[ad_1]

On the 8th, at the Planning and Finance Committee of the National Assembly, Vice Premier Hong Nam-ki receives a query from a member of parliament during an audit of the fiscal policy of the Ministry of Information and Transport (Photo = Reporter Changwon Yoon ).

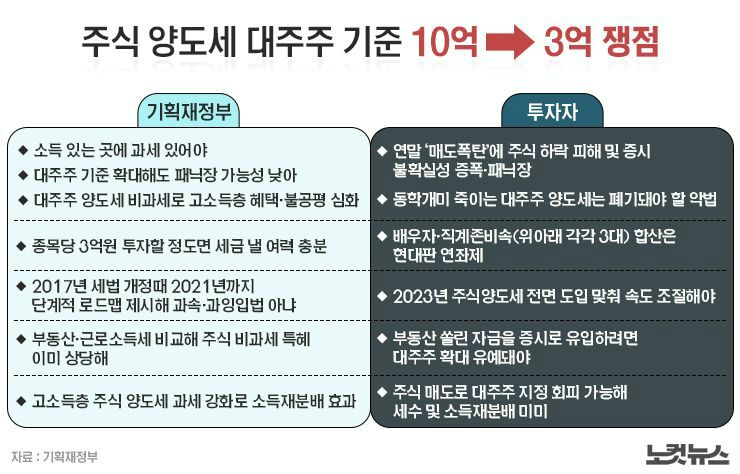

A rare show unfolded in this year’s gukgam, which has just started. It was a long-awaited collaboration between the ruler and the opposition parties to make “one voice.” That’s ‘300 million based on majority shareholder.’ Against the head of the Ministry of Strategy and Finance and Vice Premier Hong Nam-ki, who said that the standard of large shareholders subject to the share transfer tax should be strengthened from 1 billion to 300 million from next year, the opposition party drew up a ‘revision bill’ and the ruling party is responding. It pressures us to review legislation that is higher than the government’s executive decree.

As the controversy grew even as the capital gains tax, which is fully applied to individual investors beginning in 2023, became more controversial, President Moon Jae-in sided with the ants, saying: ” Individual investors should not be discouraged. ” I wonder if this time we will make the same decision.

(Graphic = Reporter Sungki Kim)

1. Controversy about ‘300 million based on large shareholders’ that angered the ants, what is that?

Currently, investors who buy stocks pay only “transaction tax,” not capital gains tax. It was a benefit to revitalize the past stock market. Instead, only the major shareholders received a “transfer income tax.” According to the current Execution Decree of the Income Tax Law, if a specific company’s share holdings exceed 1 billion won, it is considered a major shareholder and 22-33% of the profits in the Stock trading must be paid as capital gains tax.

The standards of this majority shareholder have been continuously reinforced. Before 2013, it was 10 billion won, then 5 billion won, 2.5 billion won in 2016, 1.5 billion won in 2018, and 1 billion won in 2020. Then next year , this standard was lowered to 300 million.

2. Why lower the standard of the major shareholders to 300 million?

It is said to be the Park Geun-hye administration and Moon Jae-in’s administration. It is true that the previous regime drew up a roadmap for the criteria for large shareholders, but the Moon Jae-in administration took over as it was and incorporated the ‘Moon Jae-in administration five-year plan for state administration’ with ‘the reinforcement of taxes on capital gains and financial income, such as profits from the transfer of shares by large shareholders.’ (July 2017).

At this time, it was a bit sloppy, but in August of the same year, the Ministry of Information and Transport clarified the details of the expansion of taxation on capital gains of capital shares of major shareholders through the ‘ Amendment to the Tax Law of 2017 ‘. In order to gradually expand the reach of the largest shareholders subject to taxable capital gains on listed shares, the plan was to revise the current KRW 1.5 billion in 18 years and KRW 1 billion in 20 years to reduce to KRW 300 million in April. 2009.

So it’s not sudden to lower the bar for major shareholders from $ 1 billion to $ 300 million. As Vice Premier Hong Nam-ki said, it is also the scheduled time. It also aims to reap the tax-free benefits that were granted to revitalize the stock market, respecting the principle of taxation where there is income.

‘Moon Jae-in Government Five-Year Plan for State Administration’ (July 2017) (Data = provided by the Ministry of Information)

3. But why is the ‘300 million major shareholders’ a problem now?

This is because, as one capital market expert put it, this is a very unusual year. After Corona 19, there is a background in which individual investors have greatly entered the national stock market. In September, the proportion of personal transactions registered 71.2%, exceeding 70% for the third consecutive month. Considering that the average daily trade value for September was 14.2 billion won, the ants traded over 10 trillion won. As a result, individual investor interest in stocks has also grown, and news related to the stock market is more influential than ever.

The government says that if you invest 300 million won per item, you are a high-income group and have enough room to pay taxes, but individual investors think differently. I’m not worried about people who have more than 300 million shares, but if they “sell” to avoid taxes, aren’t they hurting my shares? Eui-jung Jeong, CEO of the Korea Equity Investors Association, said: “At the time when large shareholders push for 300 million won, there is a high possibility of panic by the end of the year.” . There’s only one. “Stocks are psychological, but there are concerns that the stock market could falter if there is a rush of sales.

Even in academia, it is considered that there is no practical benefit to strengthening the standard with the largest shareholder of 300 million. This is because the effect of earning tax revenue will not be remarkably large, as investors who meet the requirements of the major shareholders will be able to avoid the tax by selling and buying again for a time. It means that not everyone will use a buy-and-sell strategy, but it will be difficult to achieve the effect the government expects. By the end of the year, the sell-off is expected to be higher than at any time in the past, but since the corporate fundamentals remain the same, a dip may occur, but I don’t expect a collapse.

(Graphic = Reporter Sungki Kim)

4. What is the current situation? How in the future?

The current situation is favorable for individual investors. The Finance Ministry alone is holding on to the 300 million won, and the ruling and opposition parties jointly insist on a 1 billion won suspension. On the 7th, when the National Supervision of the Ministry of Science and Technology took place, Vice Premier Hong made it clear that he did not intend to change his position to strengthen the requirement of large shareholders to more than 300 million won. As mentioned above, ① for the purpose of equality in taxation between earned and financial income, ② was decided two years ago, so the reason is that the policy is consistent. However, the family total was destined to be modified. However, although family consolidation is already being implemented, it was said that it would be modified, so the consistency of the policy has already collapsed.

Furthermore, the pressure from the ruling party and the opposition party to suspend the 1 billion won is very strong. Representative Seong-geol Ryu, the people’s power, which is the opposition party, introduced the ‘Income Tax Law Partial Amendment Bill’ aiming to suspend 1 billion won on the basis of the main shareholders. At the National Assembly on the 8th, Congressman Choo Gyeong-ho said, “Since the opposition parties have the same will, we will make a law that maintains the requirement of large shareholders at 1 billion won or more and the sum of stock holdings are held by individuals rather than families. ”

On the same day, Kim Tae-nyeon, head of the ruling party, said: “Since the transfer tax will be introduced in full two years later, the relaxation of majority shareholder requirements should be reviewed in accordance with the change of circumstances”. The meaning is significant because it was not spoken by one or two members of the ruling party, but by the internal representative.

In the end, this is the reason why only the decision of the Blue House remains. The post office belief is also possible because the Blue House is behind the scenes. A capital market expert commented: “As seen from the full imposition of capital gains tax on individual investors, the extent of short sales, etc., the standard of ‘300 million large shareholders ‘It will begin to be revised in response to the offensive by individual investors, “he said, saying,” The burden is too high to enforce 300 million won. “