[ad_1]

|

The crown’s fifth stimulus plan was high, but …

According to Marketpoint on the 30th (local time), the Dow Jones 30 Industrial Average on the US New York Stock Exchange closed at 2,781.70, 1.20% higher than the previous trading day. The Standard & Poor’s (S&P) 500 Index closed at 3,363.00, an increase of 0.83%. The Nasdaq index, focused on technology stocks, rose 0.74% to 11.1167.51.

What has driven the market is the expectation of the fifth additional stimulus package for Corona 19 in the United States. Trump administration Treasury Secretary Stephen Manusin told CNBC that morning: “I will again try to find a point of contact for negotiations with the Democratic Party for additional stimulus plans by the 1st of next month.” “The possibility of an agreement is hopeful.” Because of this, the New York stock market skyrocketed from the beginning of the market.

As a result, the stimulus negotiations were unable to find a point of contact. Minister Manusin and the Speaker of the Democratic House of Representatives, Nancy Pelosi, had negotiated a corona stimulus package19 that lasted more than an hour and a half, but could not be concluded.

That does not mean that the embers have disappeared. In a statement, Pelosi raised expectations for a conclusion, saying: “We will continue to discuss with the administration to prepare the fifth stimulus plan.” He said on his Twitter: “We had a broad conversation” and “I found a point where more negotiations were needed and we will continue to discuss it.”

The economic indicators were relatively good. According to ADP’s National Employment Report, employment in the private sector increased by 749,000 this month. It was more than the forecast (600,000 increase) compiled by the Wall Street Journal (WSJ). It was the material that supported the stock market in advance of the stimulus measures.

The growth rate of the United States for the second quarter was -31.4%. This is the worst level of all time. However, it was similar to the previously announced preliminary value (-31.7%), so there was no significant impact.

Troubled Talk on TV Smalsmal Side Effects

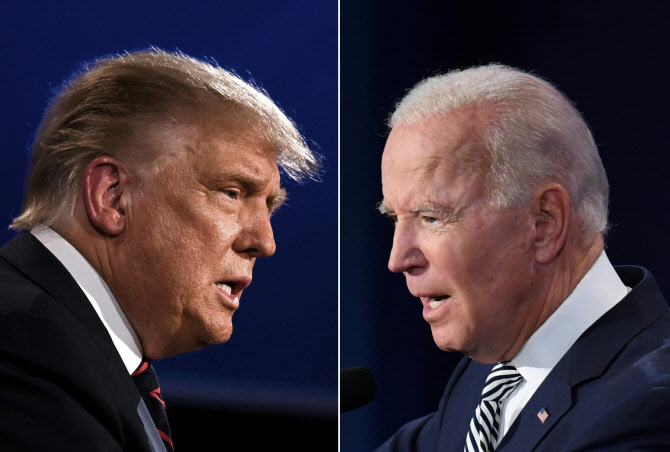

Above all, it was the television debate of the presidential elections the day before that caught the attention of investors. Amid criticism of the worst debate in history, there was growing concern that the results of the Wall Street presidential election could not be decided after Election Day on November 3.

President Donald Trump said: “We may not know the results for months (even after the presidential election). We urge supporters to go to the polls and watch carefully.” The possibility of objection was further revealed on the basis of the existing argument that the vote-by-mail is highly likely to be unfairly chosen.

Daniel Deming, Director of KKM Financial, said: “Through the discussion it became clear that the presidential elections will not end on November 3.” “The mayor won’t like this.” He was concerned that “more uncertainty would arise after the discussion.”

The Chicago Options Exchange (VIX) volatility index, also known as the Wall Street Fear Index, rose 0.38% to 26.37.

Stock markets in major European countries fell sharply. The FTSE 100 index of the UK London Stock Market fell 0.53% to 5866.10. The DAX index on the German stock exchange in Frankfurt and the CAC 40 index on the French market fell 0.51% and 0.59%, respectively. The Euro Stoxx 50 Index, a pan-European index, fell 0.64%.