[ad_1]

|

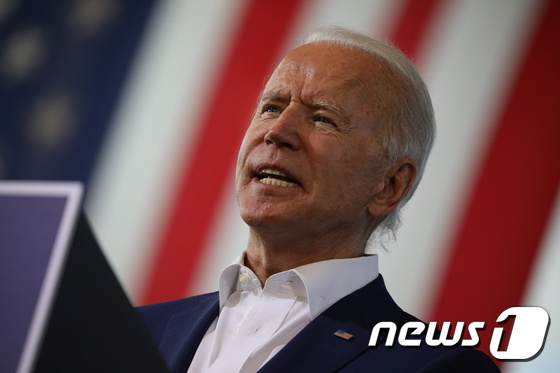

| Joe Biden, US Democratic presidential candidate. <자료사진> © Reuters = News 1 |

Ahead of the US presidential election next month, there is a strong atmosphere in the financial market to await the election of Democratic President Joe Biden.

The Financial Times (FT) quoted market analysts on the 13th (local time) as saying: “Investors are moving towards investing in small cap bonds rather than US government bonds. This is the call. ‘blue wave’ in which the Democratic Party wins not only in the presidential elections but also in the Senate and House elections. It suggests that we are preparing for a wave (overwhelming victory of the Democratic Party). “

In the United States, a new election will be held on November 3, with the election of a third of the senators and all the members of the House of Representatives.

Currently, the ruling Republican Party in the US Senate and the Democratic Party in the House have a majority of seats. However, analysts say that “investors have also been betting on Democrats because they believe that the reelection of President Trump will be difficult,” as public opinion polls say that Biden’s approval rating is outpacing Republican President Trump.

Solita Marchelli, Chief Investment Officer (CIO) of UBS Global Asset Management, said: “A few months ago, there were many stories that the ‘blue wave’ would have a negative impact on the stock market.

It was at the trial that if the Democratic Party came to power, it would increase the corporate tax rate and strengthen regulations. “As the chances of Biden being elected have increased, the uncertainty in this election has diminished.”

Marcelly said: “Investors may have been afraid of the ‘blue wave’ at first, but if the election results are delayed, the anxiety will increase.” In fact, in Washington, there are observations that if President Trump loses to Biden by a slight margin in this election, there is the possibility of dissatisfaction with the election result by raising suspicions of manipulation of the vote by mail.

In response, David Lebobits, global market strategist at JPMorgan Asset Management, said: “If you hold an election tomorrow, you are more likely to see a ‘blue wave’,” and explained that investors are also moving based on it. perspective.

According to FT, when the research firm Strategas compared the ‘Biden beneficiaries’ and the ‘Trump beneficiaries’, each of which consisted of 30 shares, the share price of the Biden beneficiaries increased by 38% in compared to Trump recipients this year. Biden’s beneficiaries include infrastructure-related stocks such as solar power and electric vehicle maker Tesla.

Columbia Threadney, an asset management company, also believes that industries related to infrastructure, consumer staples and materials will benefit if Biden takes power. This is because candidate Biden proposed a clean energy policy as an important compromise and material exports are expected to increase through better relations with China.

On the other hand, it is anticipated that pharmaceutical companies and telecommunications service providers such as Facebook and Google could collapse under pressure to cut drug prices and strengthen antitrust laws if candidate Biden takes office. Banking stocks are also expected to be affected by stricter regulations.

However, FT interpreted that “the recent increase in the possibility of the presidential election of candidate Biden has increased the price of bank shares. This means that investors believe that economic growth will outweigh the regulatory problem when Biden takes office.”

Additionally, analysts believe that if the Democratic Party wins this election, small-cap stocks will benefit from small-cap stocks rather than large stocks, and local bond markets will also be revitalized, according to stimulus measures. additional focused on SMEs, FT said.

[ad_2]