[ad_1]

From March to April, foreigners sold 1.7 billion won

“It is difficult to return to the Korean stock market in May”

(Photo = Getty Image Bank)

There is a saying on American Wall Street that says “Sell in May” in May. This is based on the statistical results that the returns on investment in shares from May to October are lower than those from November to April of the following year.

Investor interest in this proverb is growing as the stock market, which recovered from fear of the spread of the new coronavirus infection (Corona 19), has rebounded. Experts predicted that the stock market would slow down, as foreigners called the “big hand” are unlikely to return this month.

◆ “Emergence in emerging economies, concerns about poor export performance”

The Kospi index on 4, the first day of the stock market in May, is trading at 1909.89, a 1.93% drop from the day before at 1:39 PM. In the middle of the day, they even left the 1900 line. Foreigners and institutions sell shares worth 7671 billion won and 4877 billion won, respectively.

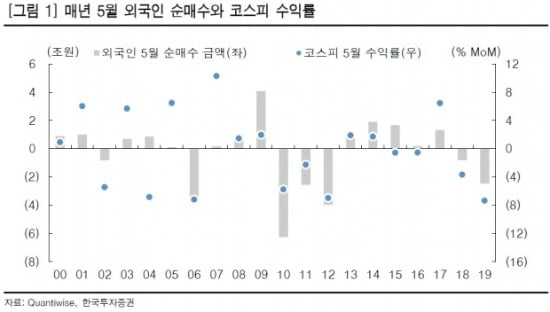

Kim Dae-jun, researcher at Korea Investment & Securities, said: “The stock market in May is a great burden for foreign investors to sell stocks. The probability is high.”

Source = Korea Investment & Securities.

After the Corona 19 crisis, foreigners escaped from the domestic stock market like a low tide. Foreigners in March and April, when Corona 19 spread through a pandemic (a global pandemic), sold all but four days of trading on the KOSPI market. During this period, net sales amounted to 17.38 trillion won.

Researcher Kim cited the internal (fundamental) fundamentals weakened by poor investment sentiment and poor export sentiment in emerging countries as the backdrop for foreigners not to return. National exports last month were $ 3.69 million, 24.3% less than in the same period last year. The trade balance became a deficit for the first time since February 2012.

He said: “The 13 main export items, excluding Corona 19 beneficiary computers (home work) and bio-health (diagnostic kits) have decreased by 10-60% compared to the same month last year.” be a bad thing for the industry. “

Lee Eun-taek, a researcher at KB Securities, also considered very positively the possibility that the aliens “cells in Mei”. The US employment index, worried about the recession, is expected to deteriorate this month. Furthermore, the conflict between the United States and China, which emerged as sudden bad news, could be resolved in the short term.

The researcher predicted that the conflict between the United States and China, which began in the trade war and peaked with Corona 19, will continue until the end of the United States presidential election.

He said: “As concerns about the Crown 19 ease, the approval ratings of the President of the United States, Donald Trump, are also falling.” China’s pressure will be Trump’s critical electoral strategy for re-election, and it’s a difficult problem for China to solve. ”

◆ “KOSPI, inevitable slowdown in elasticity”

The researcher diagnosed that the resilience of the stock market will slow down since the return of foreigners to the stock market is uncertain. Another reason for the diagnosis is that the recent surge in the stock market, which has skyrocketed as Corona’s anxiety19 has waned and containment measures in major countries have waned.

After the Corona 19 spread rapidly and fear sentiment dominated the market, the Kospi index fell to 1439.43 (noon) on March 19, and now (as of April 29, the closing price) increased by 35 %.

Researcher Kim Dae-jun said, “The absence of an individual-led stock market shift to a foreigner means a limit of increase.” The market is now in the second half of the technology rally.

Kwak Hyun-soo, a researcher at Shinhan Financial Investment, said this month’s KOSPI index will move between lines 1700 and 2050.

Kwak said: “Given the uncertainty about economic and risk-related indicators, the speed of the Federal Reserve in buying assets and the desire to make profit from the increase, it will show a break in May.” And seriously worry about the share share. “

He added that he must pay attention to the speed of economic normalization in the main countries, the development of treatment and Corona 19 vaccines, and the decision of the next Federal Open Market Committee (FOMC).

Reporter Chae Sun-hee, Hankyung.com [email protected]