[ad_1]

Big Hit Entertainment (aka BTS affiliate company) Subscription for public offering shares is ongoing for two days on the 5th and 6th. After SK Biopharmaceutical and Kakao Games, the competition is expected to be very fierce as it is a stock that attracts the attention of investors. (An internet bank even holds an event to support interest when opening your own account and receiving a credit loan)

[최근 주요 공모주 경쟁률]

-SK Biopharm

391.5662 shares allocated to general investors (49,000 won per share)

Demand forecast competition rate 835.66

General Underwriting Competition Rate 332.29

-Kakao games

3.2 million shares allocated to general investors (24,000 won per share)

Demand forecast competition rate 1,478.53

General Underwriting Competition Rate 1524.85

-Big Hit Entertainment

1,426,000 public offering shares allocated to general investors (135,000 won per share)

Demand forecast competition rate 1117.25

General underwriting competition rate ????

Big success 1,426,000 shares, 20% of the total public offering volume of 7.13 million shares, will go to general investors.The amount reallocated for each securities company that can request subscription is as follows.

[빅히트 증권사별 일반 청약물량]

-NH Investments and securities 64,8182 shares (subscription limit per person 25,600 shares)

-Korean Investments and Securities 555,584 shares (subscription limit per person 18,000 shares)

-Mirae Asset Daewoo 185,195 shares (subscription limit per person 9000 shares)

-Kiwoom Securities 37,039 shares (up to 2,000 shares per person)

* Each brokerage firm allows preferred clients to apply 0.5 to 3 times the per capita subscription limit.

The final competition fee on the 6th, the last day of the public offering share subscription, has not yet come out, but if you put 100 million won in margin for the Big Hit offering, we calculate how many weeks you can receive according to the subscription competition fee.

If you put a margin of 100 million won for the public offering subscription, it means that you requested a subscription worth 200 million won.(Because when requesting a public offering, general investors put 50% of the applied amount as a margin)

Big Hit’s offer price per share is 135,000 won. Therefore, requesting a subscription worth KRW 200 million means that you are requesting 1,481 shares, but you cannot request a subscription for public offering shares every week, and the subscription units for each securities company are different.

Regarding the subscription units for each securities company, the shares that can be requested for a subscription worth KRW 200 million are as follows.

[증권사별 청약단위]

NH Investments and Securities= More than 1000 weeks, subscription for 200 weeks → 1400 weeks

Korea Investments and Securities= More than 1000 weeks, subscription for 200 weeks → 1400 weeks

Mirae Asset Daewoo= More than 1000 weeks, subscription for 500 weeks → 1000 weeks

Kiwoom Values= More than 1000 weeks, subscription for 250 weeks → 1250 weeks

Since the subscription unit is reduced in increments of 200 to 500 weeks, even if a margin of KRW 100 million is added, the request only applies for a maximum of 1400 shares instead of 1481.You can. (For reference, the margin for 1,400 shares is 94.5 million won, and the remaining 5.5 million won is not taken as margin. That is, you can only put 94.5 million won as margin, not 100 million won. won, but assuming 100 million won for convenience)

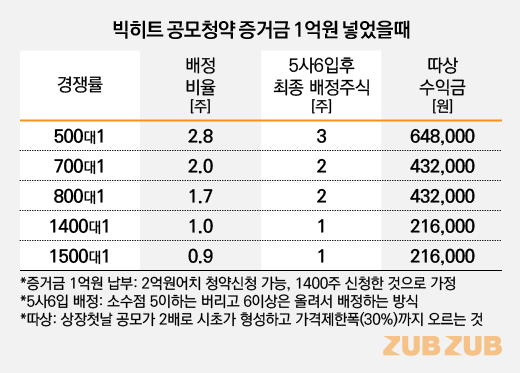

Assuming 1,400 shares have been applied for after payment of 100 million won of margin, the number of shares allocated according to the competition rate is as follows.

If the competition rate is 500: 1, the allocation ratio will be 2.8 weeks, but according to the principle of ‘5 companies 6 inputs’, you will receive 3 weeks. A competitive rate of 700: 1 wins 2 weeks and a rate of 1400: 1 gives 1 week. If the competition rate exceeds 1400: 1, the allocation ratio drops to less than 1 week. In this case, in principle, ‘5 companies, 6 mouths’ is applied and 1 week is assigned for 0.6 weeks or more. (However, it is possible within the limit of shares available for allocation)

The initial price of public offering shares (the price initially determined) is determined between 90% and 200% of the offering price on the first day of trading. Therefore, Big Hit (public offering price 135,000 won) forms a starting price between 1,215,500 won and 270,000 won. If the starting price is formed at the highest price of 270,000 won, then the price goes directly to the daily price limit (30%). If the so-called ‘Daesang’ appears, the maximum price that can be raised on the first trading day is 351,000 won, which is 216,000 won (160%) of trading profit (or valuation profit) compared to the bid price per action.You can harvest.

In conclusion, if you invested 100 million won (200 million won) in margin on the 6th, the last day of the public offering, and received a week,

Excluding the assigned price of a public offering share (KRW 135,000), the remaining margin will be redeemed on October 8 and you will have one share after the October 15 trading date. That is 216,000 won.

sure If the margin was borrowed and prepared, the interest on the loan incurred from the date of subscription to the date of repayment should be considered. Naturally, if you take a negative bank loan to increase your margin, you should be prepared to lower your credit rating. box.

* Will be published on October 13 [공시줍줍]You will analyze the results of the Big Hit Entertainment contest in more detail.

*[공시요정]Y [공시줍줍]You first go to the ‘Joop Joop’ newsletter by email. There is also special content that only appears in newsletters. If the content is good, subscribe (free).

Subscribe to the newsletter (free) ☜Click

Send Feedback ☜Click