[ad_1]

In a policy statement released the same day after the two-day Open Market Committee (FOMC) meeting in September, the Fed announced that it would freeze the standard interest rate, which is currently 0 to 0.25%, for the time being. . CNBC, a broadcaster specializing in economics, said the combined forecasts of individual FOMC members indicated the possibility of the Fed holding interest rates at current levels by 2023.

The Fed also officially confirmed President Jerome Powell’s speech at last month’s Jackson Hall conference that it will tolerate inflation even if it partially exceeds the Fed’s 2% target before raising interest rates. Powell said at the Jackson Hall meeting that to keep the momentum of economic growth going, he would introduce an “ average inflation target ” that allows inflation to continue below the Fed’s 2% target and then slightly exceed 2%. for a certain period.

Powell explained at a press conference after the announcement of the policy statement: “This policy change clarifies our strong long-term commitment.”

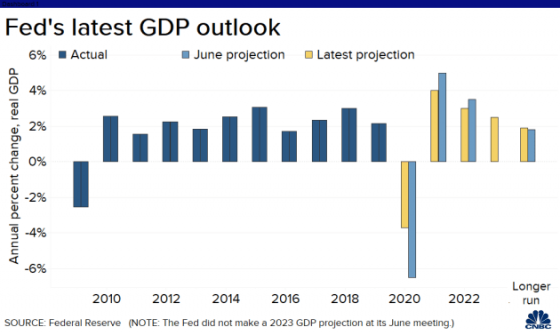

* Chart: CNBC (Data source: Federal Reserve System)

The Fed also presented a revised position on the outlook for economic growth, unemployment and inflation in the United States at its September meeting.

The Fed expects annual US GDP to decline 3.7% in 2020. This is a significant improvement from the June meeting forecast, minus 6.5%. However, GDP growth forecasts for next year and next year were 4% and 3%, respectively, and were revised down from June forecasts of 5% and 3.5%.

This year’s unemployment rate fell to 7.6% from 9.3% at the June meeting. The US unemployment rate for August was 8.4%.

Inflation forecasts for 2020 rose from 0.8% in June to 1.2% this time, but they are still well below the Fed’s target of 2%. The Fed predicts that inflation will not reach 2% by 2023.

The crypto community is hoping that the reconfirmation of the Fed’s long-term stance to keep interest rates low will be a huge long-term advantage for Bitcoin, which is seen as a new inflation hedge. However, as this outlook has already been reflected in the market, the possibility that the short-term impact is not significant cannot be ruled out.

* Image source: Shutterstock