiconductor mergers and acquisitions, which has been silent since 2015, has grown again. The semiconductor industry and M&A industry are pitching observations that this year will be the biggest market year in 5 years.

In a recent report, market research firm IC Insights revealed that a $ 63.1 billion semiconductor M&A deal was promoted this year (at the end of September). Also, if you add SK Hynix’s deal to acquire Intel’s NAND business, it means $ 73.1 billion worth of M&A is being promoted in the semiconductor market alone.

The scale of this deal promoted by SK Hynix is the highest in Korean semiconductor history, but the combined scale of the other semiconductor companies to be promoted this year is exceptional.

First, the semiconductor M&A market began to grow with the decision to acquire Maxim Integrated Products from Analog Devices (ADI), a US manufacturer of semiconductor equipment, announced in July. ADI has agreed to acquire Maxim, a rival, for $ 20 billion (about 22.8 billion won), and is still in related proceedings.

The biggest M&A this year is a deal worth $ 40 billion (about 47.5 trillion won). Nvidia, the number one graphics processing unit (GPU) in the US, is pushing to acquire ARM, a British semiconductor design company. ARM was previously acquired by Softbank and received attention. In addition to Nvidia, many semiconductor companies are still paying attention because it was a sale that caught their eye, and the size of the deal was also significant.

The second big business this year will be promoted by AMD, USA, which mainly produces semiconductors for PCs and game consoles. It plans to stake $ 30 billion (approximately 34.6 trillion won) to acquire rival Xilinx. This agreement was announced on the 8th (local time), just prior to SK Hynix’s acquisition of the Intel NAND business, and announced that it will be the second largest M&A this year, surpassing ADI’s previous agreement.

As such, this year is an important time for a major transformation in the global semiconductor industry, and voices of concern arose one after another, as none of the domestic semiconductor companies dominating the semiconductor market has entered the market. Although Samsung Electronics and SK Hynix dominate the memory semiconductor market, their performance was relatively slow in the non-memory market, which is becoming increasingly important during the transition to the fourth era of the industrial revolution.

In the midst of this, it seems likely that the pressure on Korean semiconductors has grown even further as global companies like Intel – seeking technology integration by sorting out nonessential businesses and acquiring competitors – are in full swing. In the end, the reason SK Hynix started betting on a grand scale of over 10 trillion won is the result of fierce thoughts to survive in the future semiconductor market.

The NAND business, especially the enterprise SSD market, is expected to grow faster in the post-crown era. IC Insights also predicted that this year alone, NAND (27%) will grow significantly faster than DRAM (3%). From the perspective of SK Hynix, which has been running a DRAM-focused semiconductor business, it is discussed that it will ensure the competitiveness of the NAND business, which has been somewhat slow so far, as well as providing an opportunity to rebuild a future portfolio of business. semiconductors.

Press Releases and Article Reports [email protected]

[자유민주·시장경제의 파수꾼 – 뉴데일리 newdaily.co.kr]Copyright ⓒ 2005 New Daily News-Unauthorized Reproduction, Redistribution Prohibited

recommendation

Related Posts Great to read with the article you just saw!

Vivid

Headlines Meet this visual news.