[ad_1]

Established a new holding company, Healthcare Holdings

Merged with Celltrion Holdings next year

CelltrionPharmaceuticalHealthcare will also merge

Photo = Yonhap News

Celltrion(258,500 + 3.40%)The merger of the group’s flagship subsidiaries began in earnest.

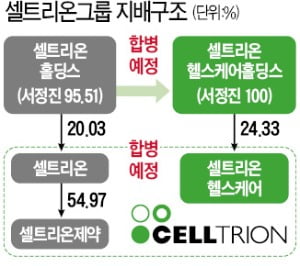

Celltrion Healthcare(87,700 + 2.93%)It announced on the 25th that it has established Celltrion Healthcare Holdings, a holding company. The company established a holding company by investing in kind 24.33% of the 35.54% stake held by Chairman Seo Jeong-jin, Celltrion Healthcare’s largest shareholder. Chairman Seo owns 100%. The largest shareholder in Celltrion Healthcare was moved from Chairman Seo to Celltrion Healthcare Holdings.

Celltrion Group plans to merge Celltrion Holdings and Celltrion Healthcare Holdings, the group’s flagship subsidiaries, Celltrion Holdings, next year. The largest shareholder in Celltrion Holdings, who owns a 20.03% stake in Celltrion, is Chairman Seo (95.51%). Celltrion Pharmaceutical, a company specialized in synthetic drugs(103,300 + 1.47%)Silver Celltrion owns 54.97%.

Celltrion Group plans to merge with Celltrion, Celltrion Healthcare and Celltrion Pharmaceutical at the same time as the merger with the parent company. He intends to divide the holding company and the trading company. A company official said: “Specific matters of the merger will be decided at the general meeting of shareholders to be held in April next year.”

Celltrion has been considering a merger plan for the three companies due to regulation to drive them away. Celltrion Healthcare purchased the biosimilar (generic biopharmaceutical drug) developed by Celltrion and then resells it abroad, sparking controversy that it would further the work. President Suh lost in a lawsuit filed in January last year seeking a refund of 13.2 billion won in gift taxes.

Hye-min Heo, a researcher at Kiwoom Securities, said: “The merger is expected to eliminate factors of mistrust, such as chronic concerns related to inventory, and reduce related costs, such as operating the distribution network.”

Reporter Jiwon Choi [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution