[ad_1]

[앵커]

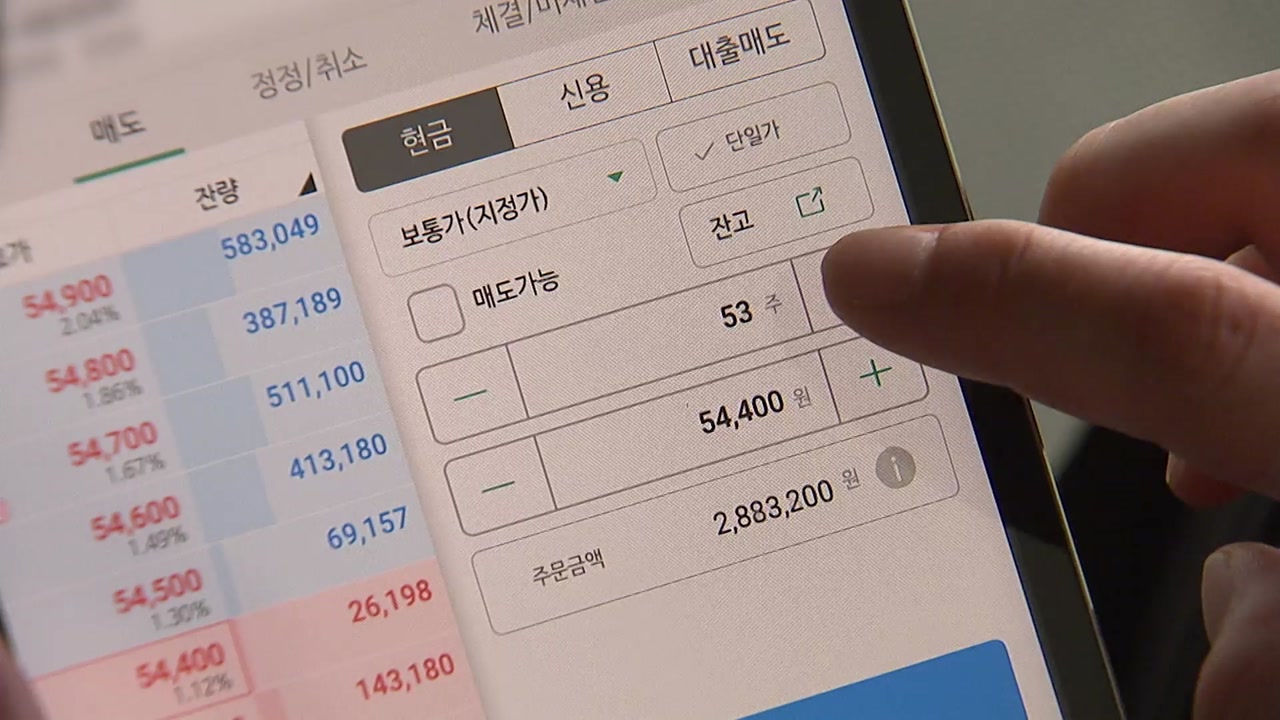

Since April next year, controversy has grown over the government’s policy of imposing a capital gains tax on more than 300 million major shareholders. Following individual investors, the ruling and opposition parties criticized the government with one voice in the audit of the state administration. The government sticks to the ‘300 million won cap’ position, but voices that the current standard of 1 billion won should be maintained by 2022 are also overwhelming. Reporter Oh In-seok about the report. The Blue House petition against strengthening the capital gains tax for major shareholders exceeded 200,000 in the last month. There was strong opposition from individual investors, saying it is a modern partnership system, and in the National Assembly audit, the government took a step back and said it would review the criteria for total family members individually. However, the controversy has not easily subsided. This time, ruling and opposition politicians were accused of expanding the standard for large shareholders to impose a transfer tax of 20-25% per item starting in April next year to 300 million won. However, Hong Nam-ki, Deputy Prime Minister of the Economy, said it was not easy to correct fiscal fairness. In the market, it is noted that the imposition of KRW 300 million on large shareholders does not have a high effect of increasing tax revenue, but has a negative aspect of increasing market volatility. Given that the government aims to induce liquidity in the market from the real estate sector to productive investment destinations, it should be noted whether an additional review of the transfer tax will be carried out. YTN Oh Inseok[[email protected]]is.