[ad_1]

[앵커]

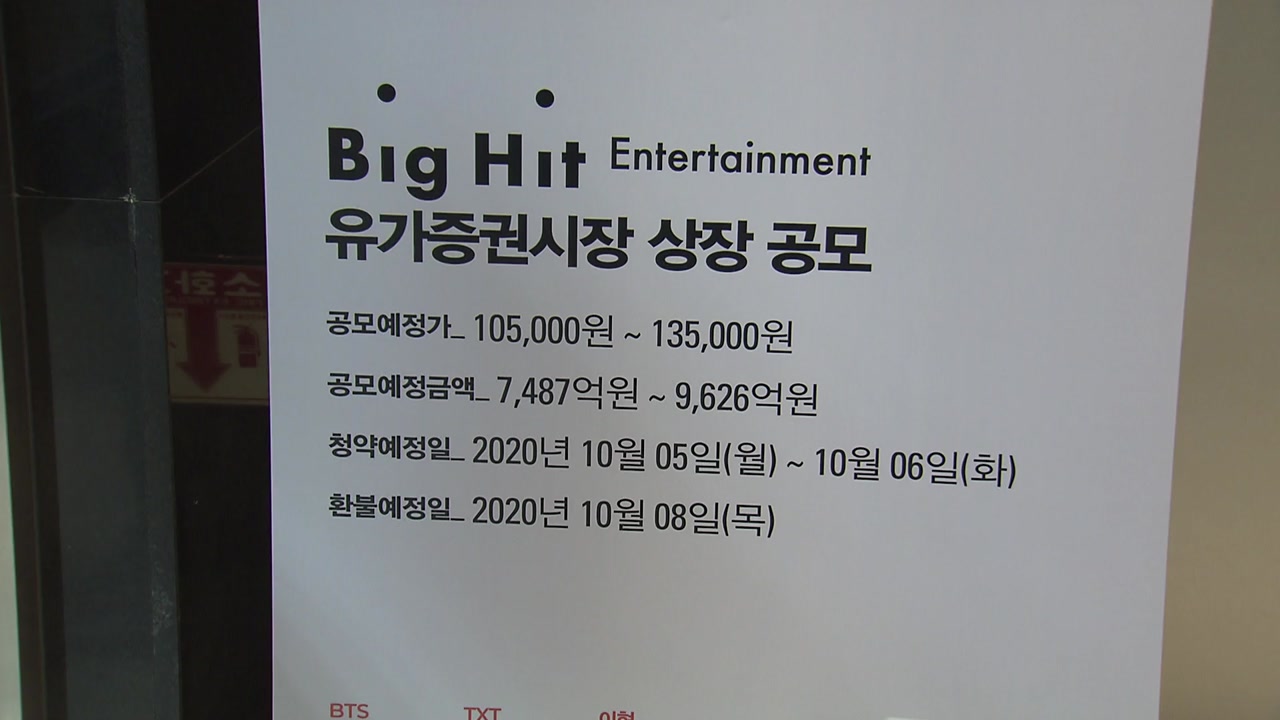

Big Hit Entertainment, BTS’s agency, which is regarded as one of the key players in the IPO market in the second half of the year, entered the general underwriting for individual investors today (5th). On the first day, the subscription margin alone was over 8 trillion won, which was higher than SK Biopharm, but lower than Kakao Games. Reporter Choi Doo-hee covered it. The first day of subscription of public offering shares of Big Hit Entertainment. The brokerage room was relatively busy. This is because many of the investors who have experienced public offering share subscriptions with SK Biopharm and Kakao Games, which have led the public offering share rush before, used online subscriptions instead of branches. Big Hit’s offer price per share is 135,000 won. The competition rate on the first subscription day was 89.6 to 1, and the subscription margin was estimated to have only exceeded 8 trillion won. From day one, it is more than SK Biopharm, but compared to Kakao Games, it is half the level. Previously, Kakao Games posted a competition rate of over 1,524 to 1, and SK Biopharm at over 323 to 1. Investors have to pay half of their subscriptions as margin, so the higher the competition, the lower the number of shares investors can receive. As a result, the focus is on how much the final margin will be, and on the second day of the competition, the focus is on whether you can break the subscription margin record set by Kakao Games. Along with this, the stock price target price for Big Hit ranges from KRW 160,000 to KRW 380,000. There are positive prospects for diversification of the business structure, but it is true that some point out that the value of Big Hit is overvalued. Since there are not many cases where the price of the stock has fallen after the listing, it is the reason why there are voices of concern who do not ask, distrust investments, caught in the madness of the public offering of shares. . YTN Choi Doo-hee[[email protected]]is.