[ad_1]

Jae-myung Lee, Governor of Gyeonggi Province. News 1

The governor of Gyeonggi Gyeonggi, Jae-myeong Lee, started when the Korean Institute of Tax and Finance (Cho Se-yeon) published an investigation report on the 15th that the issuance of local currency that can only be used in a specific region it can cause various losses and costs. On the same day, the Korea Development Institute (KDI) also released a report criticizing Governor Lee’s popular loan.

Let’s get a critique report from a national research institute

Lee Jae-myeong, claiming local currency

KDI points out Lee Jae-myung’s ‘basic loan right’ issue

Se-yeon Cho “Net loss of local currency 260 billion”

Jo Se-yeon’s associate researchers Song Gyeong-ho and Lee Hwan-woong released a report on the day the introduction of the local currency had an impact on the local economy. The report states that the local currency, which can only be used in certain regions, causes various losses and costs, and has an adverse effect on offsetting the economic effects. Seyeon Jo is a national research institute under the Ministry of Strategy and Finance.

The report noted that of the government subsidies for local currency worth 900 billion won, the untransferred net loss to consumer welfare is estimated at 46 billion won. He also criticized the fact that printing costs and financial fees of 2% of face value are incurred when issuing local currency, and that net economic losses amounted to 226 billion won this year as incidental expenses of 180 are incurred. 1 billion won per year.

In addition, the report pointed out the blind spots of the local currency, such as the repression of the so-called “ cash gang ”, which sells the local currency cheaply and turns it into cash, and the fall in real purchasing power due to the effect of inflation in some industries. It is argued that there are various losses from issuing local currency, and the economic effect that can be obtained from introducing it is inevitably limited.

![Governor Lee Jae-myung's Facebook. [페이스북 캡처]](https://pds.joins.com/news/component/htmlphoto_mmdata/202009/15/edaa1ffe-0a2c-4eaa-b6ef-347ec52d5bd3.jpg)

Governor Lee Jae-myung’s Facebook. [페이스북 캡처]

Regarding this report, Governor Lee rebutted on his Facebook page the same day as “a stupid state research institute that overcomes government policies without any foundation” and “the local currency is the best economic policy for the sense of the people of the people’s feelings to revitalize the alleys and enhance public solidarity. ”

“Social spending paid in local currency, not in cash, has multiple effects of increasing sales and inducing production of small business owners in addition to social benefits, and is playing a beneficial role in the local economy by facilitating concentration consumption by forcing use in residential areas. ” “It is a well-known fact that the local currency is being expanded and implemented by investing a huge budget, and the current government disaster subsidy is also paid in volatile local currency, and its effect has doubled.”

The governor stipulated that Jo Se-yeon’s report was “political.” He said: “I ask if it is legitimate attitude as a state research institute to defame Lee Jae-myung’s policy,” he said. The reality of wasting the national blood tax is really disappointing. ”In addition, Governor Lee ordered a strict censorship against Cho Se-yeon.

KDI also criticized Lee Jae-myung’s ‘basic loan rights’

That day, KDI also released a report that criticized Lee Jae-myeong-sik’s basic loan rights. On this day, KDI’s report on ‘Evaluation and Improvement Guidelines for Low-Private Financial Products Policies’ stated: “The effect of reducing the number of high-interest loans, such as cash services for users, has not been maintained long-term, and lenders are expected to recoup high-interest loans. It didn’t stop work, “he analyzed.

When we compare whether low-income financial policy users like Sunshine Loan and New Hope Scepter and US users have reduced their credit card cash services and savings bank loan balances, the effect of These policies that cut down on cash services and high interest loans for ordinary people are kept only for the short term. After that, they were found to use higher interest rate loans more than non-users.

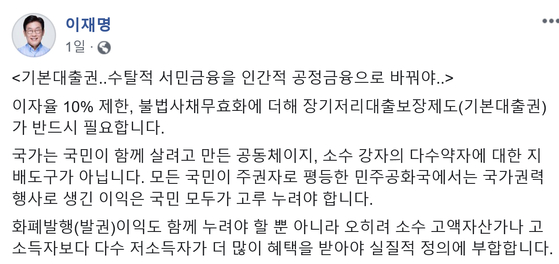

Governor Lee Jae-myung’s Facebook article demanding basic loan rights.

This report is contrary to Governor Lee’s recent “basic right to borrow” policy. On the 13th, Governor Lee insisted on Facebook on the 13th that “we should trade exploitative low-income finance for humane and fair finance.”

However, on the same day, KDI stated in the report: “Rather than focus on expanding the offering of financial products without policies, we support credit enhancement for users through credit management education for ordinary people and guide debtors excessive to debt adjustment system through credit counseling. Should be improved. ”

Reporter Oh Wonseok [email protected]

[ad_2]